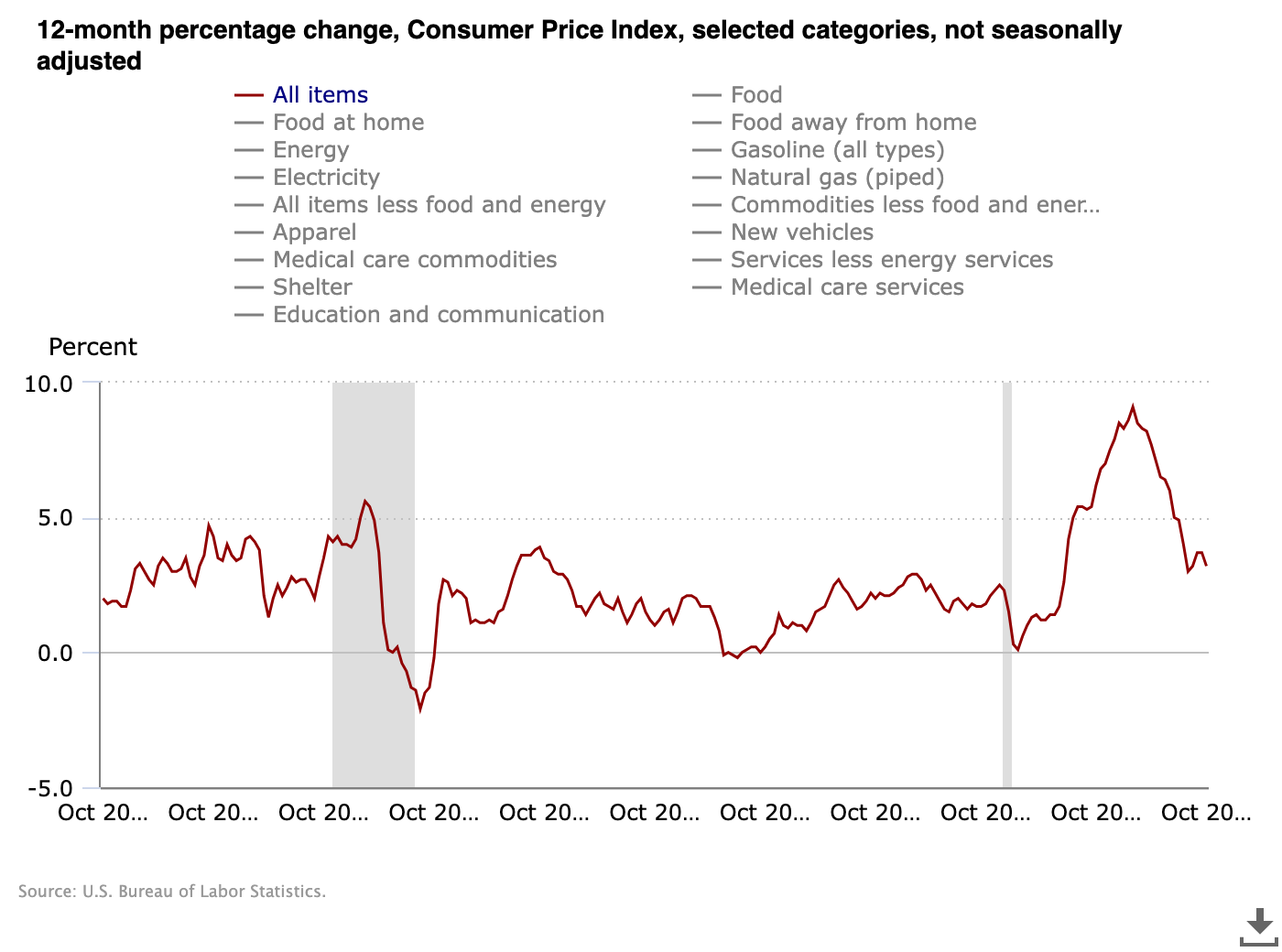

Today’s released inflation data in the US came in below expectations, and Bitcoin had its eye on the $37,000 level during the Wall Street opening on November 14th, but it faced significant selling pressure in the last hours. Data from TradingView showed that Bitcoin price reacted noticeably to the slowing inflation expectation reflected in the Consumer Price Index (CPI) data for October. So, what can we expect for Bitcoin in the coming period? Let’s take a closer look.

What Happened with CPI?

CPI was announced below market expectations both on an annual and monthly basis. The annual change reflected 4.0% for core CPI, compared to 3.2%. The official press release by the US Bureau of Labor Statistics stated:

“The index for all items increased 3.2 percent over the 12 months ending in October, a smaller increase than the 3.7-percent rise for the 12 months ending in September. The index for all items less food and energy increased 4.0 percent over the last 12 months, the smallest 12-month change since the period ending in September 2021.”

Compared to the October, where CPI was the only inflation data that exceeded market expectations, the situation was significantly different. With this development, stocks immediately reacted at the Wall Street opening, and the S&P 500 closed the day with a 1.5% increase. In parallel with the recent CPI announcements, Bitcoin gave a below-expected response and revisited its intraday low before rising towards $37,000.

Fascinating Comment from a Famous Platform

However, Material Indicators, an on-chain data monitoring platform analyzing market data, stated that liquidity remained generally weak. With whales remaining silent in the market, the rate of individual investors trading in Bitcoin increased even more.

Material Indicators commented on the pressure on the order book liquidity for the BTC/USDT pair on the Binance cryptocurrency exchange, as well as the fact that the smallest 2 order classes are buying, saying it is not a coincidence:

“The upward liquidity around the active trading area is so weak that whales cannot place large orders without causing significant slippage. As we monitor smaller order classes on FireCharts CVD, we see that as support strengthens above $36,000, the price of Bitcoin rises.”