Analysts expect Bitcoin to continue its upward trend, as it has already gained over 120% this year. The upcoming SEC decision on Bitcoin ETFs and the Bitcoin Halving event in April further support these bullish expectations. Here, we present three charts that have the potential to trigger a significant rally in Bitcoin prices.

Global Central Bank Policy Cycle

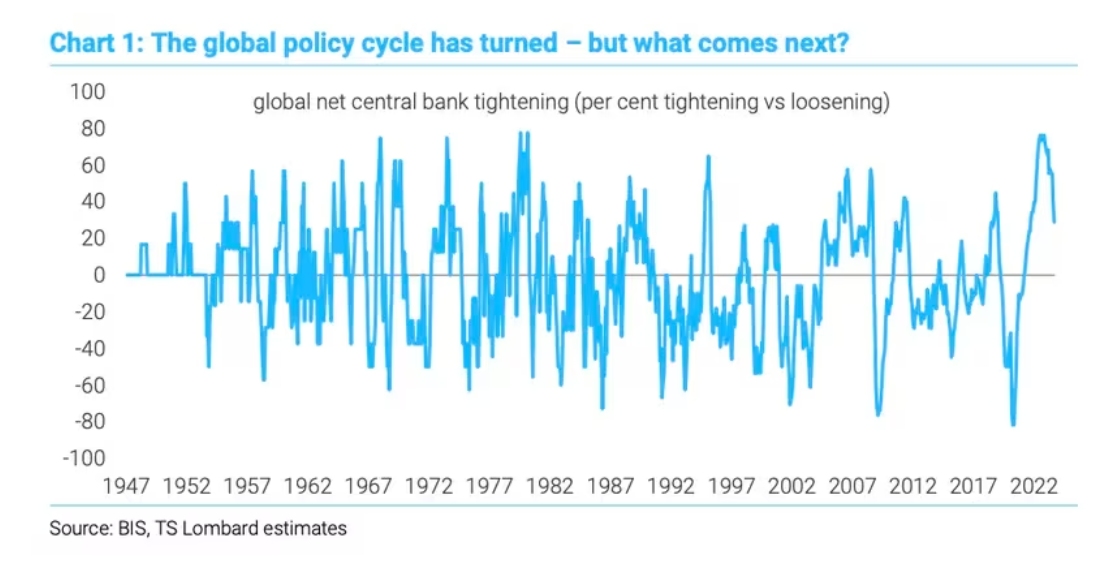

Last year, central bank tightening policies had a significant impact on cryptocurrencies. The chart below, prepared by TS Lombard, highlights the balance between tightening and easing policies among central banks since 1947. Positive values indicate a trend towards tighter monetary conditions, while negative values indicate a preference for easing.

Loose monetary policy, characterized by interest rate cuts and monetary easing, could signal an increase in Bitcoin and other cryptocurrencies. With recent declines in the chart and inflation rates, central banks may ease their policies. The injection of billions of dollars into the market will encourage individuals to take more risks, leading to an inflow of funds into the cryptocurrency market.

Financial Conditions Eased in the US

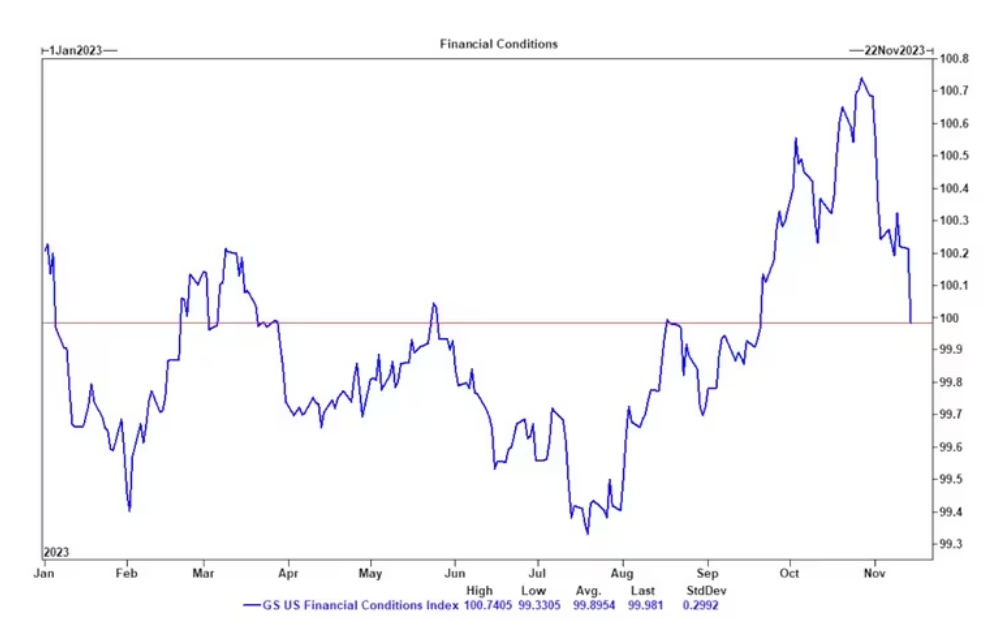

Goldman Sachs’ Financial Conditions Index (FCI) for the US, which measures the country’s financial conditions, has dropped from its highest level of 100.74 to just below 100. This indicates a more flexible US economy, suggesting that the Federal Reserve may end its high interest rate policy.

The end of the Fed’s interest rate policy is expected to create a wave of growth for Bitcoin and cryptocurrencies. The 1% drop in Goldman Sachs’ FCI index has a positive or negative impact on GDP in the following three to four quarters. The recent decline indicates the end of the mentioned monetary tightening.

10-Year Treasury Yield Distribution

Another positive development for Bitcoin is the yield on the 10-year US Treasury bond. As previously announced, the Treasury plans to slow down its bond purchases. Since that announcement, the yield has dropped 50 basis points to 4.43%. The decline in yields indicates a shift of investors to other assets, with stocks and cryptocurrencies being the primary beneficiaries. EFG Bank’s research team provides a target based on the daily graph of the 10-year Treasury yield, indicating a downward target of 3.93%.

All of these factors could increase the interest in Bitcoin and cryptocurrencies. However, it is important to note that there are risks involved. If the tighter financial conditions indicated by Goldman Sachs’ FCI index were to reverse, the Federal Reserve’s comments may take on a more hawkish tone. This could also lead to a reevaluation of the possibility of another interest rate hike in the coming months, which could potentially slow down the rise of Bitcoin and cryptocurrencies.