Bitcoin (BTC)  $91,081 mining revenues experienced a sharp decline following the block reward halving in April 2024. Daily revenues dropped from $70 million to $31 million, yet the stocks of mining companies remained surprisingly stable. Despite falling behind Bitcoin’s price performance, these stocks exhibited stronger-than-expected resistance and showed signs of recovery during a period when revenues approached their low point.

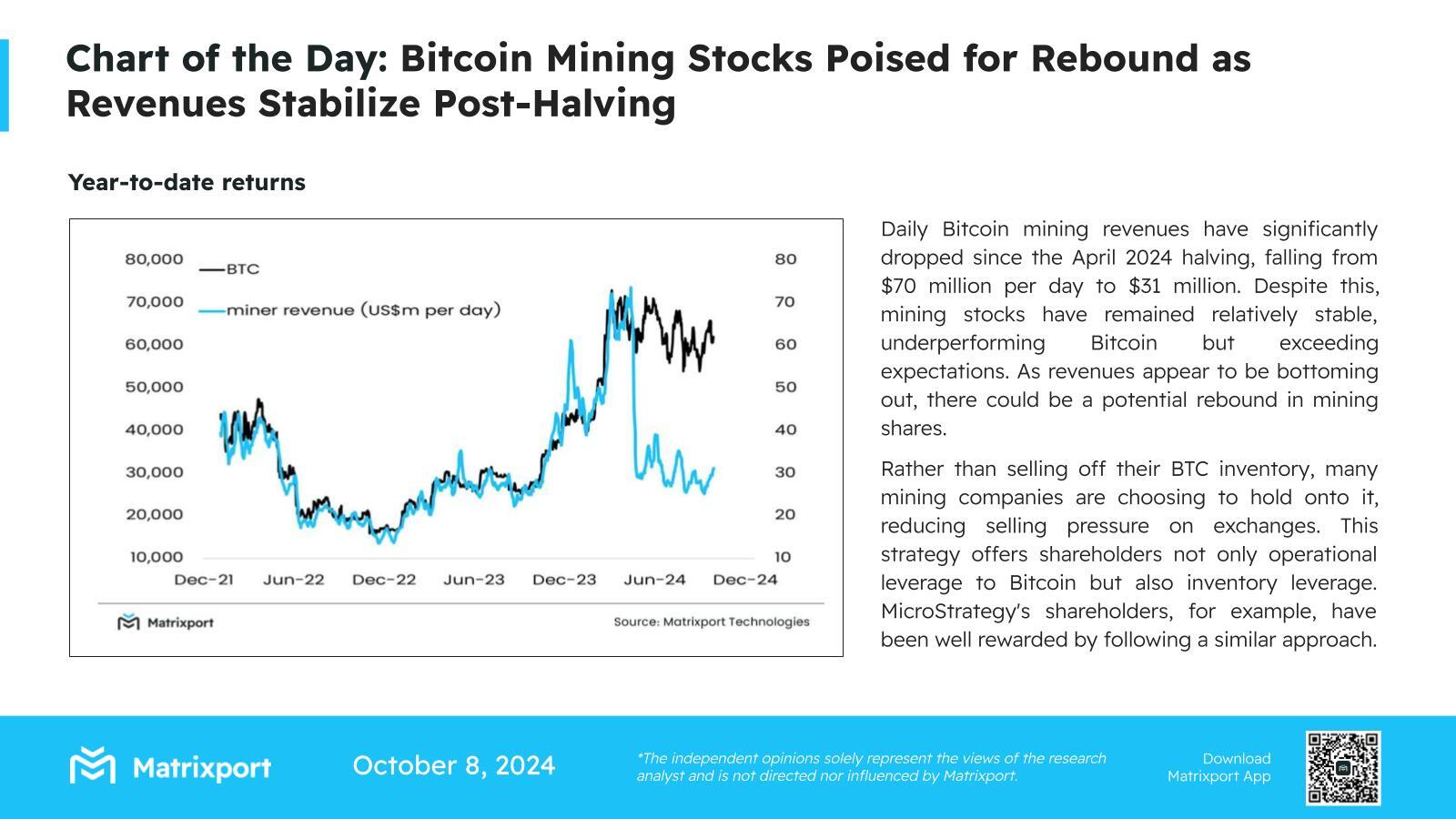

$91,081 mining revenues experienced a sharp decline following the block reward halving in April 2024. Daily revenues dropped from $70 million to $31 million, yet the stocks of mining companies remained surprisingly stable. Despite falling behind Bitcoin’s price performance, these stocks exhibited stronger-than-expected resistance and showed signs of recovery during a period when revenues approached their low point.

Mining Revenues Decrease, Stocks Remain Stable

Following the block reward halving, there has been a significant reduction in revenues generated from Bitcoin mining. However, according to Matrixport, despite this development, the stocks of mining companies performed better than market expectations, showcasing a robust stance. Market analysts suggest that strategic moves by the companies are behind this resilience.

Many mining companies prefer to hold their Bitcoin inventory rather than selling it on exchanges. This strategy reduces selling pressure on exchanges while also supporting the price of the leading cryptocurrency. In the long run, this approach offers mining companies opportunities to benefit from price increases and leverage their BTC inventories in trading.

Companies like MicroStrategy have distinguished themselves as significant gainers by choosing to hold their Bitcoin assets instead of selling. These actions also contribute to the long-term strengthening of mining company stocks, reducing the impact of short-term fluctuations.

Future Opportunities and Expectations

According to Matrixport, as mining revenues approach their lowest point, there is high potential for recovery in mining company stocks. This suggests that new opportunities may arise for participants in the Bitcoin mining sector in the future.

All these developments indicate that the industry is shaped not only by immediate performances but also by long-term strategies.