Experienced hedge fund manager Anthony Scaramucci, in a recent statement, claimed that Bitcoin‘s (BTC) market value is poised to exceed that of gold, which currently stands at 16 trillion dollars. Scaramucci shared the key factors he believes will make this possible.

“Superior to Gold as an Asset”

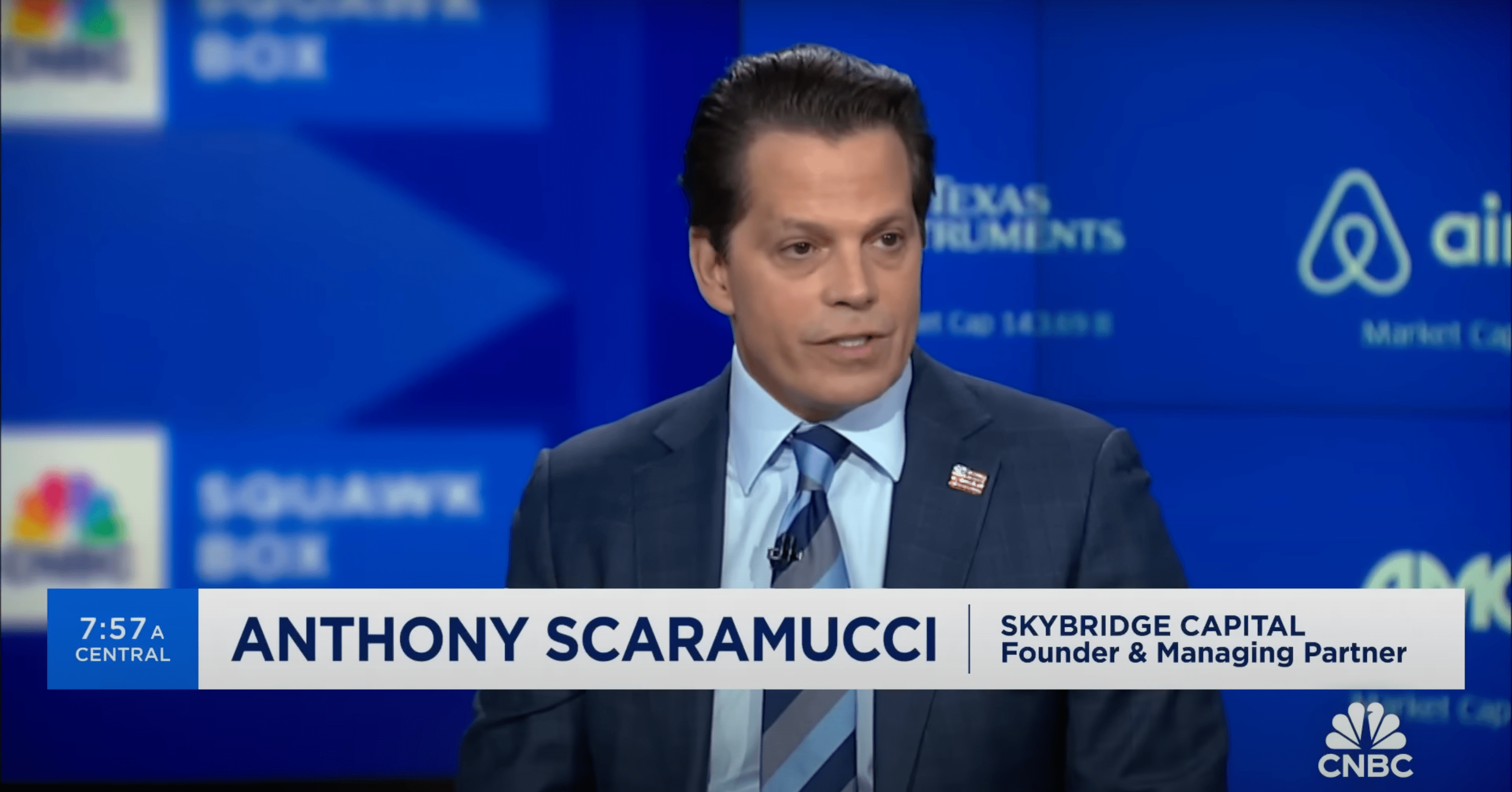

In a recent interview with CNBC, SkyBridge Capital’s founder Scaramucci emphasized Bitcoin’s superiority as an asset, stating it represents an unprecedented development in the history of human civilization over the last five thousand years.

Scaramucci highlighted Bitcoin’s immutable nature and decentralized structure as its key strengths. He pointed to the ongoing scalability improvements of the Bitcoin network, emphasizing its potential for widespread adoption and continuous growth. While acknowledging that Bitcoin has not yet reached the market value of gold, which is currently 16 trillion dollars, he expressed confidence that the leading cryptocurrency could close this gap over time, especially as regulatory frameworks evolve to integrate it into traditional investment portfolios.

The hedge fund manager detailed the evolving perspective towards Bitcoin, linking his shift from skepticism to belief to the asset’s adherence to fundamental principles that have defined money throughout history. Scaramucci highlighted Bitcoin’s resilience against central bank manipulation as a distinctive factor that enhances its appeal as a store of value and investment vehicle.

Anticipates Surpassing Gold’s Market Value with Regulatory Acceptance

Scaramucci expressed optimism about Bitcoin’s trajectory to exceed the market value of gold, suggesting that the largest cryptocurrency could potentially reach half of gold’s market value, or 8 trillion dollars, in the short term and eventually surpass it. He emphasized the role of regulatory acceptance in facilitating Bitcoin’s mainstream adoption, adding that regulatory approval would increase institutional and individual participation in investment vehicles like exchange-traded funds (ETFs).

Scaramucci countered concerns about the limitations of spot Bitcoin ETFs in the US, stating that regulatory developments have enabled broader inclusion of Bitcoin in global investment portfolios. He argued that even a one percent allocation to the largest cryptocurrency in portfolios could significantly contribute to its market value and potentially move it beyond gold’s market value.

Türkçe

Türkçe Español

Español