The launch of Ethereum‘s Blast layer-2 network brought a mix of excitement and fear to its investors, as approximately $1.6 billion of the initial deposits were withdrawn by investors within the first 24 hours. According to data provided by Defillama, this movement of funds underscores the issues encountered during the acceptance process of new platforms.

TVL Continuously Declining

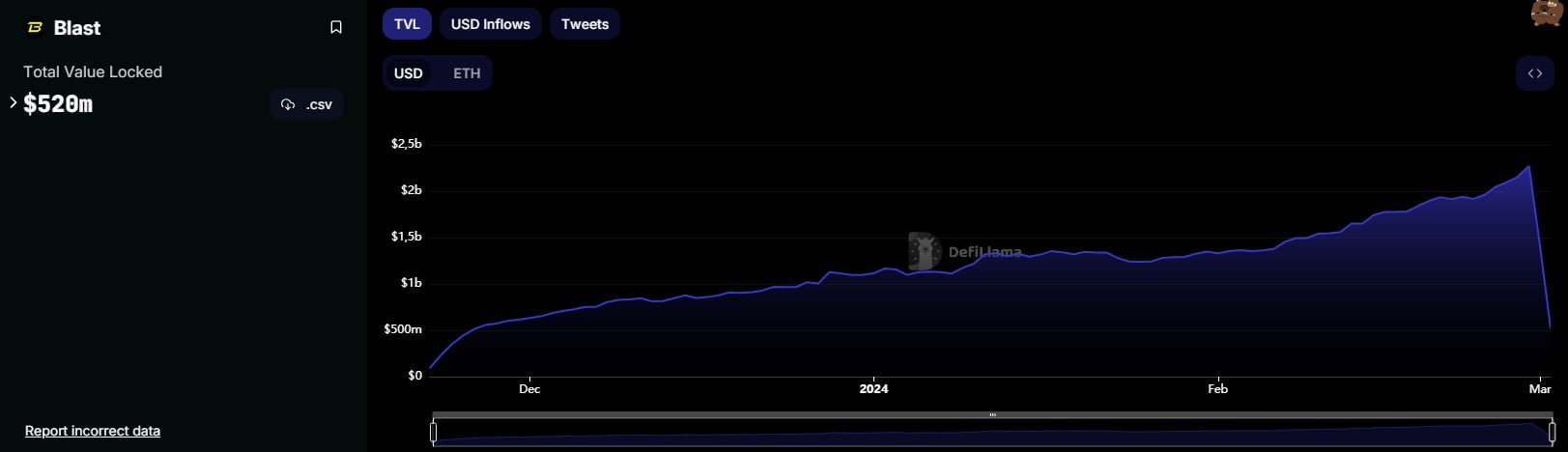

Data indicates that the Blast network had a total value locked (TVL) of $2.3 billion at launch. However, with the onset of heavy withdrawals by users, this figure has fallen to $520 million.

Consequently, the network, which positioned itself as a promising new player in the Ethereum community and offered returns on staked ETH, was shaken by a clear drop in value within a single day.

The initial allure of Blast was due to its innovative structure aimed at generating returns for its users. During its emergence, users staking their ETH were promised Blast points, which were later to be exchangeable for a token.

This incentive mechanism attracted investors seeking potential gains. Additionally, the network promised to distribute 50% of an upcoming airdrop to developers.

The Future of Blast

The rapid decline in TVL at Blast has also brought skepticism among individuals in the crypto world. Initially, debates did not have a significant impact, as the promise of high returns and an airdrop paved the way for liquidity to flow into the project.

Moreover, the swift withdrawal of funds post-launch may indicate a lack of confidence in the network’s long-term viability.

Throughout this process, to keep the ecosystem secure and maintain investor support, Blast announced plans to integrate with others, including Zora and Pyth. Along with this strategy, according to the announcement, Blast aims to increase its utility and take steps to bring together a more functional and robust dApps development infrastructure.

The network is still considered to be in its early stages, and these planned moves raise questions about what contributions they might currently make to the network.