Bitcoin (BTC) price has increased by 26.5% in October, reaching the highest level in a year, as indicated by various indicators such as BTC futures premium and Grayscale GBTC. Therefore, it may be challenging to present a bearish thesis for BTC, as the data reflects a recovery period after the crash and is also influenced by the recent interest rate hikes by the US Federal Reserve.

Positive Developments in Bitcoin

Despite the positive indicators, the price of Bitcoin remains around 50% below the all-time high of $69,900 reached in November 2021. This significant difference diminishes the significance of Bitcoin. It emphasizes that the adoption of Bitcoin as an alternative hedge is still in its early stages, following a 108% gain since the beginning of the year.

Before deciding whether the improvement in Bitcoin futures premium, open interest, and GBTC fund premium signals a return to normal or the initial signs of institutional investor interest, it is crucial for investors to analyze the macroeconomic environment.

On October 30, the US Treasury announced plans to auction $1.6 trillion in debt over the next six months. However, the most important factor to consider, according to CNBC, is the size of the auction and the balance between short-term Treasury bills and long-term bonds.

Billionaire and Duquesne Capital founder Stanley Druckenmiller criticized Treasury Secretary Janet Yellen’s focus on short-term debt, calling it the “biggest mistake in Treasury history.” This unprecedented increase in the debt ratio of the world’s largest economy led Druckenmiller to praise Bitcoin as an alternative store of value.

Bitcoin Futures

The increase in open positions in Bitcoin futures has reached its highest level since May 2022, reaching $15.6 billion. This increase can be attributed to institutional demand arising from inflationary risks in the economy. In particular, CME has become the second-largest trading venue for Bitcoin derivatives with $3.5 billion in BTC futures.

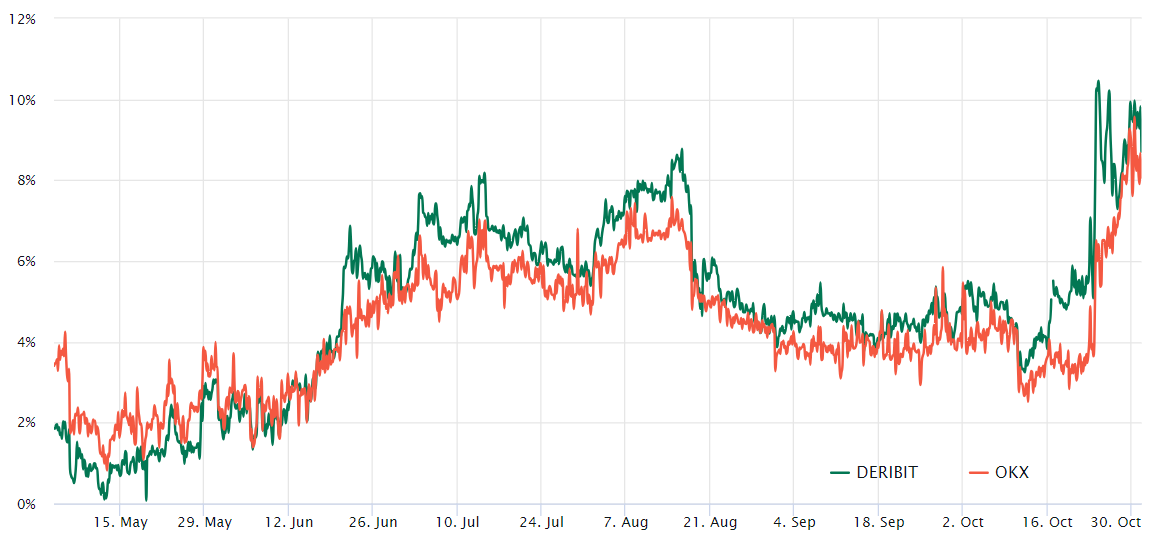

In addition, the Bitcoin futures premium, which measures the difference between the spot price and the price of 2-month contracts, has reached its highest level in over a year. These fixed monthly contracts usually trade at a slight premium in the spot markets, indicating that sellers may demand more money to delay payment.

There has been a significant increase in demand for leveraged BTC long positions. The futures contract premium increased from 3.5% to 8.3% on October 31, surpassing the 5% neutral-bullish threshold for the first time in 12 months. As a result, the positive developments in Bitcoin indicate a return to normal rather than optimism for the cryptocurrency.