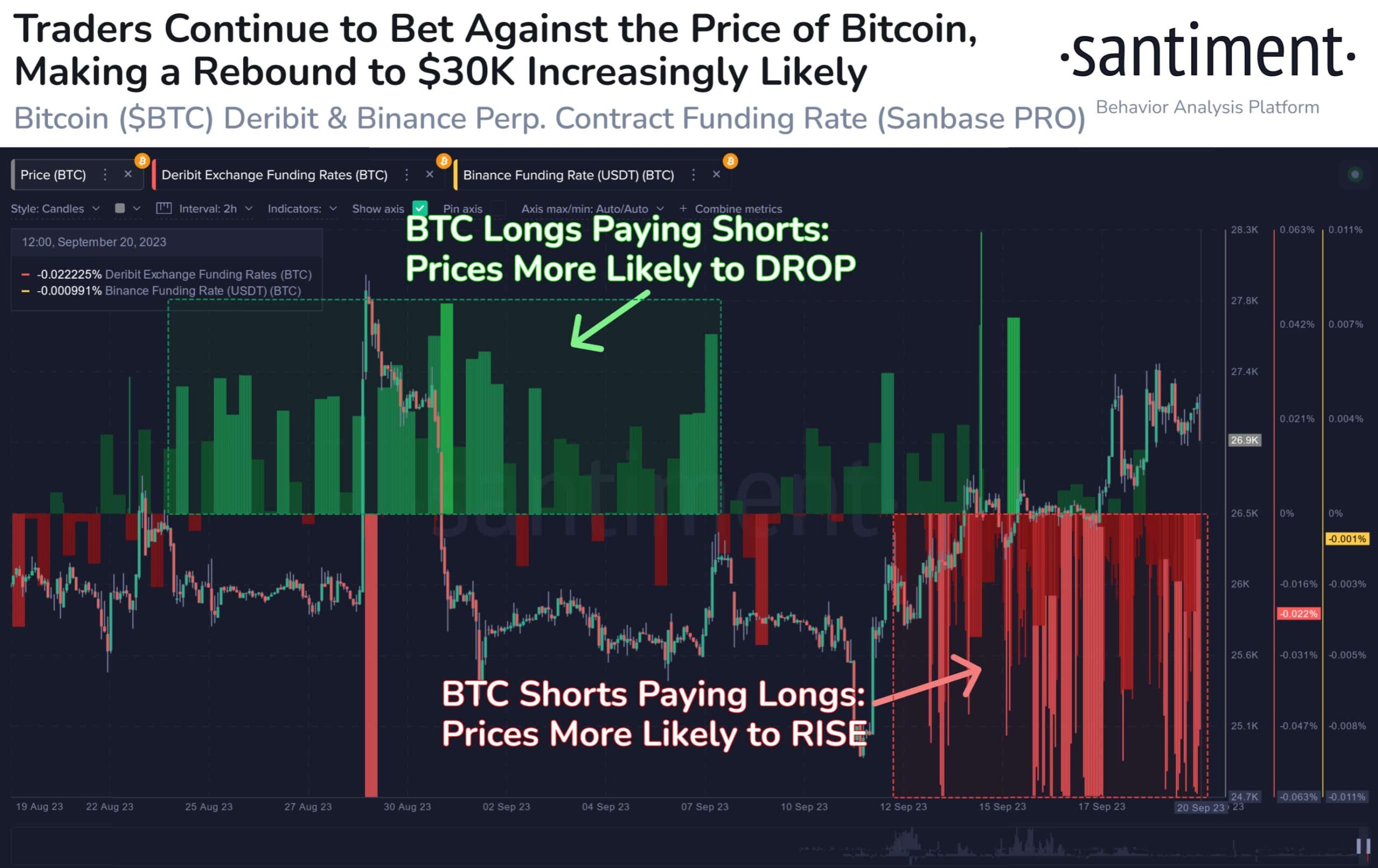

The largest cryptocurrency, Bitcoin (BTC), has been hovering around $27,000 for some time now, with high investor and network activity. On-chain data suggests that traders are heavily opening short positions in BTC, which could result in a short squeeze.

Increasing On-Chain Activity for Bitcoin

On-chain data provider Santiment reported that Bitcoin investors are expecting a decline on both Deribit and Binance. This indicates an increased possibility of potential liquidation that could cause prices to rise. Since the increase in short positions that started last week, Bitcoin’s price has risen by 4%, and there is a high probability that this trend will continue.

Furthermore, the number of active wallet addresses on the Bitcoin network has reached its highest levels in the past 5 months. This also increases the likelihood of Bitcoin reaching $31,000, its highest level in 2023. Experienced cryptocurrency analyst Ali Martinez highlighted the correlation between rising on-chain activity and price increases, indicating an expected rise.

This is evident when the monthly average of new wallet addresses (shown in red) exceeds the annual average (shown in blue). This demonstrates a strengthening of the network’s fundamentals and increasing usage. Despite the sideways movement in price, the increasing on-chain activity of BTC is noteworthy, suggesting that the potential for another bull run may not be far off.

Meanwhile, Martinez pointed out a recurring pattern that has emerged since mid-April. According to this pattern, when Bitcoin’s Relative Strength Index (RSI) reaches 73.31 on the 4-hour timeframe, the price tends to decline. Currently, a similar scenario is unfolding as BTC approaches the declining resistance trendline at $27,440. In the event of a correction, Bitcoin could potentially fall to $25,200 or below. However, if the price candle on the 4-hour timeframe closes above $27,440, it would indicate a continuation of the upward trend.

Bitcoin’s Institutional Adoption and FOMC Impact

Leading financial giants have recently shown clear interest in Bitcoin. The world’s largest asset management companies, such as BlackRock and Fidelity, have filed applications with the US Securities and Exchange Commission (SEC) for a spot Bitcoin ETF, which could further boost adoption.

Recently, Japanese banking giant Nomura announced its own Bitcoin fund to further increase adoption. Nomura’s Laser Digital Bitcoin Adoption Fund aims to facilitate institutional investors’ access to Bitcoin in a cost-effective and secure manner. Laser Digital will leverage a regulated custody solution provided by Komainu to ensure the security of its assets. Komainu, established in 2018 in collaboration with Ledger and Coinshares, will play a crucial role in safeguarding these assets.

The FOMC meeting on September 20 resulted in the expected decision to keep the policy rate in the range of 5.25% to 5.50%. Bitcoin’s price and the overall cryptocurrency market remained stable without significant impact from the critical interest rate decision.