Today, the expiration of approximately $3 billion worth of Bitcoin and Ethereum options could significantly impact the cryptocurrency market. This situation may lead to a substantial increase in market volatility due to the expiration of a large number of contracts. The maximum pain points and put-call ratios of the options could determine the direction of market fluctuations.

Status of Bitcoin Options

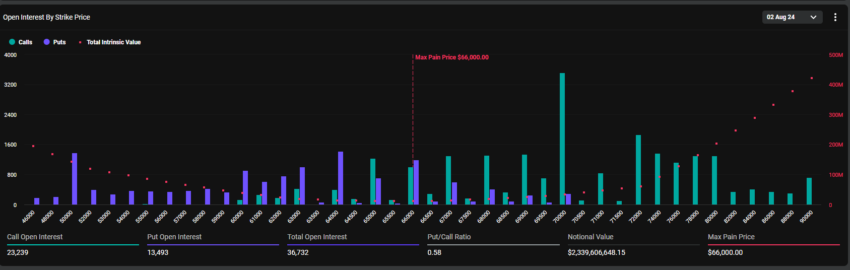

According to Deribit data, the total value of Bitcoin options expiring today is approximately $2.34 billion. The maximum pain point set for these options stands out at $66,000. The 36,732 contracts expiring today are lower compared to last week’s 61,320 contracts. This significant activity in Bitcoin’s options market is drawing investors‘ attention.

On the Ethereum side, 183,756 contracts are expected to expire. The total value of these options is $577.2 million, with a maximum pain point set at $3,300. The put-call ratio for these options is announced as 0.55, and their expiration could create significant activity in the Ethereum market.

What Are Maximum Pain Point and Put-Call Ratio?

In the crypto-based options market, the maximum pain point refers to the price level that causes the most financial pain to option holders. At this level, option holders experience the highest loss. The put-call ratio shows the ratio of put options (sales) to call options (purchases). This ratio provides information about the general trend in the market.

According to Greeks.live analysis, the Dvol Index’s drop from 62% to 48% since the July monthly delivery indicates a significant decrease in market volatility. These low volatility levels are among the lowest of this year. Analysts note that the smooth proceedings of the Bitcoin 2024 Conference and FOMC meetings have reduced volatility.

Bitcoin and Ethereum Prices

Bitcoin was trading at $66,342 at the beginning of the month but dropped to $62,000 during Asia’s midnight trading session. At the time of writing, Bitcoin is stabilized at $64,714. Ethereum experienced a sharper decline. It was trading at $3,317 on August 1st, dropped to $3,097, and then recovered to $3,178.

Analysts expect this quarter to be generally more optimistic based on historical trends. However, they note that there are no significant short-term opportunities. Therefore, they suggest that it is the right time to focus on medium and long-term buying options. It is also mentioned that Ethereum exchange-traded funds (ETFs) are expecting a steady flow of positive inflows.