Australian Tax Office, announced it is investigating personal data and transaction details from up to 1.2 million crypto exchange users to potentially enforce crypto tax obligations. The Australian Tax Office (ATO), according to a statement seen by Reuters last month, said the data would help identify investors who might not have paid taxes on their crypto trading activities.

Notable Move in Australia

ATO; will seek personal data including users’ birth dates, social media accounts, and phone numbers, as well as wallet addresses, types of crypto asset trades, and bank account details. For Australian regulators, unlike other foreign currencies, cryptocurrencies are taxable assets. This requires investors to pay capital gains tax on profits made from sold crypto assets.

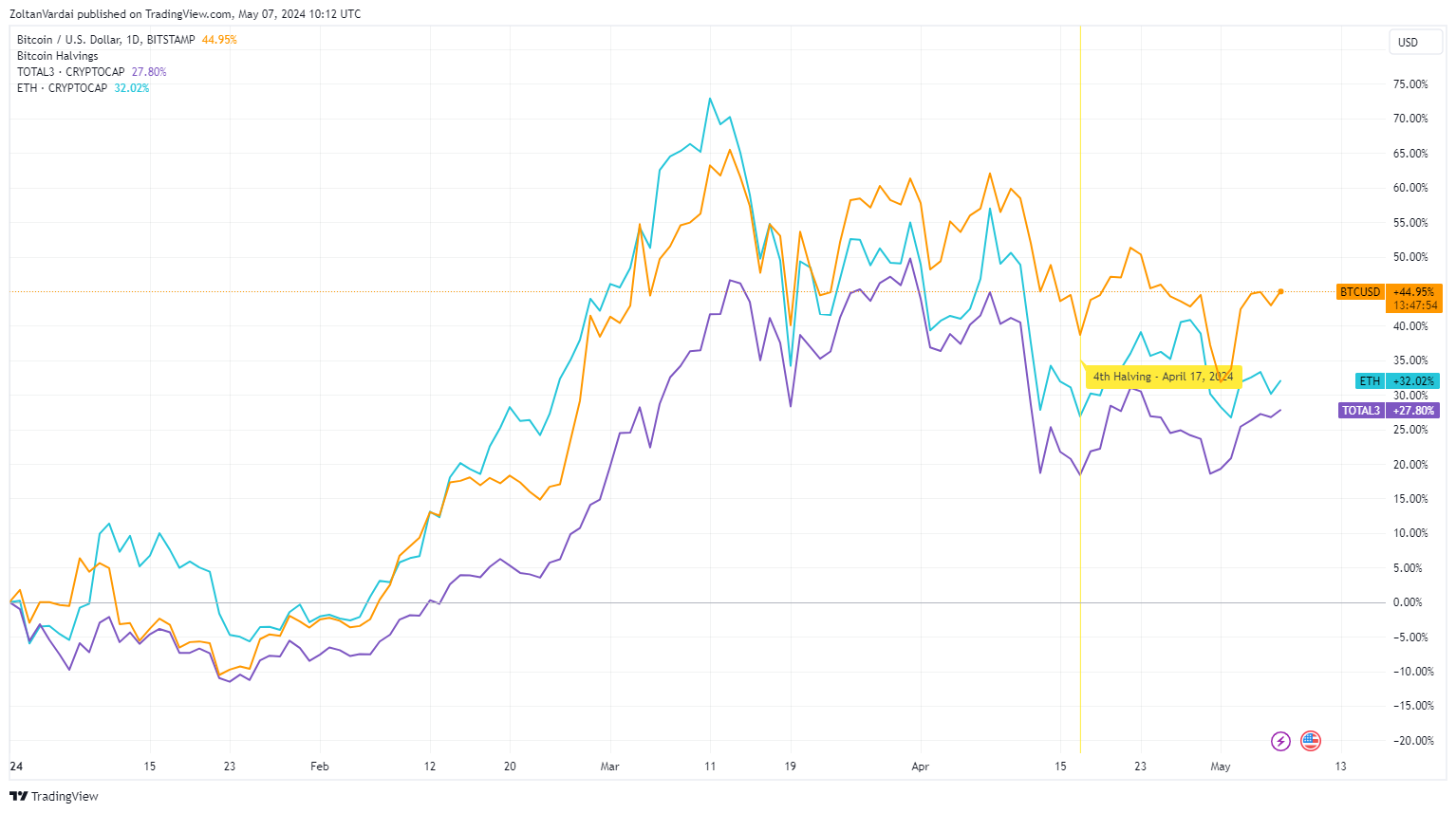

The news of the potential tax enforcement comes during a highly profitable period for crypto investors. Bitcoin has risen over 44% since the beginning of the year, while Ethereum has increased by 32% since New Year.

TradingView data shows that the market value of the best altcoin projects, excluding Bitcoin and Ethereum, has also risen over 27% since the beginning of the year. According to the ATO’s notification, the complex nature of the cryptocurrency field could lead to a lack of awareness when it comes to tax obligations:

“The ability to purchase crypto assets using incorrect information may make them attractive for those wishing to avoid tax obligations.”

Taxation Process in the Crypto Space

Australia, is not the only developed country trying to collect unpaid taxes on crypto asset gains. On May 6, Sahil Behal, General Manager of the Compliance Branch of the Canada Revenue Agency (CRA), reported that the agency conducted over 400 crypto-related audits and investigated hundreds of crypto investors to secure unpaid crypto taxes, according to a report dated May 6.

These recent audits are in addition to the CRA’s belief that there is still $39.5 million in unpaid taxes that need to be collected for the fiscal year 2023-2024. The Turkish government is expected to enact legislation related to crypto later this year. The new draft is expected to establish a legal basis for crypto taxes in Turkey, a leading crypto economy.

Regulators in the United States aim to raise the long-term capital gains tax rate to 44.6% for investors earning over $1 million per year. The same Federal Budget proposal under the Biden administration also included a 25% tax on unrealized gains for ultra-high-net-worth individuals.