The “unfortunate series of events” for Binance, one of the world’s largest crypto exchanges, appears to be far from over. The giant crypto exchange began facing serious problems, liquidity being at the forefront, especially after the lawsuit launched by the SEC. These issues, including those arising within Binance’s US affiliate, seem to have hit Bitcoin Cash (BCH) first.

Is Binance Experiencing a Liquidity Crisis?

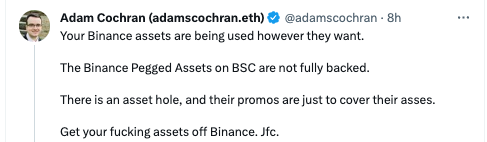

Due to the recent BCH liquidity crisis, Binance US had to suspend BCH transactions and withdrawals. As this issue was still on the agenda, a recent announcement from Binance related to this drew criticism and the puzzle pieces fell into place. Famous crypto analyst Adam Cochran shared his own interpretation of the situation.

A post shared by Binance Global at the end of June caught Cochran’s attention. According to the post, new trading pairs were added to Binance, and a BCH for TUSD pairing was introduced. The timing of the BCH/TUSD trading pair was quite noteworthy. Cochran claimed that Binance US did not have enough BCH assets to support customer balances, and hence the TUSD solution emerged.

Bad Vibes Around BCH/TUSD

According to the information shared by Cochran, a BCH/TUSD trading pair without any transaction fee was suddenly launched and people began to be directed there. True USD was recently alleged to be directly connected to Justin Sun and lost its 1:1 USD support. Binance’s move increased the suspicions.

Cochran then made a very harsh allegation. He stated that the assets on Binance are used by the platform as they please, emphasizing that the assets on the BSC network are not supported at a 1:1 ratio as believed. He pointed out that there is currently an “asset hole” and that Binance is trying to close this gap, inviting everyone to withdraw their assets from there.

Binance Global reveals the extent to which each asset is supported by the reserve evidence published on its own site, and it seems that BCH has support of 100% and above here.