Until yesterday’s pleasant surprise, most investors were in agreement about further declines in the king cryptocurrency. However, things turned around. The month of September is generally known as a period of decline for Bitcoin, and experts believe this could happen again. So what do cryptocurrency experts expect for Bitcoin in September?

Bitcoin September Predictions

Although the king cryptocurrency reached $28,140, it could not sustain its rise. Despite closing above two important moving averages, analysts prefer to remain cautious. MAC_D, an expert who shares his analyses on the CryptoQuant platform, explained that the rise in Grayscale is due to derivatives exchanges.

“Firstly, when we look at the ‘Funding Rate,’ it is not an extreme value, so we do not expect it to cause a sharp price correction. However, it is difficult to see that the spot exchange led the price increase when the BTC price rose yesterday. The reason for this is that we see that the ‘Volume Ratio (Spot VS. Derivatives)’ is decreasing instead of increasing.”

Of course, even in small trading volumes, prices tend to change significantly due to the overall decrease in liquidity in the cryptocurrency market. However, we should avoid excessive optimism about starting a parabolic rise with this rally.”

Cryptocurrency Expert’s September Prediction

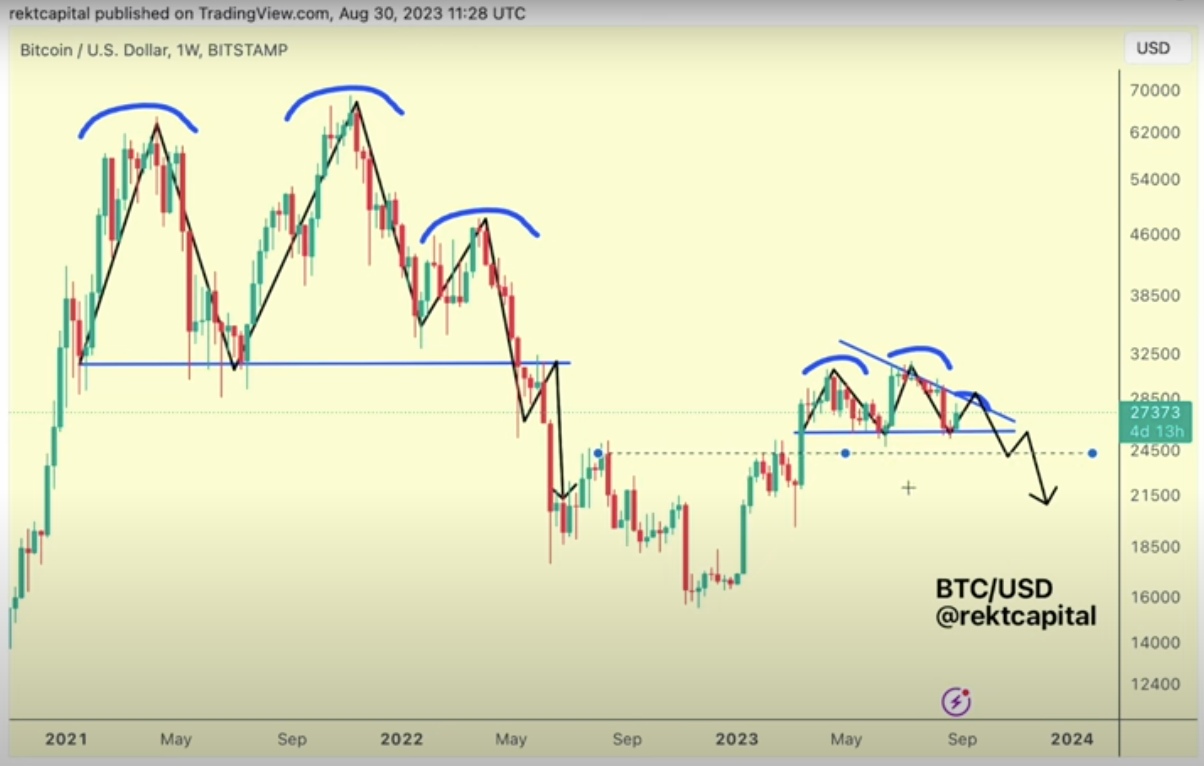

Rekt Capital, known for accurately predicting market turning points and foreseeing the 2023 rally, also shared its latest market assessment. He also adopts a cautious stance like MAC_D. Another reason for this is that the BTC price has failed to test above $30,000 multiple times. This has significantly weakened investors’ belief in the rise, and the rally triggered by the BlackRock application had a very strong reason behind it.

In the market assessment made by Rekt Capital, it suggested that BTC/USD could make a similar mimic movement to what was seen around the all-time high level in 2021.

“We see many similarities between what we are seeing now and the double top in 2021.”

If this similarity leads to a repetition, we may see that the $26,000 level turns from support to resistance in September. Rekt Capital also identified $23,000 as an important level against the market bottom structure of September 2022. According to him, the price can bottom out and recover in this range.