BTC has once again crossed the $52,000 mark, leading Ether to target $3,000, and altcoin investors are feeling hopeful. What does the dollar index, S&P 500, and BTC price outlook tell us? Historically, these three have always provided significant signals about the short-term future of cryptocurrencies. Currently, the markets seem to be at a decision point, so it makes sense to look elsewhere for guidance.

S&P 500 Index (SPX)

The inflation data for January was significantly higher than experts anticipated. This started to temper the “excessive” part of the excessive optimism regarding the interest rate cut cycle. Over-optimism has often slapped investors in the face during tough bear markets.

There is a positive correlation between the S&P 500 and cryptocurrencies, especially Bitcoin. We also clearly see the impact of Fed policy on risk markets here. For all these reasons, monitoring the performance of the U.S. stock market is important. The index has rebounded from 4,940, so belief in the uptrend continues. However, bears won’t give up easily and are trying to defend the major resistance at 5,048.

The divergence in the RSI is a warning of a potential decline favoring the bears. If the index falls below 4,940, it will highlight the possibility of a strong correction. Conversely, if resistance is breached, the 5,200 level could be targeted.

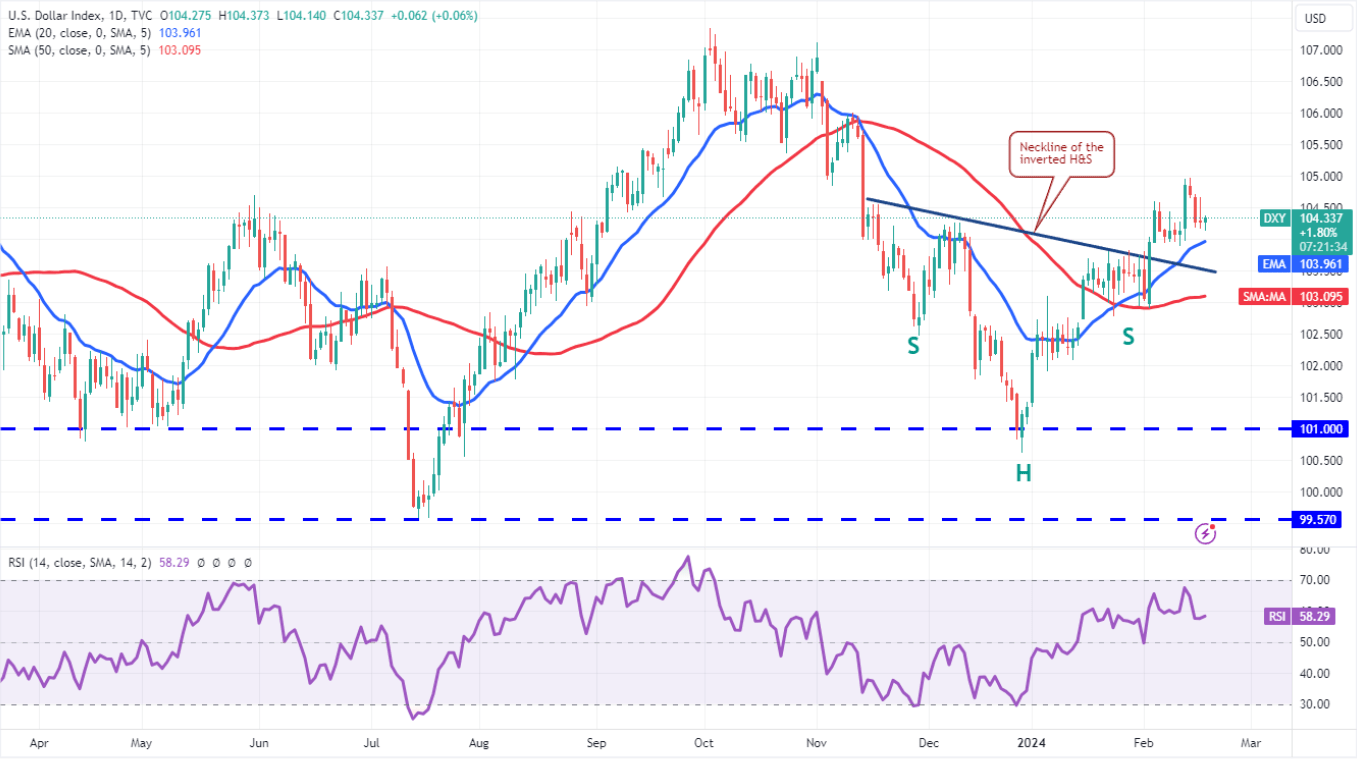

Dollar Index (DXY) Commentary

The U.S. dollar index shares an inverse correlation with Bitcoin, meaning its decline is favorable for investors. On February 13, supported by macroeconomic data, a rally began but was halted by the 105 resistance. The target for DXY is closing below 104 and dipping into the safe zone at 103. However, a recovery from the 104 area could lead to a swift rise to 106. The upcoming Fed minutes on Wednesday are significant in this context.

Bitcoin (BTC)

At $52,000, bears are actively selling, striving to maintain this area as a strong resistance. There is tight consolidation near a significant resistance, a pattern we’ve seen frequently in recent months. Although it usually results in an upward breakout, the price will need to pause at some point. If this pause doesn’t come sooner than feared, the price should reach between $58,000 and $60,000.

However, closings below $48,800 to $48,260 could trigger a shift to deeper support levels at $44,647 and beyond.