Bitcoin ETF had initiated a significant surge in the crypto market, and now it’s Ethereum (ETH)’s turn. As the end of sales in Germany approaches and the US inflation data is awaited, the first major news will be the SEC’s announcement of the listing date. This could break the months-long decline.

Bloomberg ETH ETF Predictions

SEC approved the Ether ETF after reversing its stance. However, due to a last-minute change, the filings were not completed as quickly as expected. The final listing date will be determined once the revised S-1 Form files, which have been updated several times, are submitted to the SEC. The final versions were submitted to the SEC by the issuers today.

What is the expected inflow after ETH ETF listings on exchanges? Bloomberg Senior ETF Specialist James Seyffart commented:

“My estimate is about 20-25% of the net flows seen by bitcoin ETFs. This means a net inflow of 3-4 billion dollars in the first 6 months. These numbers would make ETH one of the most successful launches of all time. Perhaps second only to Bitcoin. What are we talking about here? No one knows the future. It’s all a guess. Of course, it’s an educated guess, but why do you care so much about our predictions regarding the demand for some ETFs? Don’t you have more important things to worry about?”

ETH ETF and Crypto

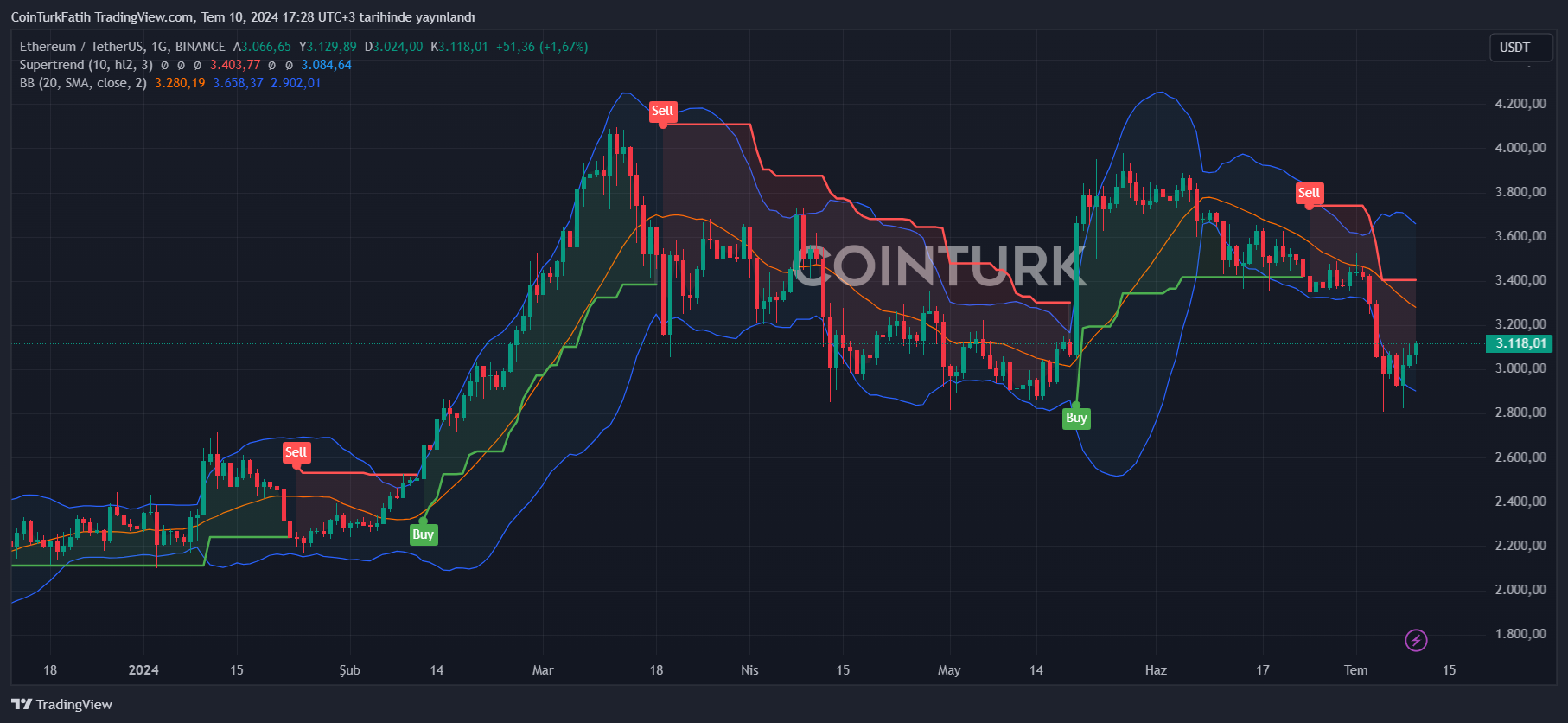

If James’s prediction comes true, a new bullish period could be seen for ETH and altcoins in general. The BTC ETF had triggered significant price increases, pushing the leading cryptocurrency to its all-time high. ETH, on the other hand, has the potential to break BTC’s dominance in the market to some extent, accelerating cash inflows to altcoins.

We should remember the days when ETHE issued by Grayscale experienced high negative premiums and could face similar mass exits like GBTC. If this happens, ETH could be shaken by strong net outflows in the initial listing period, reinforcing the sell-the-news narrative.

Ultimately, while traditional market investors show intense interest in BTC, a balanced ETH exit environment could create a positive atmosphere in the market. Moreover, the US elections at the end of the year and potential Fed rate cuts could support this bullish narrative.