Crypto currency exchanges have made it a tradition to publish reserve reports. By disclosing reserve reports, exchanges try to fulfill their responsibilities and commitments to their customers. The latest reserve report was released by Binance. The report is significant due to its publication after Binance’s $4.3 billion fine.

Binance’s Reserve Report

Binance announced its thirteenth reserve report on December 1 and showed a strong net inflow of $311 million compared to the previous month. This milestone underscores the platform’s enduring appeal and the increased trust of users in Binance’s ecosystem.

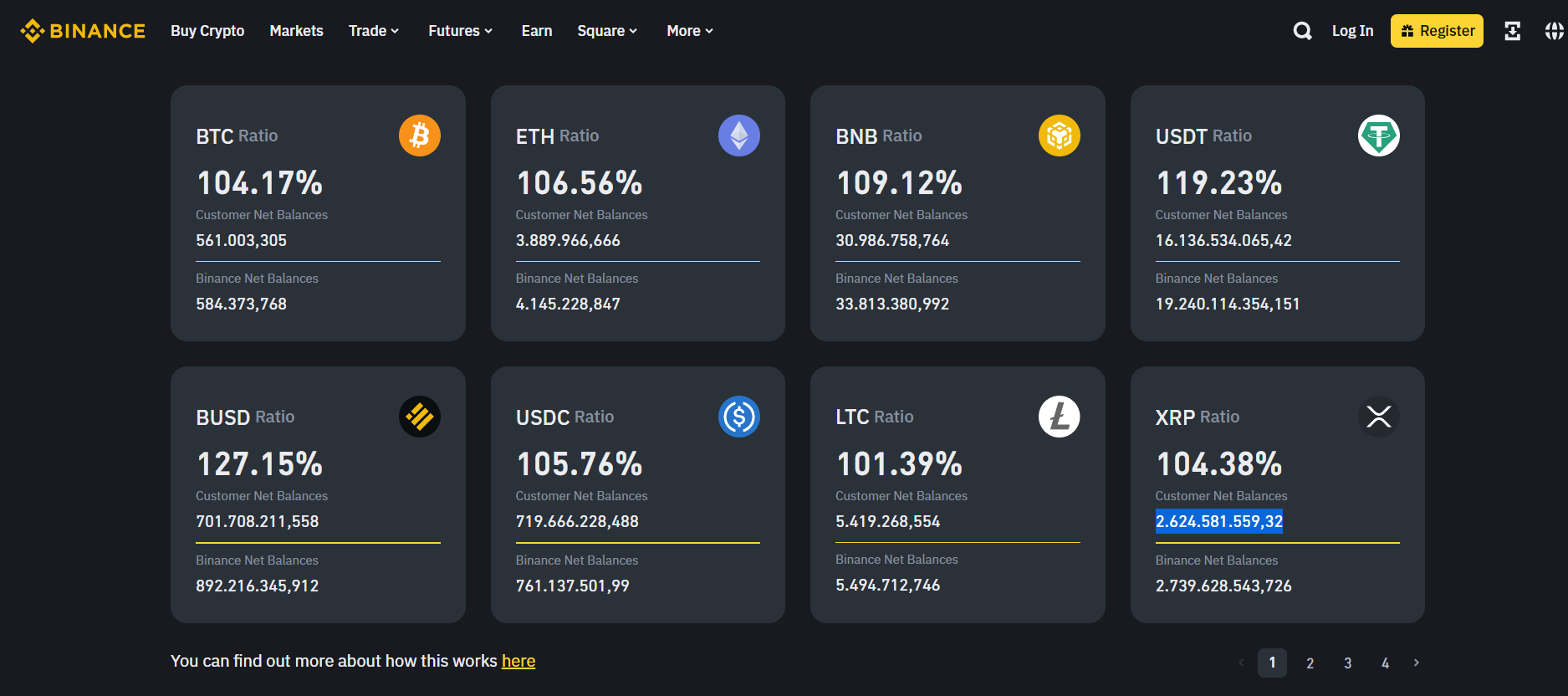

Looking at the user asset portfolio, the BTC assets were recorded at 561,000. On a monthly basis, there was a 4.05% decrease compared to the previous month. Accordingly, reserves in terms of BTC decreased by 23,656 BTC.

At the same time, the assets in Ethereum, totaling 3.88 million, saw a very low decrease of 0.67%.

On the other hand, customers’ USDT assets at the cryptocurrency exchange showed a significant increase, reaching 16.136 billion. This marks an $866 million increase compared to the previous month, with a percentage increase of 5.67%. The total USDT assets held by the exchange are 19.24 billion.

Navigating Binance’s Financial Environment

This announcement comes as Binance continues to be a central player in the cryptocurrency exchange arena. Users are benefiting from the platform not only for trading but also for innovative financial instruments such as reserve certificates.

These periodic disclosures not only demonstrate the platform’s commitment to transparency but also serve as a barometer for market trends and user sentiments.

Regarding the assets held by the exchange in other cryptocurrencies, Binance holds 33.813 million BNB, of which 30.986 million belong to customers. Binance also owns 5.494 million LTC, of which 5.419 million belong to customers. As for XRP assets, the exchange holds 2.739 billion XRP, 2.624 billion of which belong to platform users.

Strategic Moves on the Crypto Chessboard

Strategically releasing Binance’s thirteenth reserve certificate reflects its proactive approach to adapting to market changes. The increase in net inflow reflects the resilience of the crypto market and the confidence of users in Binance’s role as a financial facilitator on the crypto chessboard.

As the crypto world evolves, Binance users find themselves at the forefront of financial innovation. The platform’s ability to seamlessly integrate traditional financial elements such as reserve certificates with the dynamic world of cryptocurrencies positions users to take advantage of opportunities while navigating the constantly changing market landscape.