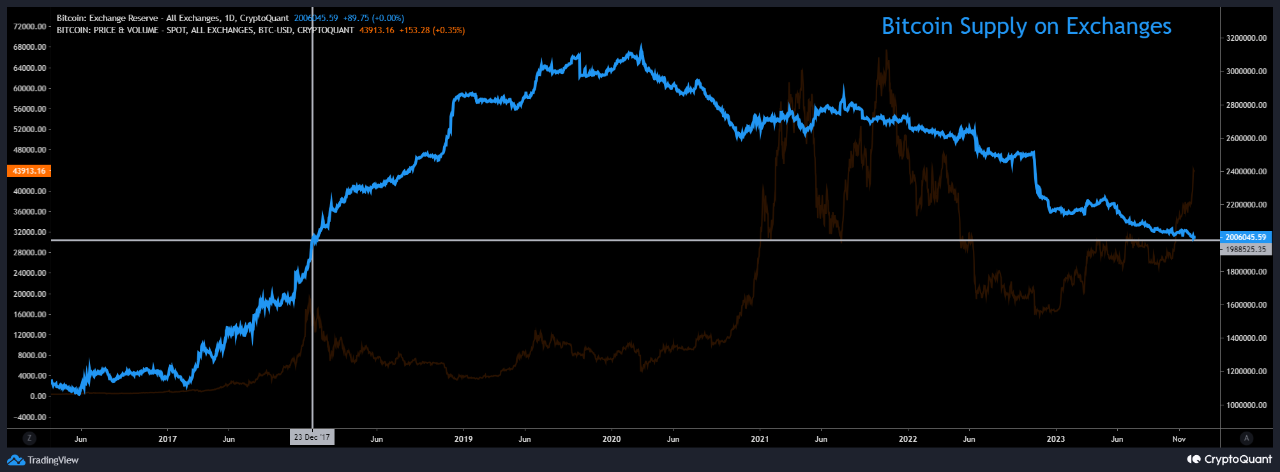

Bitcoin (BTC) is hovering at the highest levels of the year, while a report from CryptoQuant shows that the supply on central exchanges is at its lowest level in six years.

Whale Activity in Bitcoin

Whales usually transfer their Bitcoins to a central exchange to sell. When accumulated, they withdraw from central exchanges to self-custody solutions. Therefore, low supply on central exchanges is generally considered a bullish signal for cryptocurrencies. This situation may indicate that investors are not intending to sell their tokens in the near future. However, there are other factors that investors need to pay attention to.

Additionally, according to the CryptoQuant report, Bitcoin can rapidly rise to the range of $50,000 to $53,000 in early 2024. The report indicated a Metcalfe price valuation band metric based on data such as market cap, transaction volume, and user activity.

On the other hand, the report advised caution, considering that 86% of the circulating supply is currently profitable.

The funding rate is a fee that helps keep the price of a token’s futures contract balanced with the spot price. If perpetual futures contracts are trading at a premium, long position investors will pay funding fees to short position investors, and vice versa.

Critical Metric in Bitcoin

Finally, Global News Director Ali Martinez shared that Bitcoin has a stable support at $42,700. The analyst stated:

This level is important as 642,000 wallets have bought 347,000 BTC here.

If Bitcoin violates the $42,700 support, Martinez stated that the next critical area to watch would be $38,000. However, if Bitcoin continues its upward trend from $42,700, it could visit the next major supply zone at $47,300.

In conclusion, while the low supply of Bitcoin on central exchanges indicates that investors are not intending to sell, the CryptoQuant report suggests a potential rapid increase in 2024; however, it is important to note that the majority of the circulating supply is profitable and that $42,700 is an important support level according to technical analysis.