Since the beginning of February 2024, Bitcoin‘s price has seen a 25% increase, influenced by the approval of spot Bitcoin ETFs in the United States and subsequent accumulation by major whales. Additionally, the decreasing BTC supply and increasing mining difficulty suggest that miners may face pressure to sell. On the other hand, the Fear and Greed Index points to extreme greed with a value of 76, supporting the view that sales might start.

Are Bitcoin Miners Heading Toward Selling?

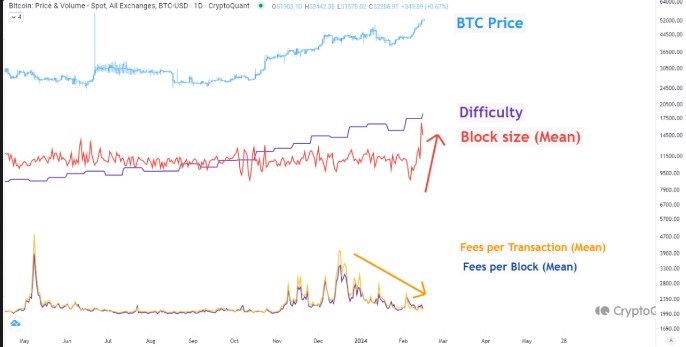

According to an analyst at CryptoQuant, the recent rally in BTC has also led to an increase in Bitcoin network activity, with the Bitcoin block size showing an approximate 40-50% increase.

It is known that an increase in network activity has an upward effect on block size, which typically leads to higher fees. However, a significant increase in fees has not been observed, raising questions about whether the increase in block size is related to high-volume BTC trading.

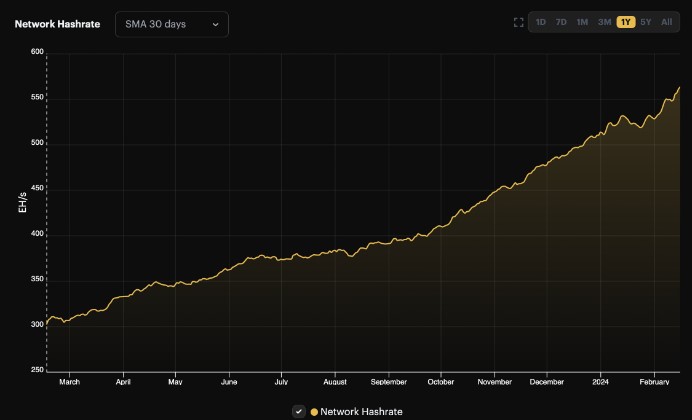

Although mining difficulty and block size are independent concepts, it is a known fact that block size indirectly affects mining competition. According to data provided by BTC.com, the Bitcoin mining difficulty has reached a value of 81.73T as of the time of writing, while the network’s hashrate has nearly doubled over the past 12 months, rising from 303 EH/s to 577 EH/s.

This situation could create an environment where the increased mining difficulty and block size amid the movement in BTC prices pressure individuals and institutions involved in Bitcoin mining to sell their assets.

Current State of Bitcoin Reserves

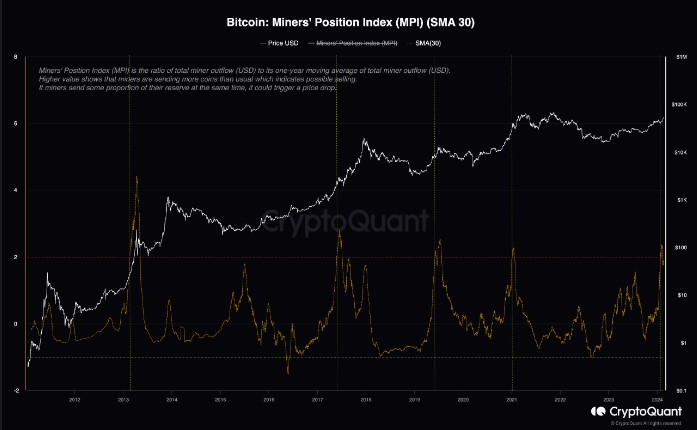

Particularly, when examining the Bitcoin Miners’ Position Index (MPI), the selling pressure on miners is emphasized, causing significant concerns among investors.

Historical data shows that during periods when the MPI index was high, a noticeable decrease in miners’ reserves was observed, leading to a correction in BTC prices.

As of today, miners’ reserves are at a three-year low due to the demand created by spot Bitcoin ETFs and market conditions. Meanwhile, looking at the reserves held by exchanges, it is thought that by the end of November, levels could fall below the critical 2 million BTC mark.

On the last trading day of the week, Friday, Spot Bitcoin ETFs hosted a net inflow of $323.90 million, and since being approved and starting operations, inflows have almost reached the $5 billion level.

While all these events are taking place, the BTC price has also experienced a decline of over 1% in the last 24 hours, finding buyers at the level of $51,640. Lastly, popular crypto analyst Ali Martinez also made a prediction in recent days, indicating that a downturn could occur in the next few days.