Bitcoin has pushed its historical peak higher and the halving event hasn’t even occurred yet. Investors are therefore quite excited. As this article is being prepared, BTC is finding buyers above $69,000. The price, consolidating at its historical peak, might signal bigger upcoming rises for altcoins in the following days. So, how much could popular altcoins be worth in a potential rally or correction?

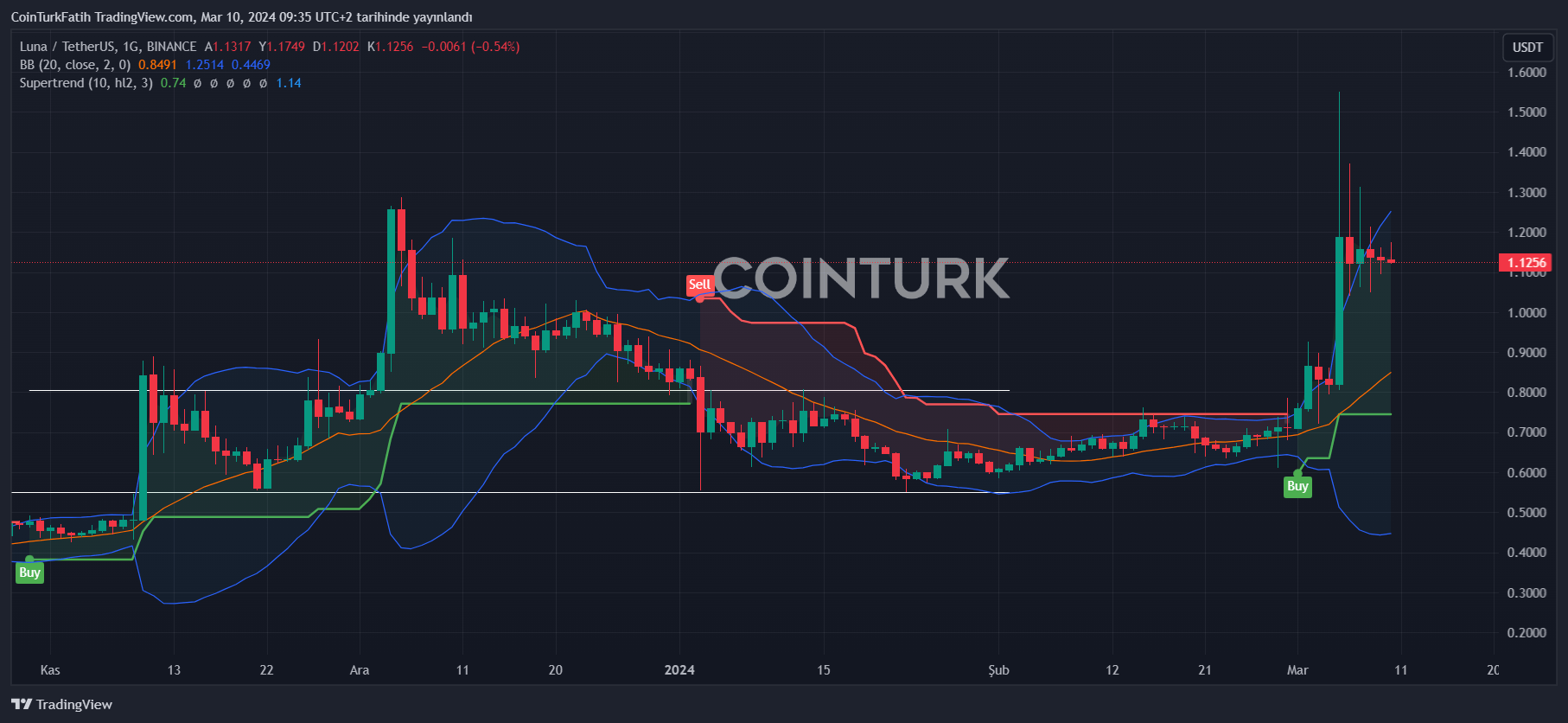

LUNA Coin Price Prediction

Terra founder Do Kwon is set to return to South Korea soon to face his deserved punishment. However, despite this, Terra (LUNA) currently seems to disregard its detained founders and executives. Spikes above $1.2 indicate that speculative rises are benefiting short-term investors. For now, the $1.1 level has turned into support, preventing a rapid decline.

In a potential downturn, we might see the price drop to $0.63 after $1.05 and $0.87. The risk here is that investors aiming to make easy money from short positions could be liquidated by irrational upward spikes.

Aptos (APT) Price Prediction

This week will see the unlocking of $300 million, and we will experience together how it affects the price. It is one of the altcoins launched at the end of 2022 and is among the strongest competitors to SOL Coin. Therefore, it has long-term growth potential.

The key area was $11, and APT Coin continues to close above it strongly. If BTC continues to linger at current levels, we could return to the $16.5 and $20.43 levels. Closures above the ATH level of $20.43 (excluding the absurd spike on the first day) could motivate a new peak in the $27-$30 range.

Solana (SOL) Chart Analysis

Despite spikes to the $103 region, SOL Coin price is targeting $150. If the price, which reached $152 this week, can overcome the $157 barrier, the rally may accelerate. In this case, targets of $176 and $205 will come into play.

In a potential decline scenario, a rapid return to $103 and closures below it could lead to a descent to the $88 support base.

Chiliz (CHZ) Commentary

While BTC dropped to $59,000, CHZ Coin offered a significant buying opportunity at $0.11. It is now lingering around the $0.156 barrier. Closures above this could pave the way to $0.17 and $0.2.

Türkçe

Türkçe Español

Español