Arbitrum price increases have significantly brought the altcoin project close to its all-time high level. This could be highly profitable for thousands of investors. However, even a slight decrease could mean millions of dollars in losses for ARB investors. So, what can be expected in the future? Let’s examine together.

What’s Happening on the Arbitrum Front?

Arbitrum is trading at $2.16 and is close to reaching its all-time high. The ATH of $2.42 occurred earlier this year, and ARB is guaranteeing an 11% rally to surpass it. The chances of this happening are high for two reasons. The first is investor support, and the second is market conditions.

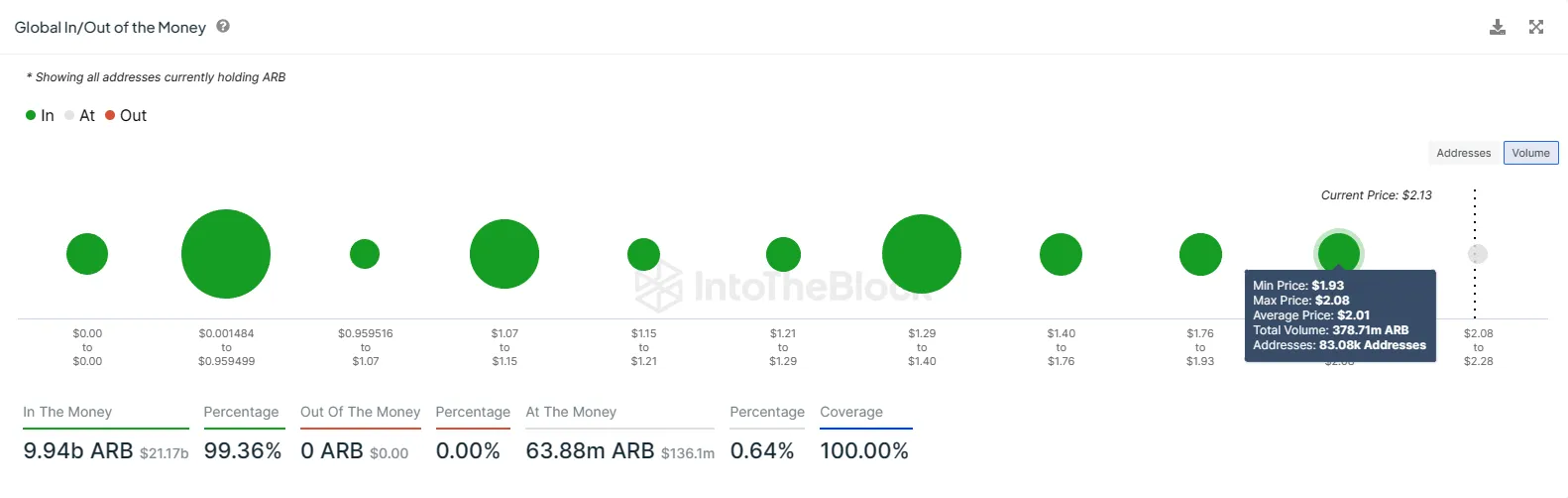

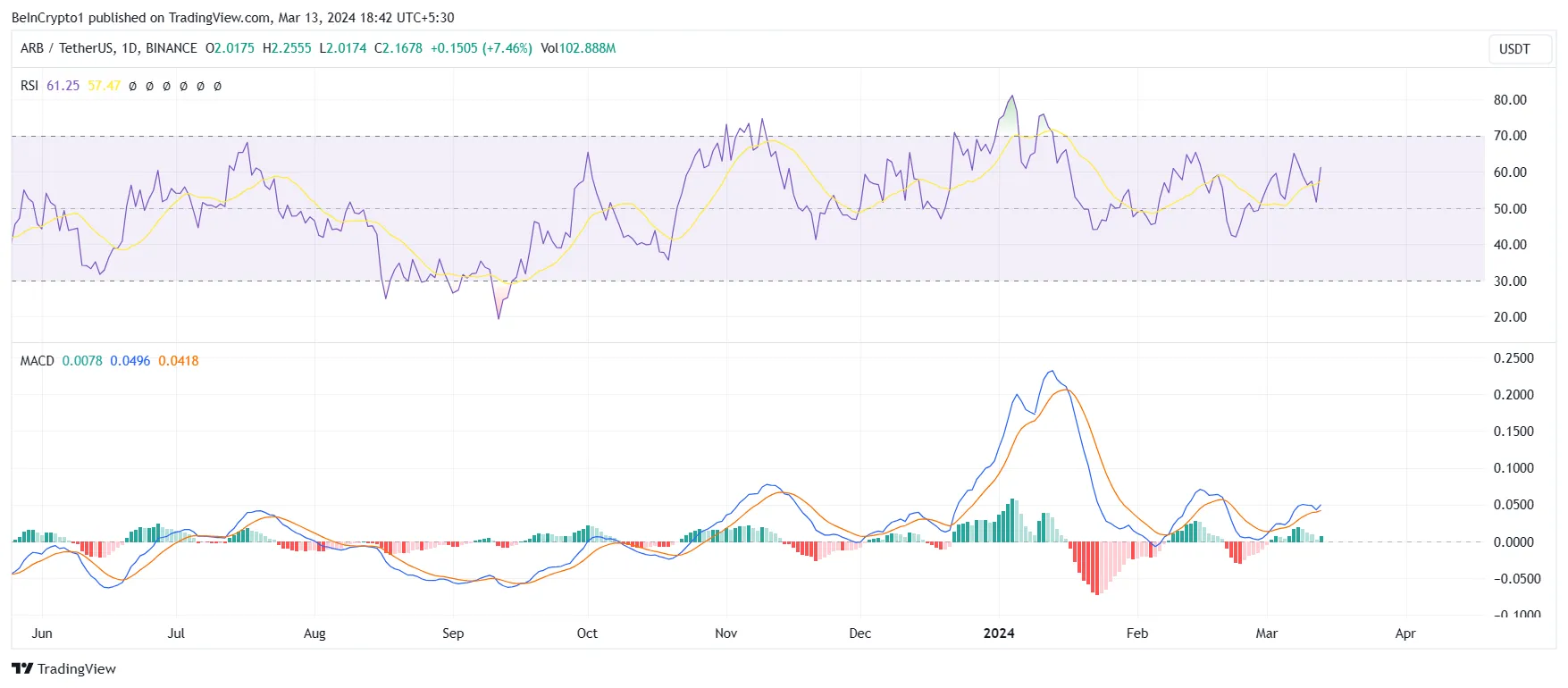

ARB holders will likely postpone selling until the aforementioned level is reached. This is because approximately 64 million ARBs, worth over $140 million, are on the verge of becoming profitable. Secondly, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) currently indicate an upward trend. RSI measures the speed and change of price movements, indicating overbought and oversold conditions.

MACD follows the relationship between two moving averages of a price, as a trend-following momentum indicator. It consists of a MACD line, a signal line, and a histogram that help identify trend changes and momentum processes. The first is in the bullish zone above the neutral line, and the second indicates an active bullish crossover.

ARB Chart Analysis

Considering the conditions mentioned above, Arbitrum’s price has enough momentum to complete an 11% rally in the coming days, which would make 64 million ARB profitable. This could also result in the altcoin reaching its all-time high level.

However, considering ARB’s sideways movement over the past few days, a potential decline cannot be ignored if investors choose to sell. A solid support base can be identified at $2.00, but losing this level could invalidate the bullish thesis due to $841 million worth of ARB facing losses. Consequently, Arbitrum’s price could test the next support at $1.68.