In the past few days, movements by whales have accelerated. Especially, Bitcoin (BTC) addresses belonging to whales have ended their long periods of inactivity. This activation of wallets by crypto investors has caused significant anxiety in the market due to the potential for triggering a selling wave.

Bitcoin Whales Take Action

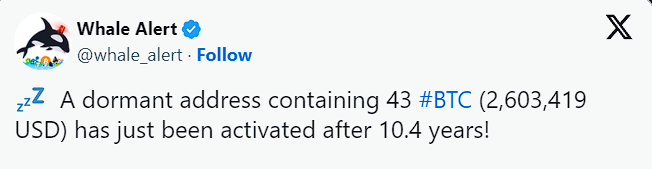

A move by a whale, tracked by Whale Alert known for monitoring crypto whales, caught attention. A wallet that had been inactive for over 10 years became active again, causing concern.

This wallet was known to hold 43 Bitcoins, equivalent to approximately $2.5 million at the time of activation. The mentioned value was calculated based on BTC’s current price. BTC had surpassed the $63,000 level at the start of the week. Currently, after a 3.74% drop in the last 24 hours, it is trading at around $60,000.

In March 2024, data emerged that had a significant impact on BTC. The rise in spot Bitcoin ETF entries had taken BTC’s price to a whole new level. By the end of this process, BTC had reached over $73,000, symbolizing its ATH.

After the price rise, the decline was equally sharp. Following the drop, BTC’s price gradually pulled back and exhibited volatile movements. The biggest blow came after the FED interest rate decision announced two weeks ago. BTC’s price then fell to $58,500.

Another whale also became active around the same time. A Bitcoin address that had been inactive for over 5 years reappeared at the beginning of June. This address, which became active, sent 8,000 BTC to the Binance exchange in 6 different transactions, valued at $535 million at that time. Such transactions are known to create significant selling pressures.

Current State of Bitcoin

At the time of writing, Bitcoin seems to have balanced its price drop slightly. BTC’s price has seen a 3% drop in the last 24 hours but continues to hold above the $60,000 level.

BTC’s market cap has fallen to $1.188 billion during this period. Its trading volume has increased by over 40%, surpassing $29 billion. This growth in trading volume could be interpreted as a result of investors selling to mitigate emerging losses.