ARK Invest’s 2023 research report highlights that Bitcoin has historically outperformed major assets. The investment management firm’s annual report, published on January 31st, also included various research findings focusing on technological convergence in blockchain technology, artificial intelligence, energy storage, and robotics. A significant portion of the report is dedicated to Bitcoin portfolio allocation and the leading cryptocurrency’s performance since its inception, with a focus on data from the past three years.

ARK Invest’s 2023 Report

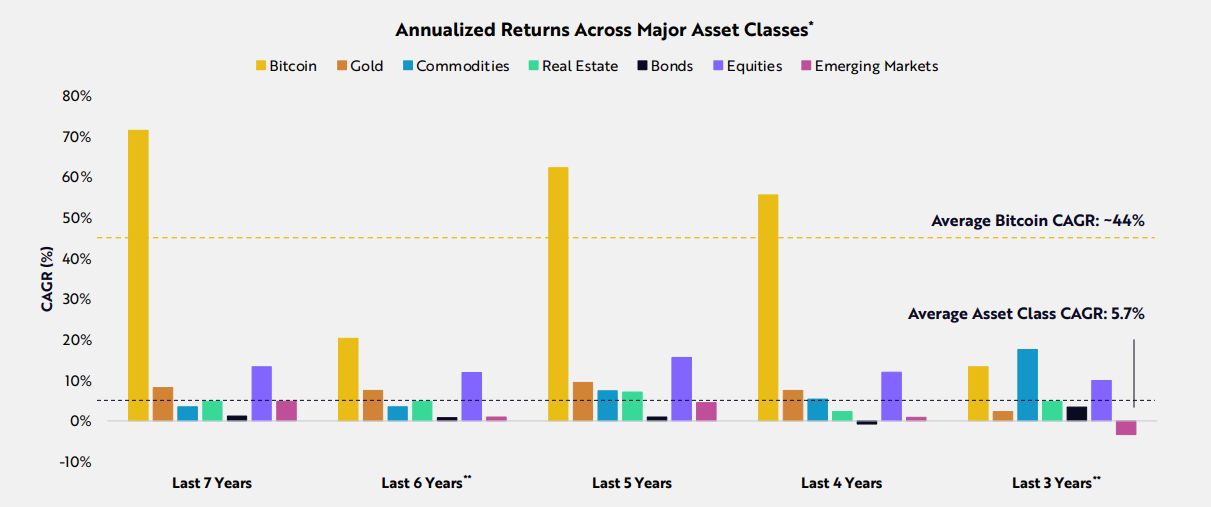

ARK has presented data reflecting Bitcoin’s superior performance over longer time frames compared to other major traditional investment assets. The average annual return of Bitcoin over the last seven years was reported to be 44%, while the average for other major assets was 5.7%.

Analysts note that Bitcoin investors with a long-term time horizon benefit from holding the asset over extended periods. The report mentions that Bitcoin’s historical volatility rate can obscure long-term returns due to short-term price increases and decreases:

“It would be more accurate to ask ‘how long?’ instead of ‘when?’. Historically, investors who have bought and held Bitcoin for at least five years have profited, regardless of when they made their purchases.”

ARK’s research examines the volatility and return profiles of traditional asset classes and suggests that a portfolio aiming to maximize risk-adjusted returns would have allocated 19.4% to Bitcoin in 2023.

Notable Details in the Research

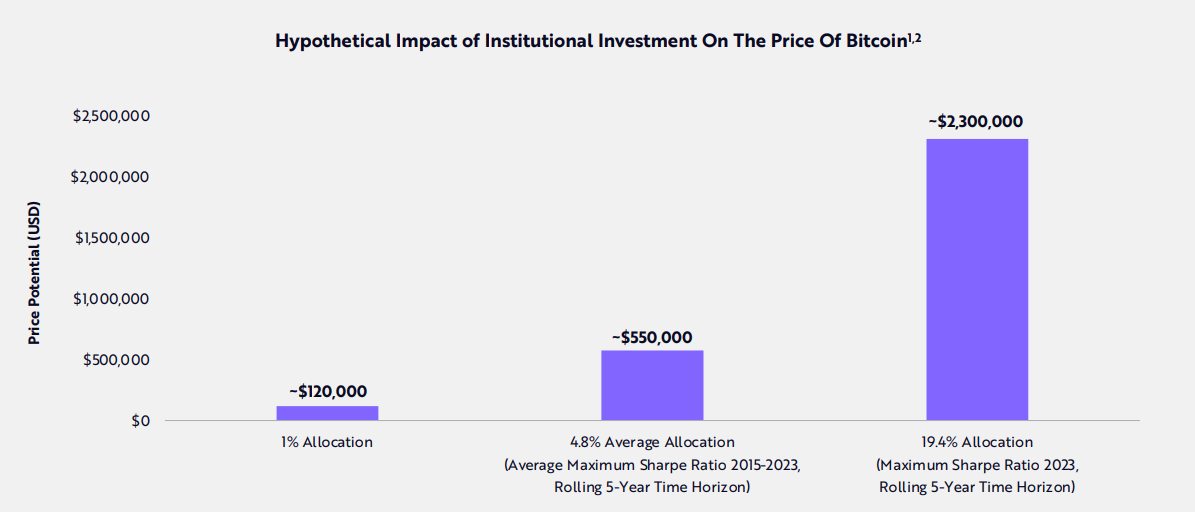

ARK’s research also considers a scenario where institutional investments from the $250 trillion global investable asset base follow a 19.4% Bitcoin portfolio allocation.

If the global asset base had invested just 1% of its assets in Bitcoin, the price could have reached $120,000. If the global investment base had allocated an average maximum Sharpe ratio of 4.8% from 2015 to 2023, Bitcoin’s price could have hit $550,000. Following ARK’s 19.4% allocation, Bitcoin would astonishingly be valued at $2.3 million per token.

ARK’s research takes into account a multitude of market data to reach the 19.4% Bitcoin allocation for maximizing risk-adjusted returns. Previous years’ projected allocations were more in line with other leading investment analysts and experts.