Had the SEC not brought down its legal hammer on the crypto market last week, Bitcoin’s price would likely be in a far more favourable position today. Yet, due to the lawsuits and lower than expected inflation, the interest rates failed to push the price to the desired level. It raises the question: what is Bitcoin’s next target? Could the recent slump actually be a strong signal?

Bitcoin: An Uncertain Future

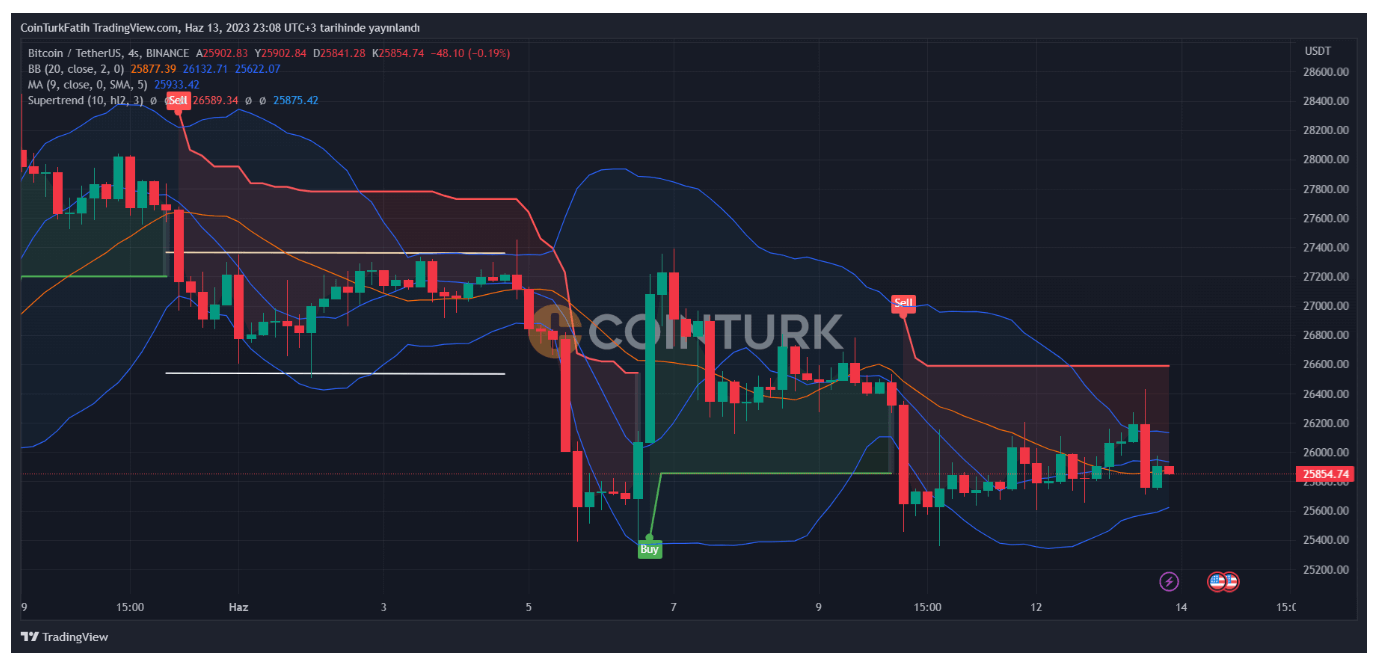

After successfully defending the $25,500 support level, the king of cryptocurrencies has been trading in a narrow 3.4% range for the past three days. During this period, investors’ attention shifted to macroeconomic factors, mainly the U.S. Federal Reserve’s interest rate decision to be announced on June 14th.

Though not directly linked, the crypto market is indirectly influenced by the cost of capital. Cryptocurrencies, now included in risk markets, have been experiencing constant downturns for more than a year due to Fed’s rate hikes. In May, the Fed raised the benchmark interest rate to 5%-5.25%, the highest level since 2007, with widespread belief that after pausing this month, the increase will continue for another two months.

Bitcoin’s Plunge: A Combination of Factors?

The upcoming FOMC meeting is not the only concern for the economy as the U.S. Treasury is set to issue over $850 billion in new bonds between today and September. This additional government bond issuance tends to result in higher returns and consequently, higher borrowing costs for companies and families. Considering the already tight credit market due to the recent banking crisis, a serious threat to GDP growth in the coming months is highly plausible.

According to Glassnode, miners have been selling Bitcoin since the start of June, potentially creating additional pressure on the price. This sell-off can be attributed to a decrease in earnings due to a cooling down in Ordinal’s operations and the mining hash rate reaching an all-time high.

Additional to miner sell-offs, we must also consider the decreasing demand in the U.S. region. Major investors who made massive sales on May 1st seem to have anticipated something. Now, the same is happening with altcoins, with some major altcoins reaching their 2-3 year lows due to heavy sales.

Possible reasons for Bitcoin to test the $25,000 level once again in the coming days include the trend in futures, fear of the SEC, liquidity problems, regulatory uncertainty, and the possibility of the Fed raising rates again in July, among others. In such a scenario, investors will hope that the support remains strong at $23,600.