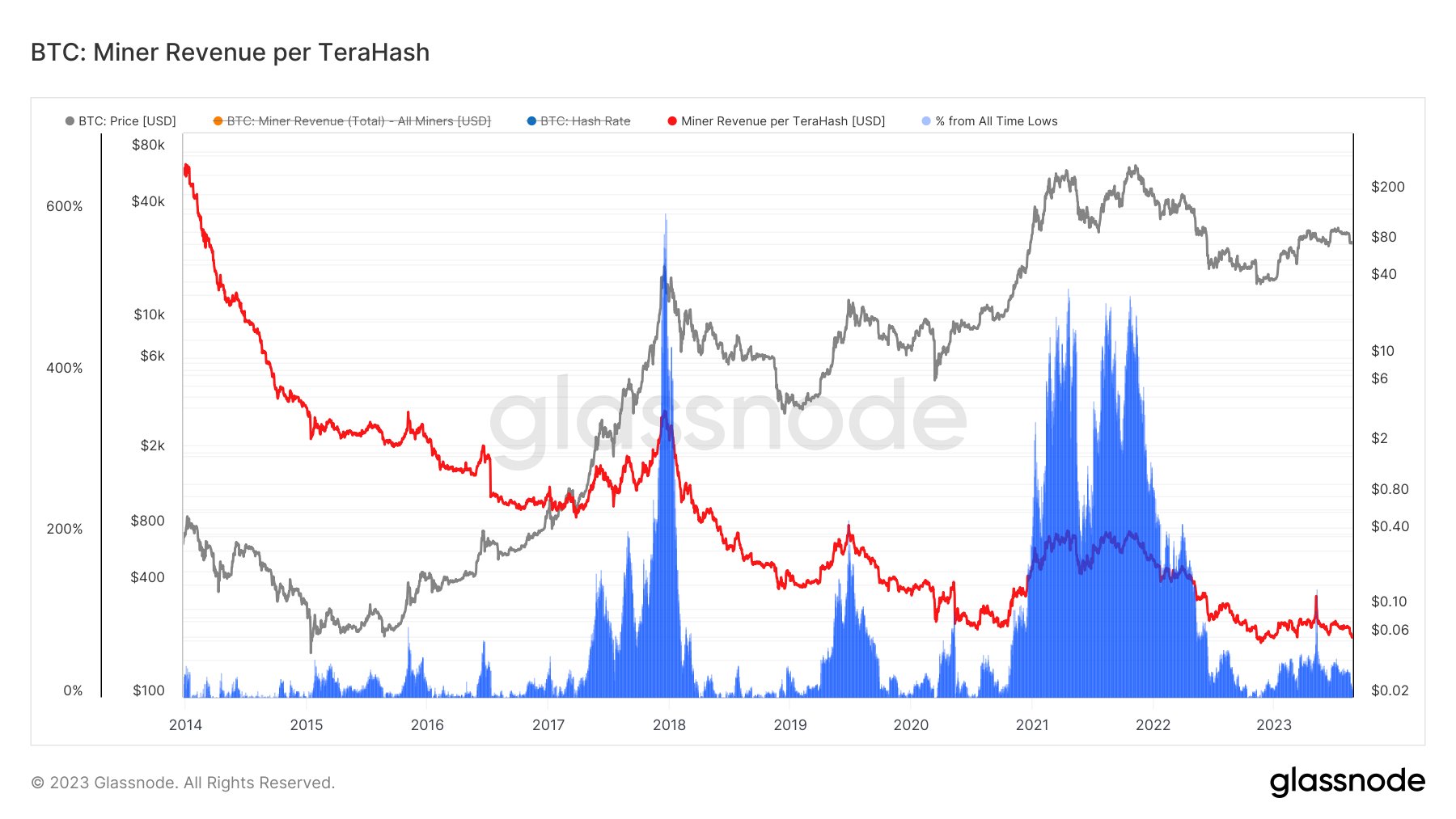

Bitcoin mining revenue, or the measure of dollars earned per daily TH/s, has reached unprecedented levels since the collapse of FTX in November 2022, while the hash rate has reached new highs. Bitcoin miners are using funds obtained from stock sales to survive the bear market, but this is causing concern among some shareholders and increasing pressure in the market.

Mining Revenue Decreased by 50%

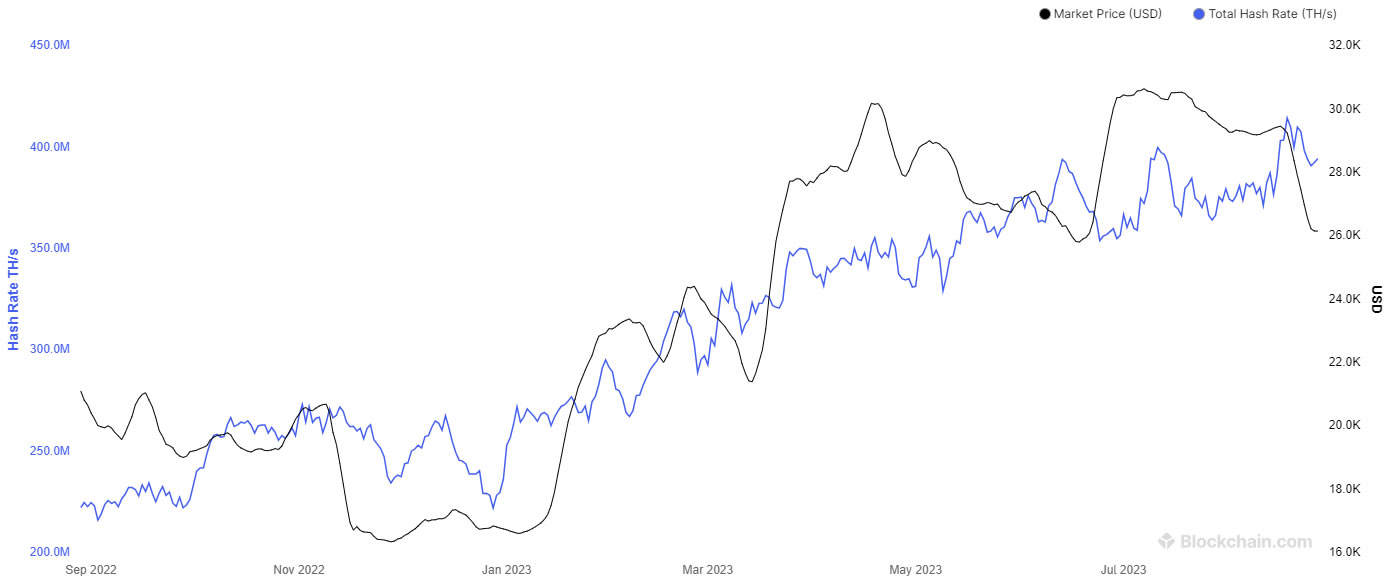

Last week, the Bitcoin network’s hash rate reached a new peak of 414 exahash per second (EH/s) on August 18, according to Blockchain website. This peak indicates a 54% increase compared to the value at the beginning of 2023 and an 80% increase in the past 12 months.

However, things are not going so well for Bitcoin miners in terms of revenue, as it has sharply declined and reached the lowest levels of a market cycle of around $16,500 in November 2022. According to HashPriceIndex, the revenue is only $0.060 per daily second terahash, which is about half of the level at the beginning of May, when the Bitcoin Ordinals mint frenzy caused intense demand for block space.

Bitcoin Price Should Rise

Market analyst Dylan LeClair commented on the declining revenue and the peak hash rate, stating that more efficient new machines will continue to be produced, but “it’s almost time for the price to catch up” and that prices need to be adjusted upwards to keep mining profitable at such high hash rates.

Bitcoin miners were reported to rely on funds obtained from stock sales to survive the bear market. On August 24, Bloomberg reported that 12 major publicly traded miners raised approximately $440 million through stock sales in the second quarter.

Mark Jeftovic, who manages the Bitcoin Capitalist newsletter, said, “Some mining companies are putting excessive pressure on their shareholders by selling stocks.” He added, “If you are being pressured more than the rise of Bitcoin, then you are on the wrong track on a treadmill.”