July 23rd Bitcoin (BTC)

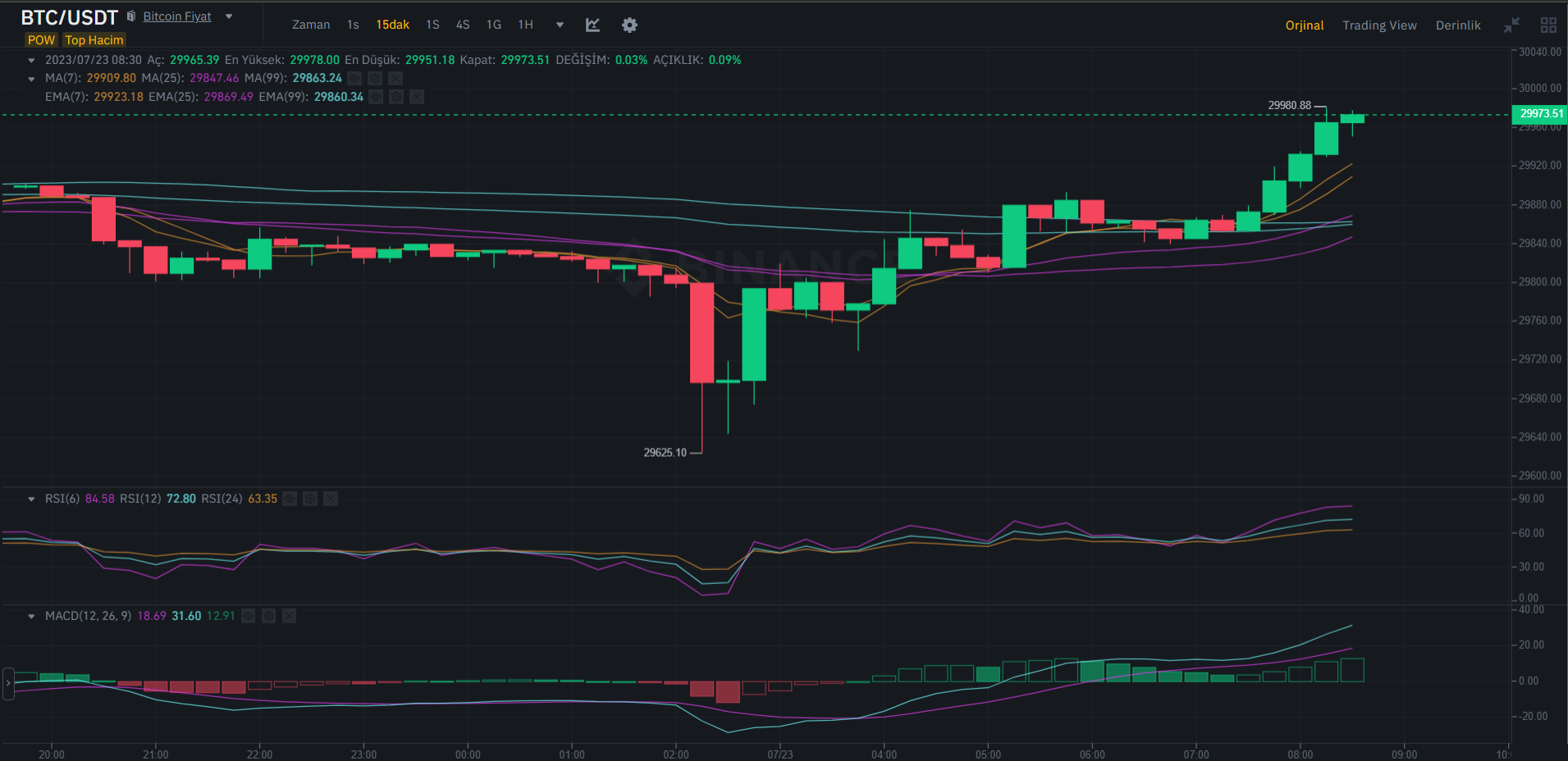

As the king of cryptocurrencies, Bitcoin continues to stay below $30,000. However, its trading volume has weakened. The price gained momentum following the applications for a Bitcoin ETF, but now it faces a lack of demand. So, how did crypto investors wake up on Sunday morning, July 23rd?

Crypto market cap has dropped to $22 billion, and shallow volatility continues on Sunday morning. While Bitcoin is trading in a narrow range, investors are focused on the interest rate decision to be announced next Wednesday. The Fed is expected to raise interest rates by 25bp at this meeting. Furthermore, their statements about future meetings will determine the direction of the risk markets. As the meeting approaches, the possibility of further negativity in Bitcoin’s price remains.

According to Bloomberg, we will start to feel the effects of a recession in the coming months. This means further declines for cryptocurrencies as a whole. Economic stagnation implies a decrease in income and unemployment. Stocks have always performed poorly in such an environment. If Bloomberg turns out to be right, cryptocurrency investors will not be smiling by the end of the year.

Crypto Market Analysis

The cumulative value of cryptocurrencies is currently at $1.2 trillion, and this level is prone to decline due to Bitcoin’s negative sentiment. While BTC and ETH remain relatively stable, XRP Coin has lost approximately 4% of its value. TRX has dropped by 5%. The top gainers in the past 7 days were XDC, XLM, MKR, LINK, and OP Coin, with OP being the exception. Except for OP, the other altcoins closed the week with gains of nearly 20%, while the rally leader XDC increased by 50%.

The biggest losers of the week were RPL and LDO Coin, which are part of the ETH ecosystem. Despite an increase in stake amount, token prices on liquid stake platforms have faced excessive selling due to the negative sentiment in the overall market.

Earlier this morning, Elon Musk announced that Twitter’s logo will be changed to an X. This announcement suggests that Twitter will soon transform into an app similar to WeChat. If the mischievous billionaire includes cryptocurrencies in his plan, details may emerge in the coming hours. However, we know that the company will not take a concrete step in the crypto space for now, as we have seen from its payment license applications.