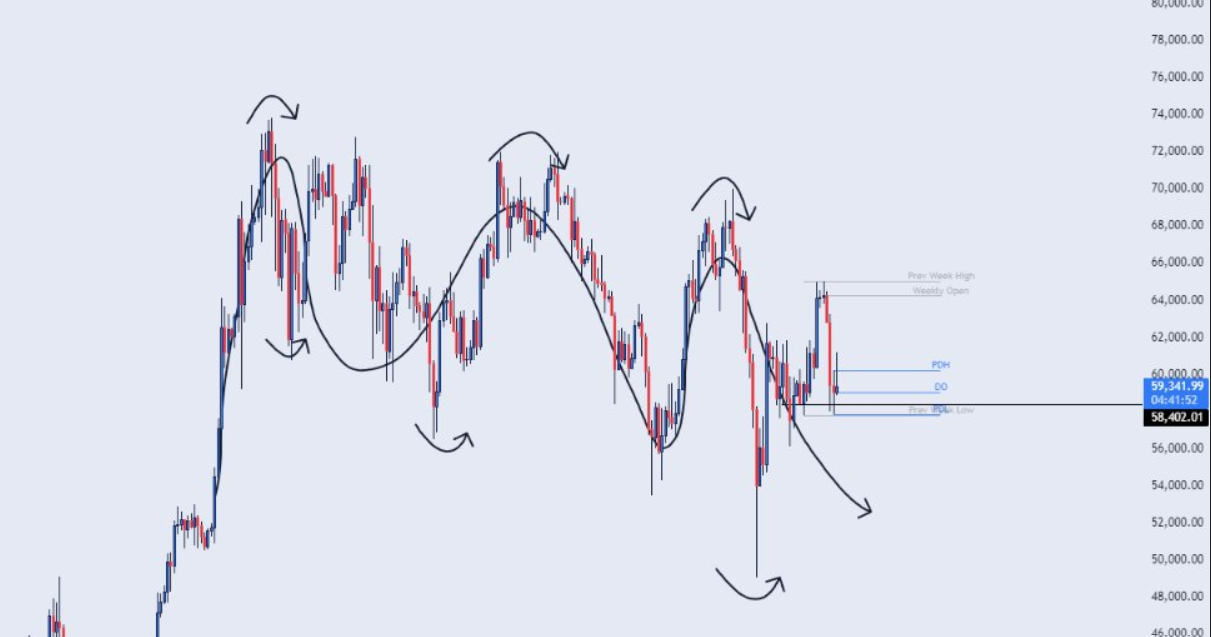

Bitcoin (BTC) price was at $58,300 at the time of writing, having dropped to $57,128 in the last 24 hours. It is clear that September has not started well, and this negativity has been ongoing for months. Volumes are also quite weak, making altcoins less attractive. So, what are the current predictions of the popular cryptocurrency analyst?

Cryptocurrency Analyst’s Commentary

The Flow Horse, one of the popular analysts, draws attention to the current major problem of the cryptocurrency markets. Lack of volume is noticeable in many cryptocurrencies. On-chain volumes have also weakened in altcoins; for example, we are seeing volumes for the Solana network similar to when the spot price was $12.

According to the analyst, we will not witness the desired activity in cryptocurrencies without a momentum increase in BTC.

“Bitcoin is most likely following the same slowbleed.exe model as ETH/BTC. Ultimately, large buyers need to step in and start rising to send a signal to everyone else; otherwise, it will be dominated by buyers and sellers with a time horizon of less than a week. This is not as simple as ‘ETFs are buying’ because there is no pool of passive or mandatory buyers. If there were, we would see a positive deviation.”

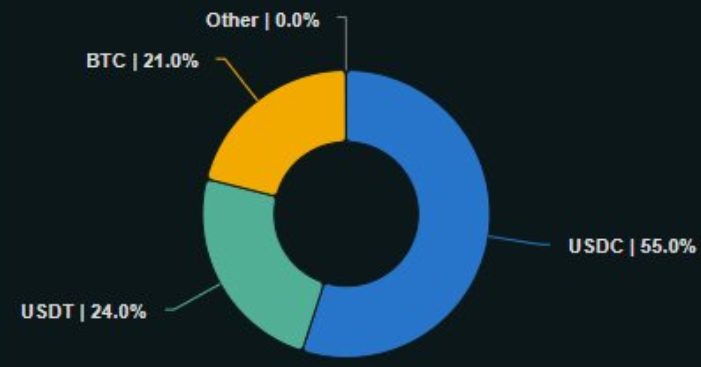

The problem for investors in the ETF channel is that demand is limited and the selling liquidity on exchanges is strong, so ETF demand does not support the spot price as we saw in the first quarter.

When Will Cryptocurrencies Rise?

Some analysts compare the current situation to 2020, and the lack of desired appetite despite interest rate cuts somewhat supports this possibility. The Flow Horse says that investors are waiting in stablecoins and that the current boring period will continue unless these balances flow into BTC and altcoins.

The analyst who shared the above chart emphasizes that unless we see a major change here, the BTC price will continue to trade in a narrow range. Indeed, BTC, the largest asset by market value, has even paused attempts above $63,000. The last wave of sales at $65,000 shows how active short-term investors are in the liquidity book.