The year 2023 started off well, continued in a challenging manner, and seems to be ending on a positive note. However, it is still too early to celebrate. The price of Bitcoin was stuck at around $36,500 on Sunday, November 19. But on-chain metrics are sending promising signals for the king of cryptocurrencies. Moreover, this good news also affects altcoin investors.

Bitcoin On-Chain Analysis

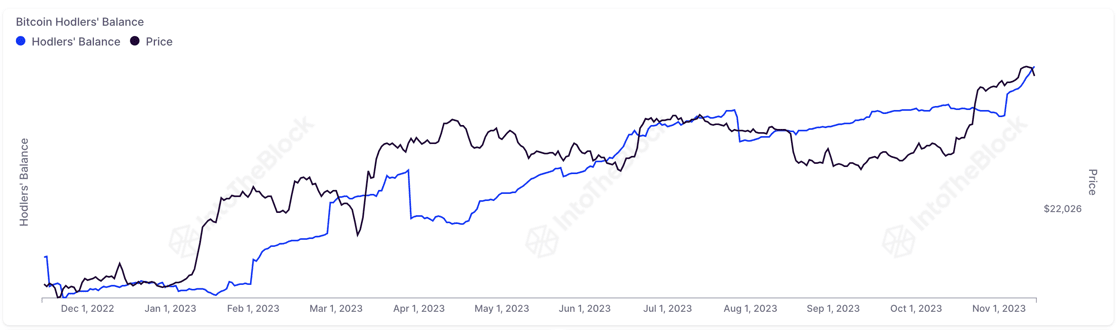

Fluctuations in BTC price affect the charts of altcoins, and this is quite normal. So, what’s the current situation in the on-chain arena? According to a recent IntoTheBlock report, the amount of Bitcoin held by long-term investors has reached a new record level. The increase in the percentage of long-term investors could indicate the end of the accumulation phase and the beginning of a bullish trend.

This growth in this category demonstrates confidence in a potential future price increase. However, when the price reaches a certain point, investors in this group will start creating selling pressure in profitable zones.

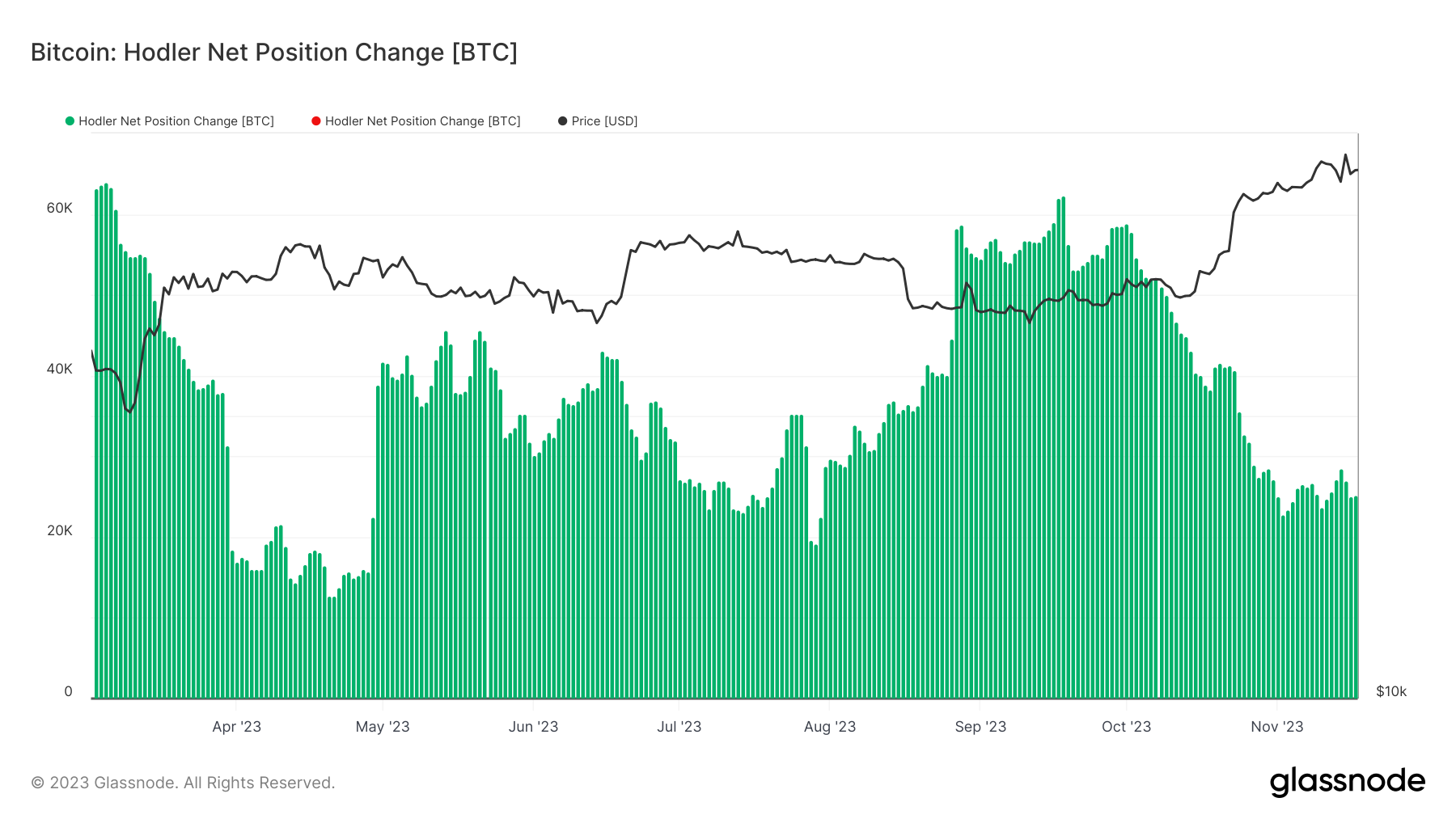

An analysis of Bitcoin Hodlers’ net position change prepared by Glassnode emphasizes the stability in long-term investor demand. This indicates that investors have increasing confidence that the bear season marked its bottom last year.

The Future of Bitcoin Price

The small detail in the Glassnode graph is the sales made by long-term investors that cannot turn their net position negative. This shows that the sales made in the middle of the resistance test at $38,000 were also supported by long-term holders. This is not surprising, as gains exceeding 100% over a period of one year are satisfying for some investors. At the same time, it can be reasonable to sell at resistances, albeit risky, for those who want to reduce their costs.

The graph has continuously shown growth and has reached a record level. Recent data indicates that the number of long-term investors has increased by over 1 million since November, reaching 50.5 million.

The price of Bitcoin experienced a slight drop as it failed to hold the $37,000 level. However, ongoing spot purchases are preventing the price from plunging deeper for now. What matters is the weekly close we will see in the coming hours and its position above $37,000, which is crucial for a short-term rapid rise. However, even delayed closures above $35,500 will indicate that the recovery will continue.