Bitcoin price dropping $20,000 from its peak has worried investors about further losses and worse scenarios. Some believe the bear trend has started due to the weakening percentage of bull market peaks from cycle to cycle. But is this really the case?

Is the Crypto Bull Market Over?

The size of open positions in futures has significantly weakened. DOGE alone dropped from about $10 billion to around $2 billion in open positions in roughly a month. The same situation applies to many altcoins and BTC. On July 4, the price fell below $60,000, and five days later, investor motivation hit a two-week low according to the long-short metric. Market makers, whales, and professional investors are wary of high-leverage positions in the upward direction.

On June 7, BTC was trading at $72,000, and the one-month change in futures positions is seen as concerning by some experts due to the lack of enthusiasm. DCinvestor stated that 25% Bitcoin price corrections from intra-cycle highs are normal and do not indicate the end of the bull market.

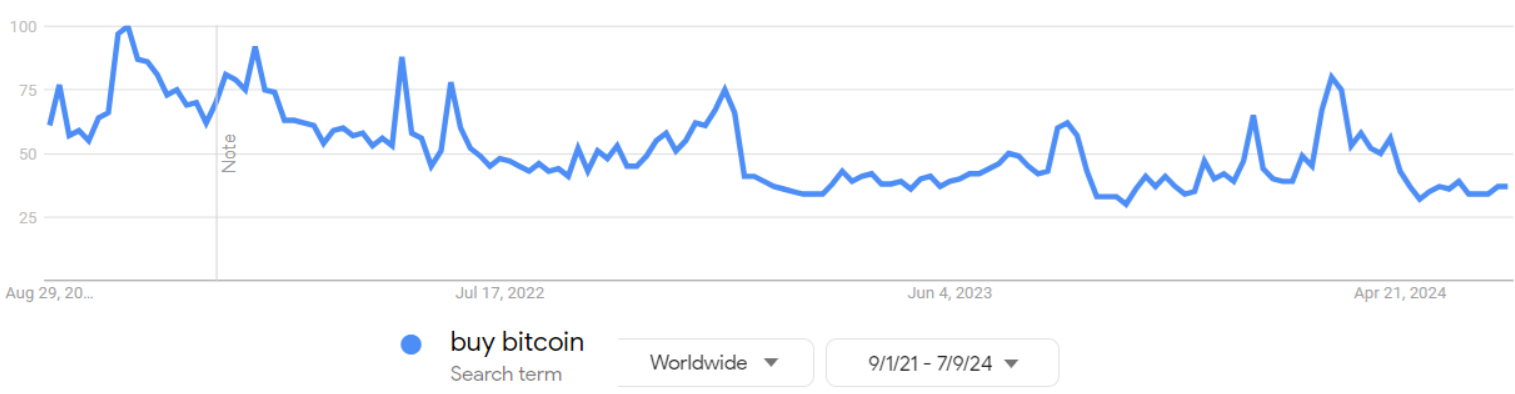

However, the inability to reclaim $72,000 since March 24 and other metrics like “buy Bitcoin” search trends, when considered together, increase the demoralization due to the waning interest over the past four months.

Moreover, while shares of companies like NVidia, Taiwan Semiconductor, Eli Lilly, Broadcom, Applied Materials, Meta, Qualcomm, ASML, and Netflix have gained 40% or more since the start of 2024, BTC has increased by 30%. This diminishes its appeal. Even gold is trading just 3% below its ATH level, and Fed rate cut expectations have increased compared to the past few months.

What Do Top Traders Expect?

There is an indicator that measures the intensity of long and short positions of the top traders in futures. Traders on Binance and OKX exchanges have reduced their leveraged long positions to the lowest levels in two weeks. The indicator was at 1.8x long on July 2, but it has dropped to 1.2x for the past three days. This suggests that professional investors might be worried even about short-term bullish scenarios.

The summer months, the inability to surpass the ATH level, uncertainties related to MTGOX returns, and many other issues might be causing everyone to remain cautious for now. However, a potential upward breakout will likely surprise everyone in terms of timing. Time will tell what triggers this. Or will we see bull markets end meaninglessly while ETFs have not yet shown their full potential and Trump has not yet won the elections as a crypto-friendly candidate?