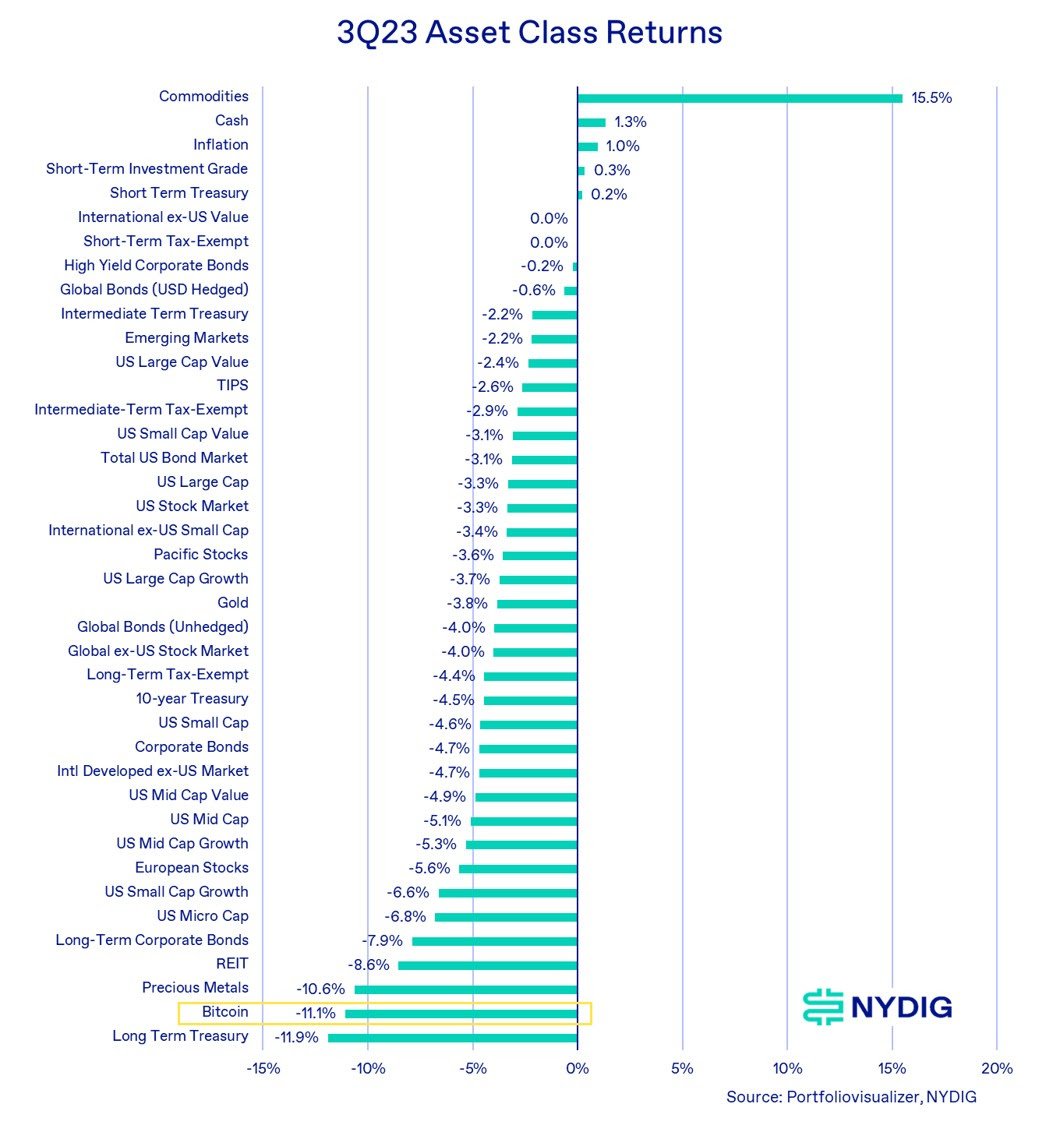

New York Digital Investment Group (NYDIG) stated in its “Weekly Bitcoin News and Forecast Summary” report that the largest cryptocurrency Bitcoin (BTC) had a decline of 11 percent in the third quarter of the year, making it one of the worst-performing assets. The report emphasized that BTC has been the best-performing asset since the beginning of the year, while also highlighting the high potential for the fourth quarter for the largest cryptocurrency.

Emphasis on a Strong Quarter for Bitcoin

NYDIG, which has made significant crypto custody agreements with major US banks and other institutions, has released its latest “Weekly Bitcoin News and Forecast Summary” report. The report states that Bitcoin’s price dropped by 11 percent in the third quarter and was one of the worst-performing assets during the quarter.

Despite this decline, the report highlights that Bitcoin has risen by 63 percent since the beginning of the year, making it still the best-performing asset of the year.

The NYDIG report emphasizes that the third quarter is the weakest period for Bitcoin based on historical data, but it also highlights that the fourth quarter is one of the best-performing quarters in the history of the crypto king.

Best and Worst Performing Assets of the 3rd Quarter

Although the NYDIG report reveals that the third quarter was negative, it also shows that it was positive for various other assets. Commodities provided a gain of 15.5 percent during the quarter, while cash assets yielded a 1.3 percent gain. Furthermore, inflation increased by 1 percent during the quarter, while short-term investment grade notes and short-term treasury bills yielded gains of 0.3 percent and 0.2 percent, respectively.

On the other hand, long-term treasury bonds performed worse than Bitcoin, with a loss of 11.9 percent during the quarter. Among the worst-performing assets during the quarter were long-term corporate bonds, real estate investment trusts, and precious metals. These assets lost 7.9 percent, 8.6 percent, and 10.6 percent, respectively, during the third quarter of 2023.