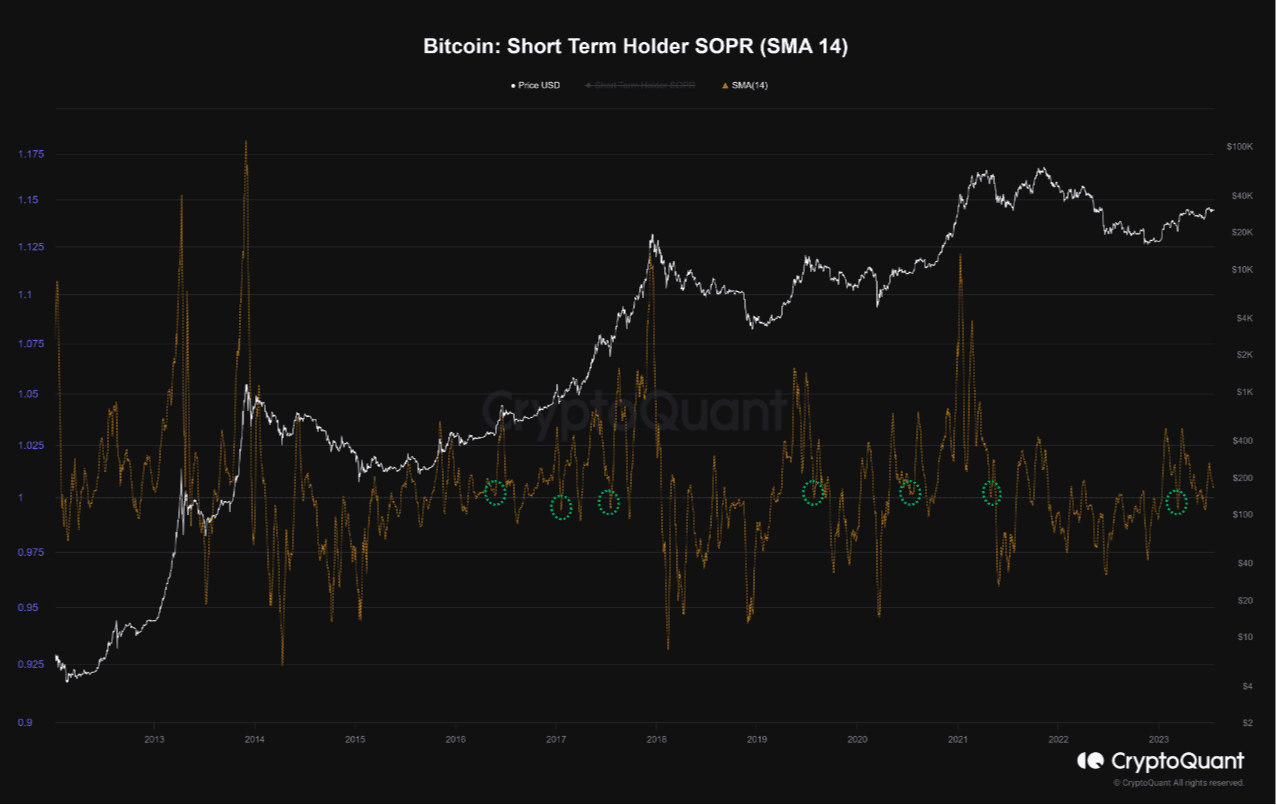

The drop of Bitcoin (BTC) below $30,000 has affected the previous gains of Short-Term Holders (STH). According to on-chain analyst Gustavo Faria, the Spent Output Profit Ratio (SOPR) of STH data was working close to 1.

BTC On-Chain Data!

SOPR provides an insight into the realized profit and loss of all crypto assets moved on the chain. A value below 1 means current sellers are losing money, while a higher value indicates sellers are making a profit.

Faria, who published his analysis on CryptoQuant, noted that after the bullish period of BTC, the SOPR range should have acted as a support zone. However, this was not the case. A push towards 1 can indicate that most STHs have made little to no profit. The expert crypto analyst stated:

Despite the tendency of investors to hold on, it is important to note that this is a price sensitivity zone, following the pattern observed from the 14-day moving average SOPR in other upward price movements.

If this metric is excessively high, it can mean that Long-Term Holders (LTH) have higher spent profit than STH. Additionally, when this occurs, it could imply that BTC may be close to the market peak. However, the SOPR ratio of 1.38 was relatively low. This suggests that BTC could be considered closer to the bottom than the top of the market. Therefore, the profits made by STH can be considered close to LTH data.

Santiment Reports!

Meanwhile, Santiment’s data showed that the Market Value to Realized Value (MVRV) long/short difference remained around 18.49%. Like the SOPR ratio, MVRV long/short difference measures the market value and profitability. Negative values of the MVRV difference can imply that long-term holders would make higher profits compared to short-term holders if they sell at the current price.

However, since the metric is positive, it means that STH would still generate more profits than LTH. On-chain data for the 30-day MVRV ratio showed a drop into the negative territory. This measurement provides valuable insights into investor buying and selling behavior. As the ratio increases, investors may be more willing to sell as potential profits increase. Conversely, a decrease in the ratio could mean that investors are not inclined to sell as their unrealized profits decrease.