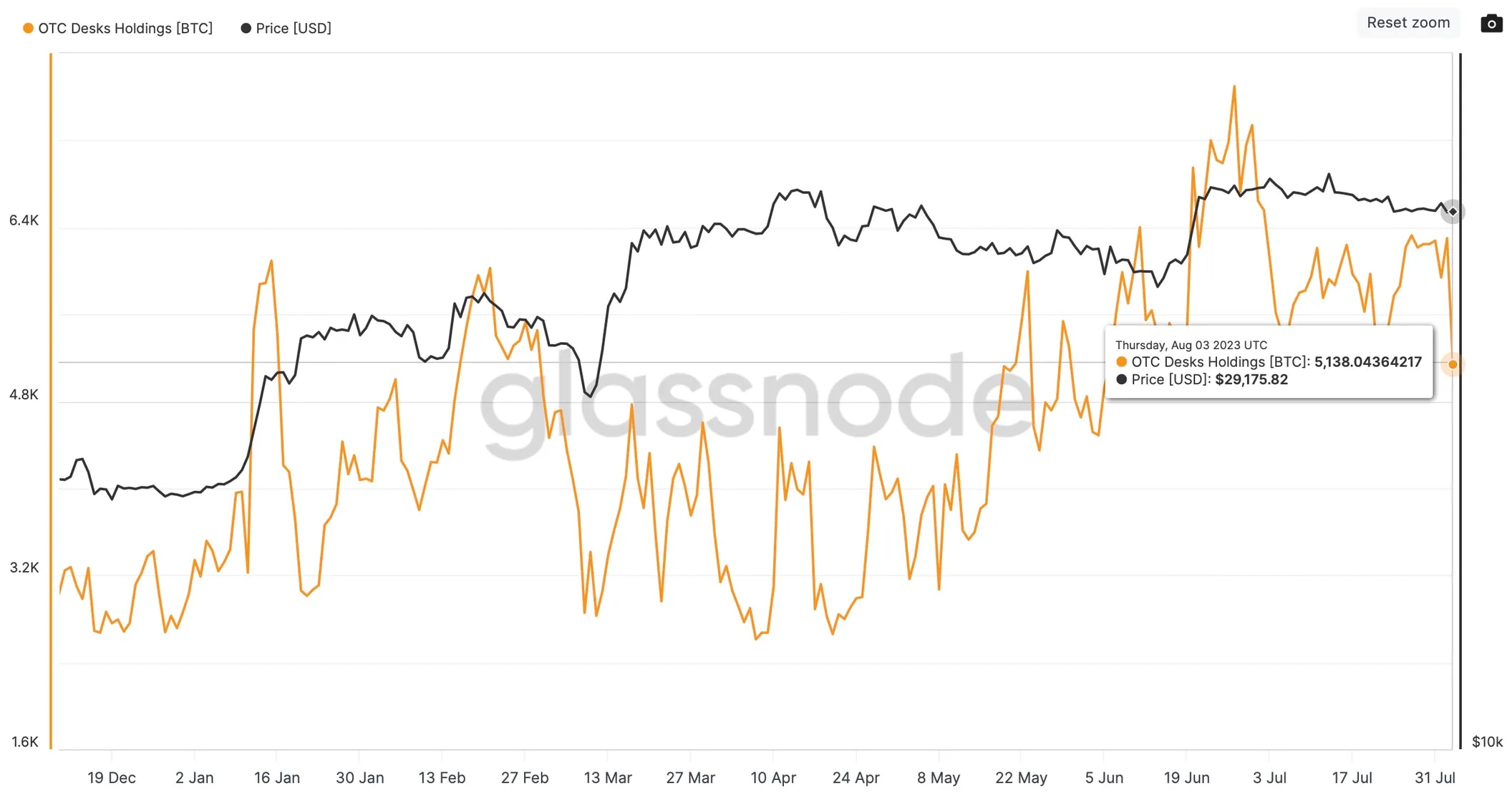

The amount of Bitcoin (BTC) held in wallet addresses associated with over-the-counter (OTC) markets, which is an important indicator of institutional investor activity, has reached its lowest level since June 15.

Bitcoin Amount in Wallet Addresses Decreased by 33%

As of August 3, there are 5,138 BTC, or approximately $150 million worth of Bitcoin, held in wallet addresses connected to OTC markets. According to data tracked by crypto data platform Glassnode, this represents a 33% decrease compared to the highest level of 7,697 BTC at the end of June.

During the first half of the year when Bitcoin’s market value increased by 84%, the amount in wallet addresses in OTC markets increased by 156%. Some observers at that time considered this to be a bullish signal. In a report published by Ark Investment Management in June, it was noted that “the increase in the balance of wallet addresses in OTC markets indicates that institutional investors and other major capital owners are increasingly focusing on Bitcoin.”

Crypto investors, like their counterparts in traditional markets, can trade on cryptocurrency exchanges or over-the-counter markets. While a cryptocurrency exchange acts as an intermediary that matches orders between buying and selling parties, transactions on OTC markets occur directly between two parties, with one of the parties usually being the owner of the OTC wallet.

The Significance of Movement in OTC Wallet Addresses

High-volume and institutional investors often trade on OTC markets to avoid affecting the market price of the asset. Therefore, it is generally accepted that the activity in OTC markets reflects the behavior of large, sophisticated investors. In the past, some analysts associated increases or decreases in wallet balances in OTC markets with miners’ intentions to increase or decrease their cryptocurrency holdings.

However, making definitive conclusions from changes in wallet balances on OTC markets can be risky because it is not always possible to determine if a wallet address is specifically created for OTC markets. Furthermore, the balance of wallet addresses does not necessarily mean that they are making purchases on behalf of their customers or trying to provide additional liquidity.

Noelle Acheson, the author of the crypto newsletter “Crypto is Macro Now,” commented on the matter, saying, “The accumulation of BTC in wallet addresses on OTC markets could mean that they are making purchases on behalf of their customers, but it could also mean that they are transferring their customers’ BTC to sell on OTC markets.”