Bitcoin mining is becoming less profitable according to recent data. However, new data shows that Bitcoin mining hashrate continues to rise, suggesting that miners may not be too concerned about the decline.

Historic Metric for Bitcoin at its Peak

As Bitcoin is a Proof of Work (PoW) network, miners, who are the chain validators, compete with each other by using computational power to hash the next block. “Hashrate” is an indicator that measures the total amount of computational power currently connected to the Bitcoin blockchain, which shows how much interest miners have in the mining process and how the competition between them is currently perceived.

In general, the higher the hashrate, the more secure the network is, as it becomes much more difficult to perform a 51% attack. Of course, this is valid when considering that the hashrate is decentralized enough. However, this indicator is more important because it can give us an idea of the miners’ interest in the existence of mining and how the competition among them currently appears.

When hashrate increases, it means that miners find the BTC blockchain attractive for mining at the moment, so new validators join or existing ones expand. Since the block rewards that miners receive for solving blocks in the BTC network are permanently halved, except during halvings, the increase in hashrate potentially leads to everyone involved receiving a smaller piece of the pie.

On the other hand, when the value of the metric decreases, it indicates that some miners may be withdrawing from the network because they may not find mining profitable at the moment. The remaining miners who are still connected to the chain naturally have an easier time due to the decreased competition.

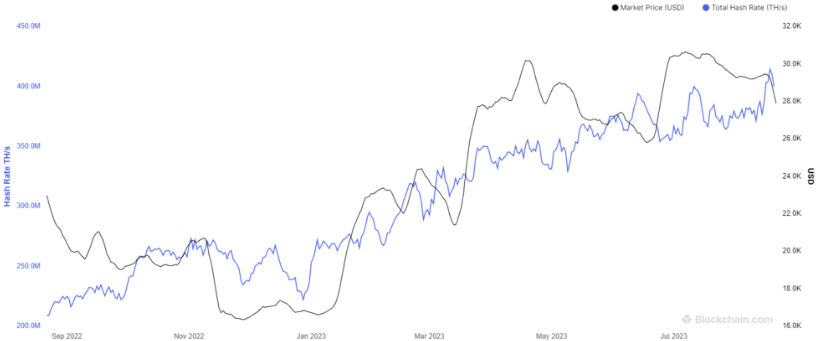

Now, here is a graph showing the trend in the 7-day average Bitcoin mining hashrate over the past year:

The aforementioned block rewards are the primary source of income for miners. Whenever the price of the asset decreases, the value of these rewards also tends to decrease, which may put pressure on miners if there are significant drops in the asset.

From the graph, it can be observed that the 7-day average Bitcoin mining hashrate has been rising recently and has reached an all-time high, despite the recent decline due to BTC trading below $26,000.

Current Situation in Bitcoin Mining

It appears that miners are not affected by this price drop, at least for now. However, considering how sharp the price drop is, if the asset does not recover soon, it is likely that the hashrate will eventually suffer a blow, and some small miners who were already making very little profit may have no choice but to disconnect. At the time of writing this article, Bitcoin was trading around $25,900 with a 12% drop in the past week.