Bitcoin (BTC) miners may have faced a challenging period due to a variety of factors, including regulatory pressures and concerns over environmental impacts, potentially creating a long hardship season for the industry.

Are They Stronger than BTC?

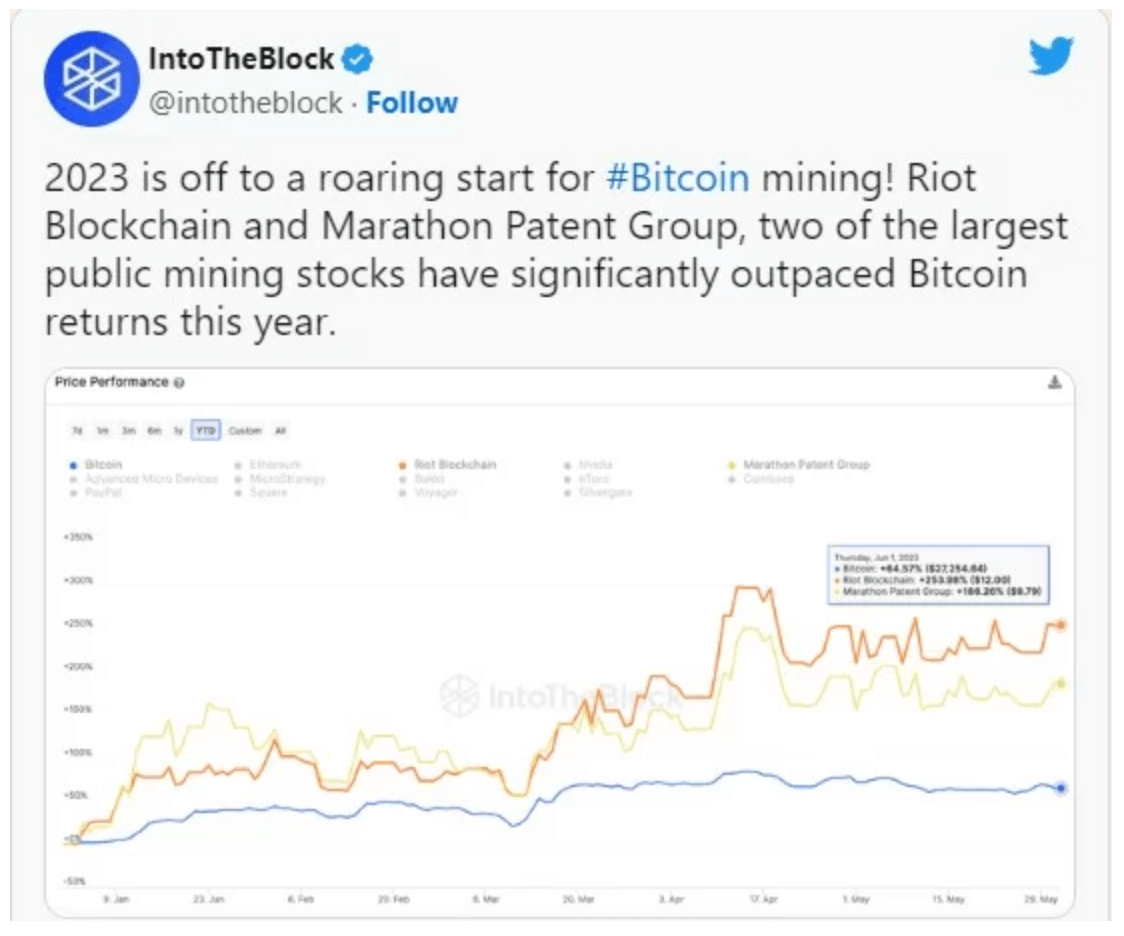

There are indications that the end of this bleak period may be approaching, as some mining stocks show signs of strength and resilience. According to IntoTheBlock, Mathent Patent Group and Riot Blockchain’s stock prices have performed better Year To Date (YTD) than BTC.

As of June 1, Bitcoin‘s performance increased by 64.57%. Riot registered a 253.98% increase while Mathent’s stock value rose by 186.26%. As a result, this situation brought BTC back to its once-held title of the best-performing digital asset of the year.

One reason for this comeback is the increased revenues and fees recently recorded by miners, possibly connected to the adoption of Bitcoin Ordinals. Notably, the rise of BRC-20 tokens also had an impact as it increased the number of transactions on the Bitcoin blockchain. It’s essential to note that these factors alone did not revitalize the mining sector.

Instead, some mining companies have also taken steps to address operational environmental concerns, possibly leading to the adoption of greener and more sustainable practices. This not only aids in reducing negative environmental impacts but also enhances the sector’s public perception.

Security and Gap Markers

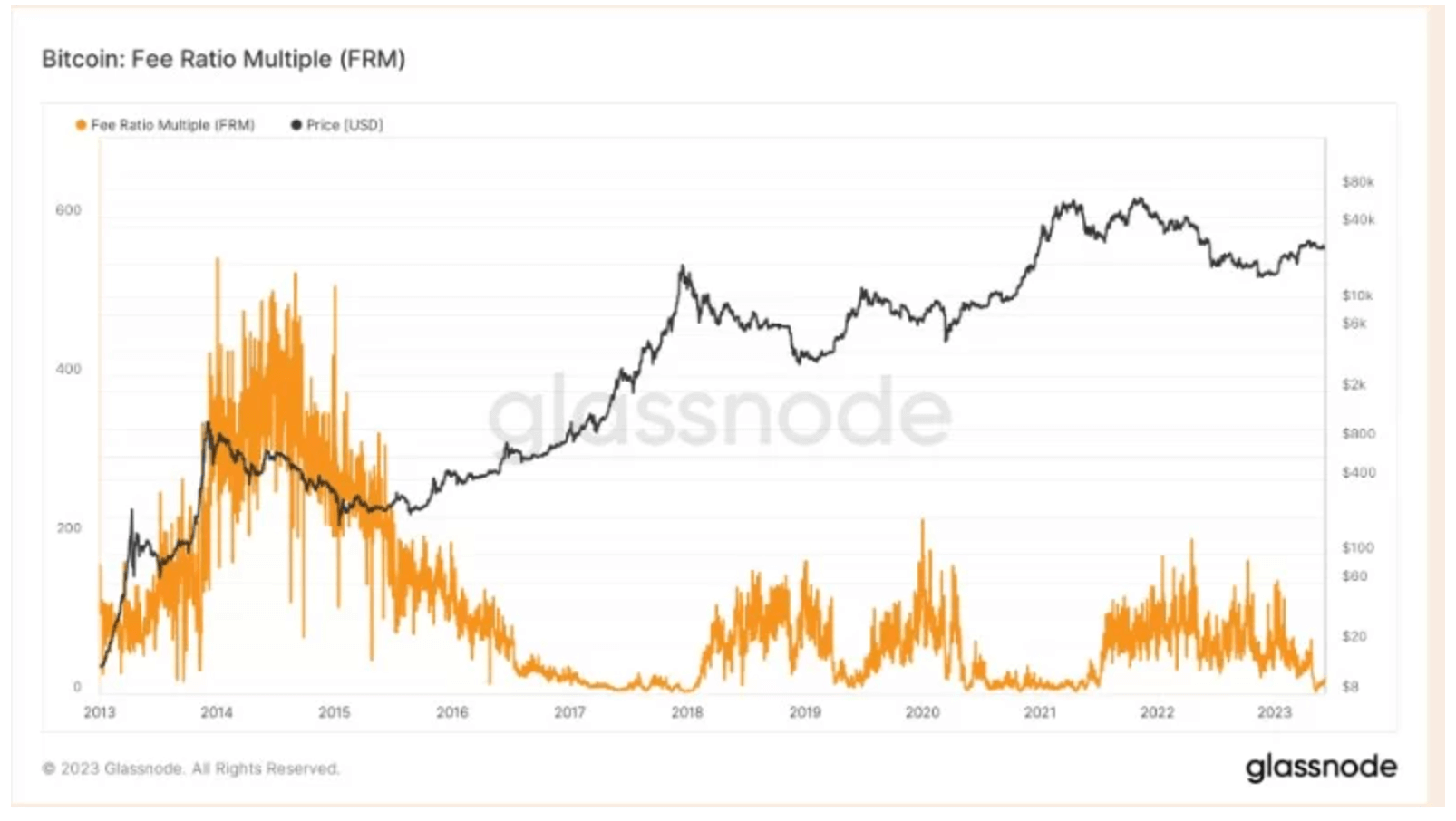

Interestingly, Glassnode data showed that the Fee Rate Ratio (FRM) has dropped to 19.38. Calculated as the ratio of total revenue and transaction fees, FRM serves as a measure of blockchain security when blocks are lost.

The low FRM of Bitcoin means that miners can maintain their security budget with their revenue without relying on an inflationary subsidy. Conversely, if the FRM had been high, miners would have needed block reward subsidies to preserve their income.

However, indicators from the hash ribbon suggest that the worst is not yet over for miners. The metric uses a 30-day Moving Average (MA) to measure miners’ capitulation and identity buying opportunities.

When the hash ribbon transitions from light red to dark red, capitulation is considered to be over. However, at the time of writing this article, that point had not yet been reached.

Will Bitcoin Be Profitable in the Short Term?

Meanwhile, the same metric showed that Bitcoin could be presenting a good buying opportunity. This is due to the hash ribbon entering the white-colored area and the price momentum shifting from positive to negative.

In addition, short-term investors were desiring a rise in BTC, despite the recent drop in Q1 performance. According to Crazzyblockk’s CryptoQuant publication, the Spent Output Profit Ratio’s (SOPR) balance level revealed the aforementioned result. SOPR, used as an indicator of macro market sentiment, reflects the degree of realized profit and loss carried on-chain. The analyst noted,

These players showed a desire to be profitable and stay in the market, and each time the SOPR data’s ‘balance level’ approached and dipped below level 1, it rebounded and improved, which suggests these players still have interest and hope for a price increase.