The leading cryptocurrency is lingering at $61,400, and altcoins have started moving sideways again. The rise in BTC price not surpassing $62,500 limits risk appetite for now. On the other hand, examining the current state of Bitcoin whales and miners can give us an idea of what is happening.

Bitcoin On-Chain Commentary

BTC miners’ reserves had fallen to a 10-year low. This explains the long-standing sales. Continuous outflows from the ETF channel also supported the losses in BTC price. At the time of writing, BTC miner reserves returned to the June 19 level. Continuous miner sales are not unreasonable due to increasing costs and the BTC price being at a reasonable point for selling.

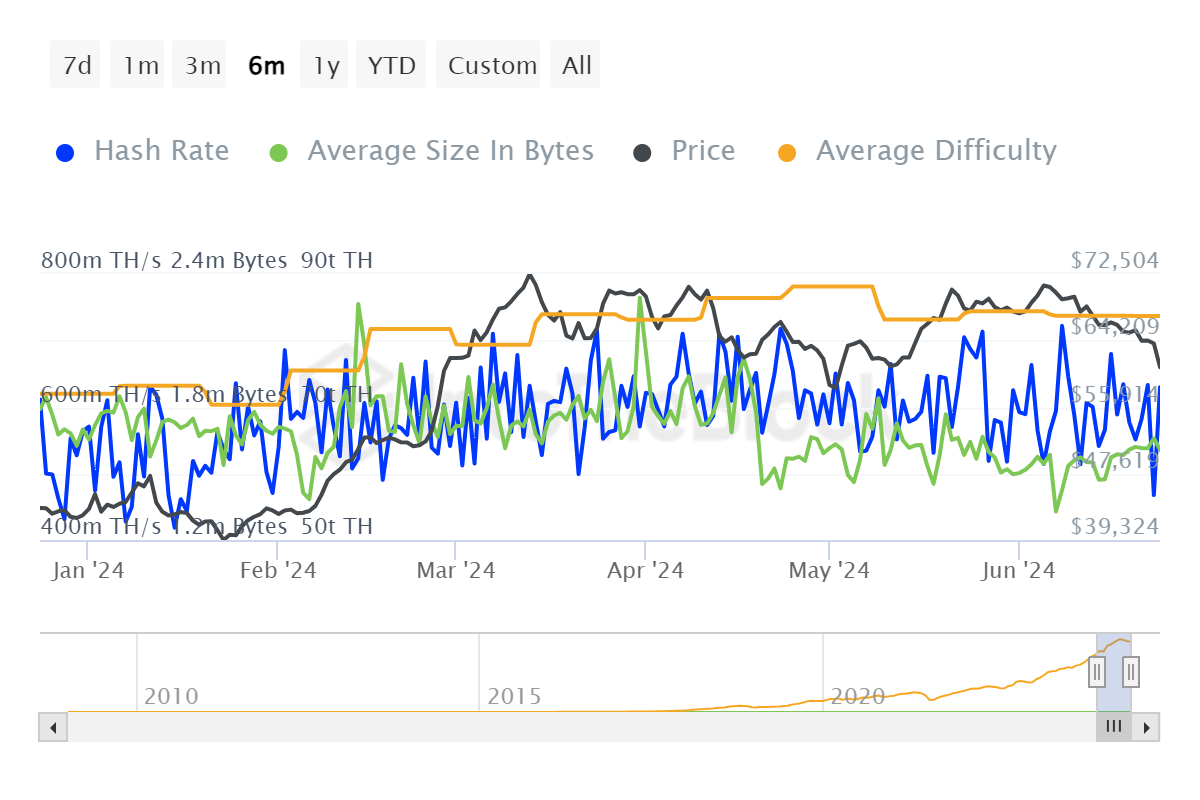

In the last 30 days, miner reserves fell by 1.18% and by 1.45% in 90 days. Considering the daily continuous production, we can say that miners’ sales are stronger than the reserve depletion. The halving reduced profitability, leading to the shutdown of inefficient ASIC devices, which also weakened the hash rate.

As of early June, the hash rate is weakening. This confirms the thesis that miners are shutting down operations. The weakness among miners also led to a reduction in reserves, and in June, we saw excessive sales not seen in a long time. On the daily chart, BTC hit the year’s low partly because of this. Moreover, the weakening of block sizes by ordinals shows us that miners’ fee revenues are also weakening, which feeds the sales.

Other Data

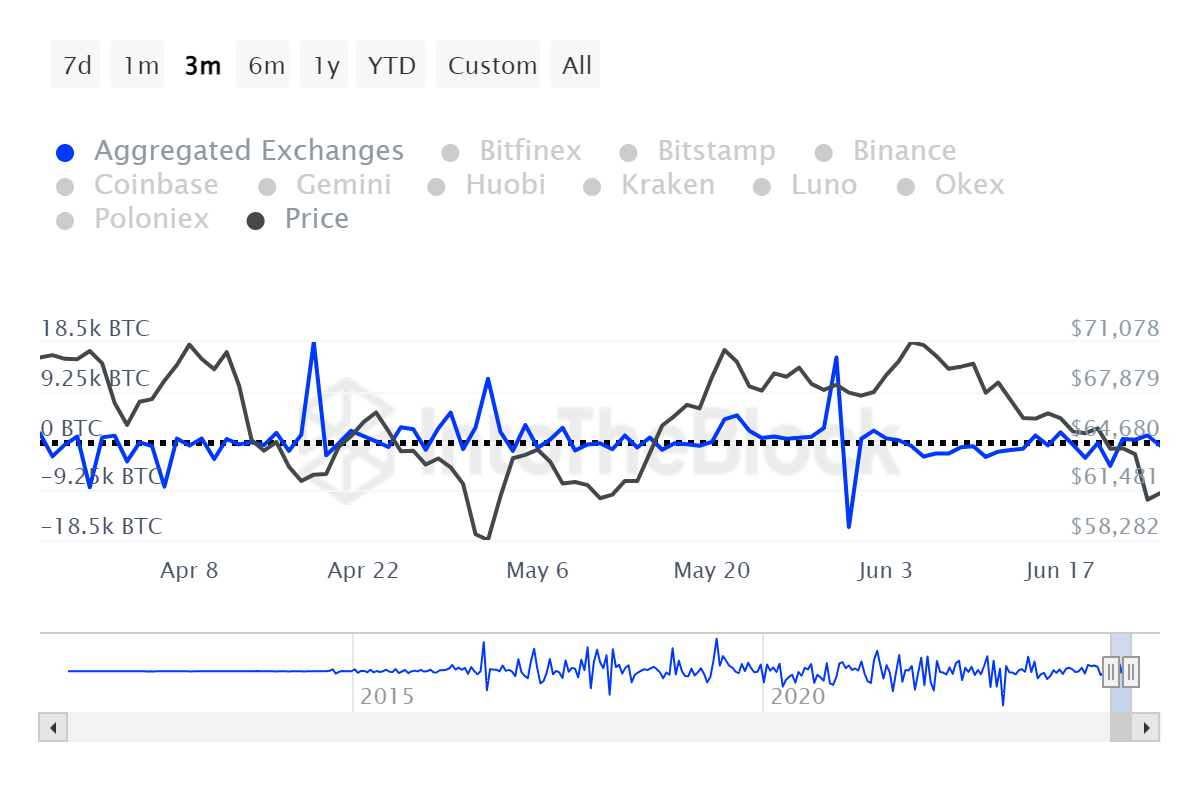

Net inflows to exchanges continued on June 22 and 24, and during this time, the BTC price weakened. However, there was a net outflow of around 800 BTC from exchanges yesterday. This shows that after the recent decline, the assets transferred to exchanges for sale are now lagging behind those withdrawn for storage. If this continues, it is a positive development.

The increased Google search trend data on June 22-24 has now dropped again. The weakening of search data, which reached the May peak this month, also reflects a lack of interest. The search trend, which climbed to 100 in April, has been below 59 for months. In bull markets, this data should hover around at least 50. This indicates that the consolidation process may continue for a while.

Finally, while whale transactions increased, the BTC price fell. This shows that whales moved to sell in mid-June. In summary, while miners remain inclined to sell, investors show summer indifference. How long this will continue is uncertain. BTC may see limited rises during this process.