The movements in the price of Bitcoin, the world’s leading cryptocurrency, typically significantly affect the broader market.

Headlines from the Fed!

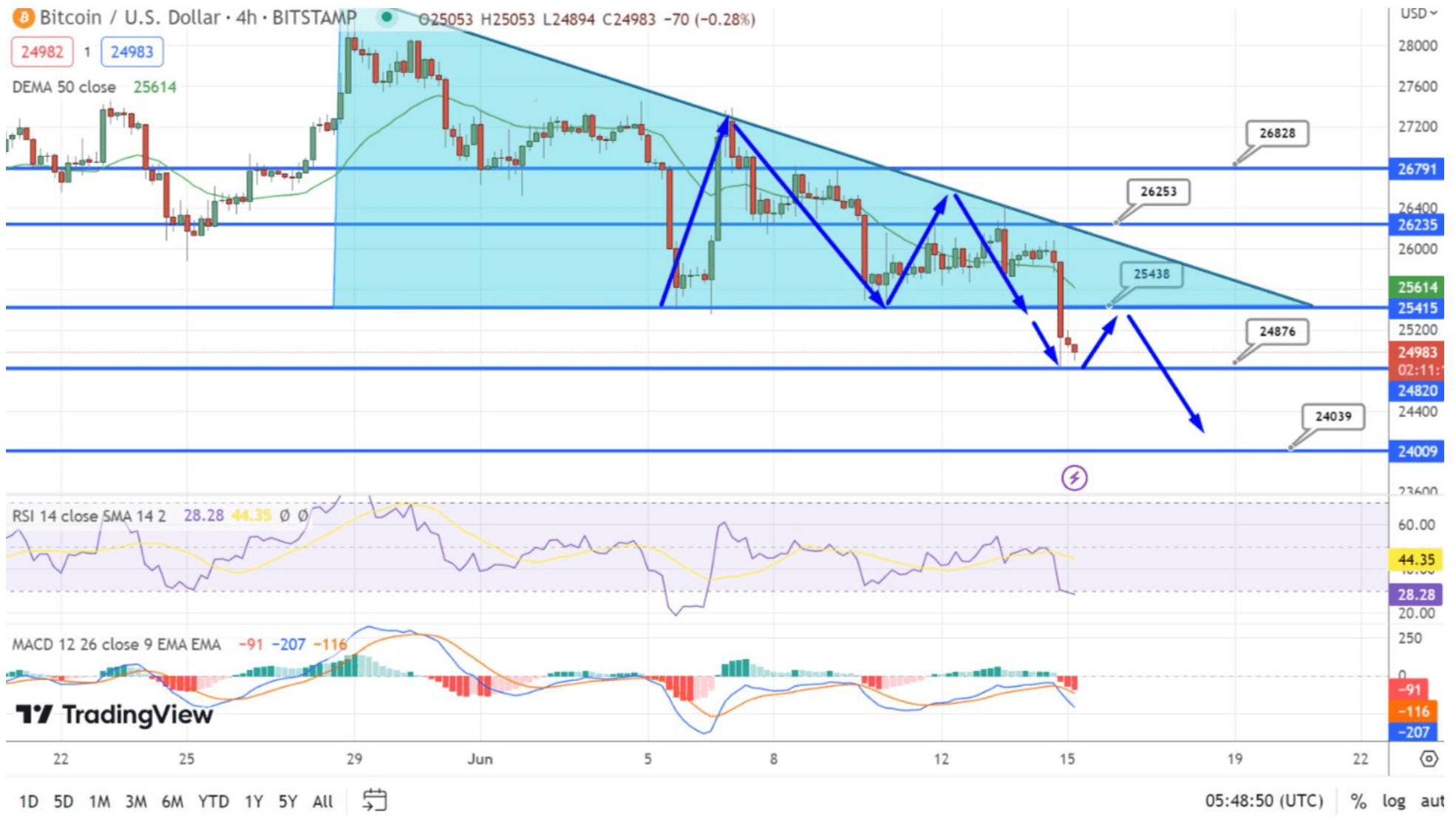

Will Bitcoin find enough support to prevent further decline and maintain stability above the crucial $24,000 level? After ten consecutive hikes, the Fed has paused raising interest rates. The United States Central Bank chose to keep the federal funds rate at its current level this month, following ten successive rate increases since March 2022. The decision followed indicators suggesting a modest increase in economic activity, as highlighted in the FOMC statement that also acknowledged the strength of employment gains and a low unemployment rate.

The ongoing goal of the FOMC is to continue to reduce inflation to the 2% to 3% target range, as stated in the Fed’s announcement. The latest data on the consumer price index (CPI) released this week by the US Bureau of Labor Statistics shows that inflation is easing, with the annual rate dropping to 4%.

Crypto Expectations!

To reach the 2% inflation and full employment targets, the FOMC chose to keep the target range for the federal funds rate between 5 and 5-1/4 percent. All four major stock indices on Wall Street saw declines after the announcement, along with a slight drop in the cryptocurrency market. Jerome Powell stated in his press conference following the FOMC meeting:

Almost all committee participants believe it would be appropriate to raise interest rates a bit further by the end of the year.

Crypto market investors positioned for a rally were disappointed. Although the pause in interest rate hikes could be supportive for risky assets like crypto, the Fed policymakers’ so-called “hawkish pause” stance signals more rate hikes to come, which is negative for the bulls.