According to Singapore-based QCP Capital, the drop in US inflation figures and increased institutional demand for risky assets could drive Bitcoin‘s (BTC) price to $74,000 in the coming weeks. As expected, a positive scenario for Bitcoin also corresponds to a positive trend for altcoins.

Positive Outlook for Bitcoin and Altcoins

Yesterday, the US Consumer Price Index (CPI) for March increased by 0.3%, below the expected 0.4%, triggering a significant upward breakout for Bitcoin. This movement allowed Bitcoin to reclaim the $66,000 level for the first time since April and achieve the largest single-day gain since March. QCP Capital emphasizes that this upward momentum, combined with traditional financial demand, could push Bitcoin back to its March record of $73,700.

Millennium and Schonfeld, major asset managers, have shown increasing interest in the largest cryptocurrency by investing in spot Bitcoin ETFs. QCP Capital highlighted that these asset managers allocated approximately 3% and 2% of their assets under management (AUM) to Bitcoin spot ETFs. Multiple filings revealed that major funds, including Millennium Management and Elliot Capital, held significant amounts of spot Bitcoin ETFs in their portfolios. This indicates a notable increase in institutional interest in Bitcoin.

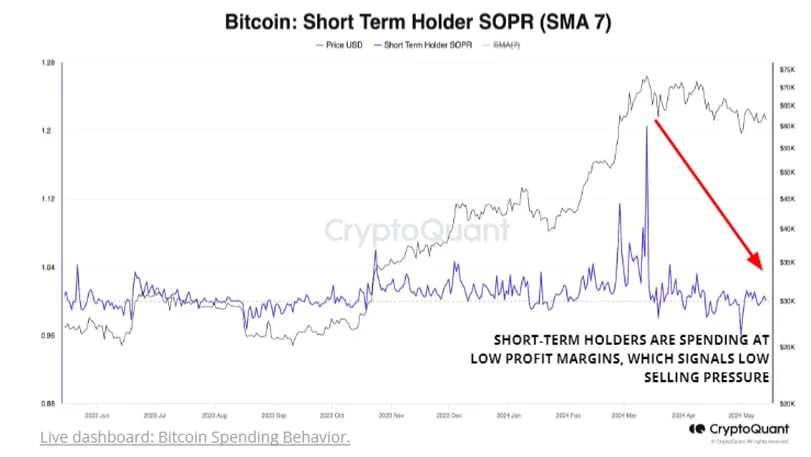

On-chain analysts observed that the selling pressure from short-term investors has eased. According to CryptoQuant, short-term Bitcoin investors are selling at almost zero profit, and investors have been depleting their unrealized profits in recent months. Additionally, Bitcoin balances on over-the-counter (OTC) desks are stabilizing, indicating a decrease in the supply of Bitcoin entering the market through these entities. For those unaware, CryptoQuant defines short-term investors as those who hold Bitcoin for less than 155 days and typically capitalize on short-term price movements.

Bitcoin’s price recent rise follows weeks of low volatility, where the market remained between $60,000 and $70,000. Despite the expected rise not materializing in April due to a lack of market catalysts, the recent softer CPI figures have increased the upward momentum for Bitcoin, altcoins, and other risky assets.

“Keith Gill” Effect on Cryptocurrencies

Additionally, a higher risk appetite for token bets has emerged, partly influenced by the recent activities of individual investor Keith Gill. Known for his role in the 2021 GameStop short squeeze, Gill made a post on the popular social media platform X for the first time in three years.

Gill’s post caused fluctuations in meme stocks and memecoins, signaling potential market volatility in the coming months.