The price of Litecoin (LTC) has managed to maintain the $70 zone for three consecutive days, a feat it hasn’t achieved since August. In-depth chain analysis reveals the critical factors behind the ongoing Litecoin price surge.

Will LTC Erase its Losses?

Popular altcoin LTC has struggled to find a stable market demand amidst the ongoing cryptocurrency market rally. However, certain on-chain data trends indicate that this situation might soon change as we approach 2024.

Cryptocurrencies with massive market capitalizations like Bitcoin (BTC) and Solana (SOL) have gained over 100% in annual returns. Recently, the price of Litecoin has managed to recover its losses and reclaim the $70 mark.

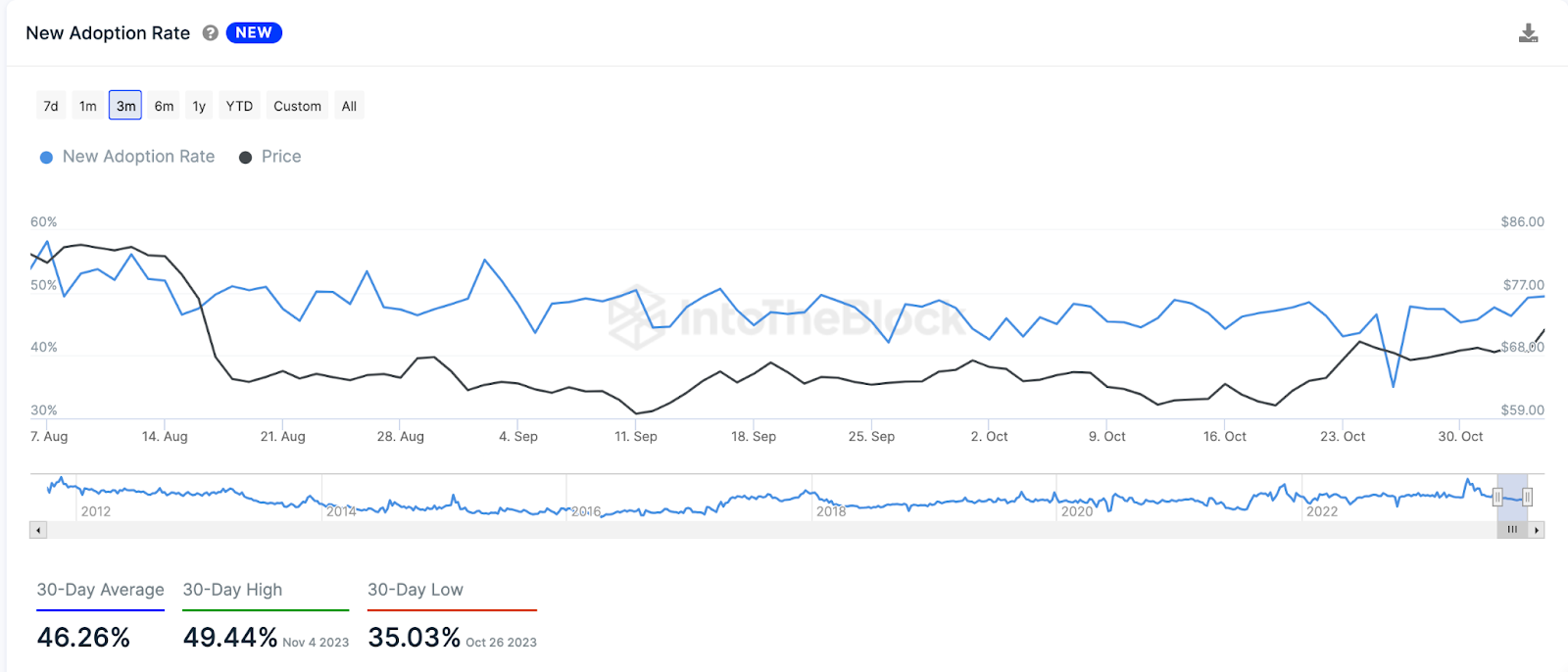

On-chain data reveals that Litecoin’s recent price recovery is largely attributed to stable growth in network demand. Blockchain data analysis platform IntoTheBlock reported a 44,000 increase in funded LTC wallets since the second half of 2023.

According to the shared charts, Litecoin’s non-zero address count, which was 8.77 million on June 30, has now reached 9.21 million.

The metric of funded addresses is often referred to as non-zero balance addresses. As mentioned above, an increase in this metric can indicate a growing adoption and expansion of the blockchain network.

Key Data for LTC

If the growth of funded addresses continues, increasing demand could push Litecoin’s price towards the $100 level as we approach 2024.

On the other hand, recent data suggests that LTC’s price increase above $70 is primarily driven by organic network growth. With these indicators still in an upward trend, Litecoin could find itself in a significant position to expand its gains towards $80.

Global inflow/outflow of money (GIOM) data, which groups current Litecoin holders based on their entry prices, can also confirm this bullish prediction.

However, in order for bulls to be confident in reclaiming $80, LTC needs to first raise its initial resistance to $76. Around 364,400 individuals purchased 4.53 million LTC at an average price of $75.99. If these holders close their positions early, they could slow down the rise in Litecoin’s price.

Nevertheless, if bulls manage to push through this resistance level, Litecoin’s price will likely regain $80 as predicted.