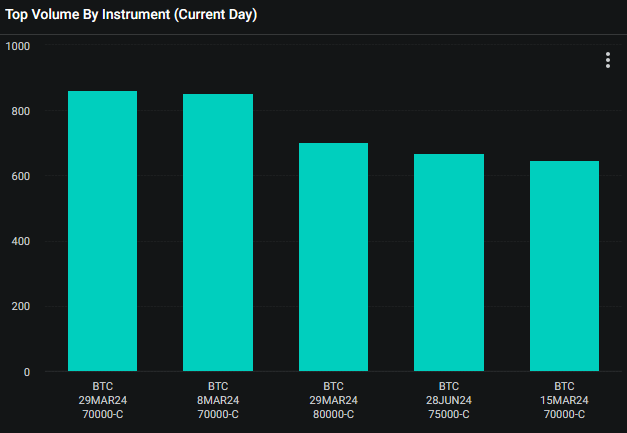

According to an analyst, Bitcoin options indicate a bullish momentum for the upcoming end-of-month expiry, as evidenced by strike position and put-call ratio. Jag Kooner, the Head of Futures Products at Bitfinex, stated that since Bitcoin reached its all-time high, the most traded instruments by volume have been monthly and mid-month expiry call options with a $70,000 strike price.

What’s Happening in the Futures Market?

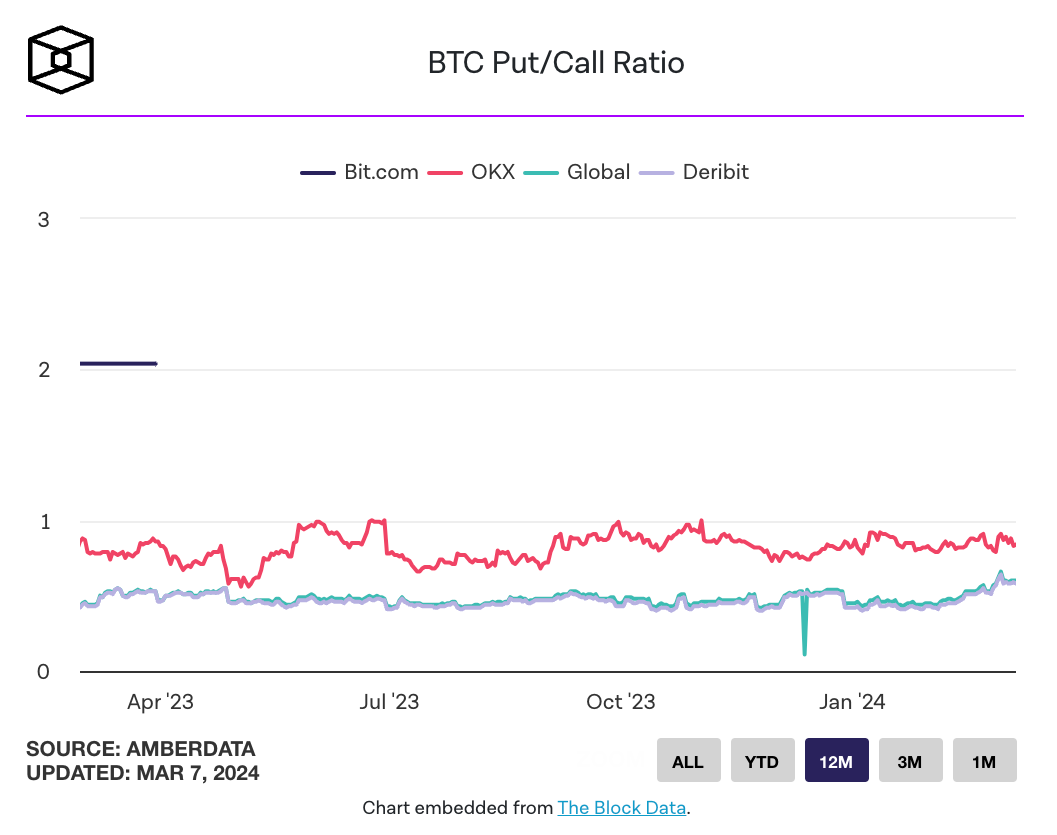

The concentration of call options with a $70,000 strike price for both the weekend of March 8 and the end-of-month expiry in March on Deribit, the world’s largest Bitcoin options platform, has caught the attention of many analysts. Kooner suggests that the current put-call ratio of Bitcoin options indicates investors are leaning towards a bullish trend. Kooner made the following statement:

“The put-call ratio has consistently stayed below 0.6 for the first time in six months, and the 24-hour put-call ratio is at an even more bullish 0.47.”

According to The Block’s Data Dashboard, the global put-call ratio for Bitcoin options is currently at 0.6. A put-call ratio below 1 signifies bullish momentum, indicating more interest in potential upward movement. Conversely, a put-call ratio above 1 typically points to a bearish trend and shows more interest in downward protection.

Details on the Futures Market

The Head of Futures Products at Bitfinex noted that the high volatility in the options market has recently decreased, which points to lower volatility expectations among investors in the last 24 hours. As a result, the option premium has dropped across all strike prices, making it cheaper to take positions. Deribit’s volatility index for Bitcoin has fallen from 77% to 72% in the last 24 hours. Kooners commented on the matter:

“Lower volatility values typically lead to a decrease in option premiums because the expectation of a lack of volatility in the future compared to the past provides lower risk for options market participants.”

Options are derivative contracts that give an investor the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. A call option grants the right to buy, while a put option grants the right to sell. It is assumed that an investor who buys a put option is indirectly bearish on the market, while a call option buyer is considered bullish.

Türkçe

Türkçe Español

Español