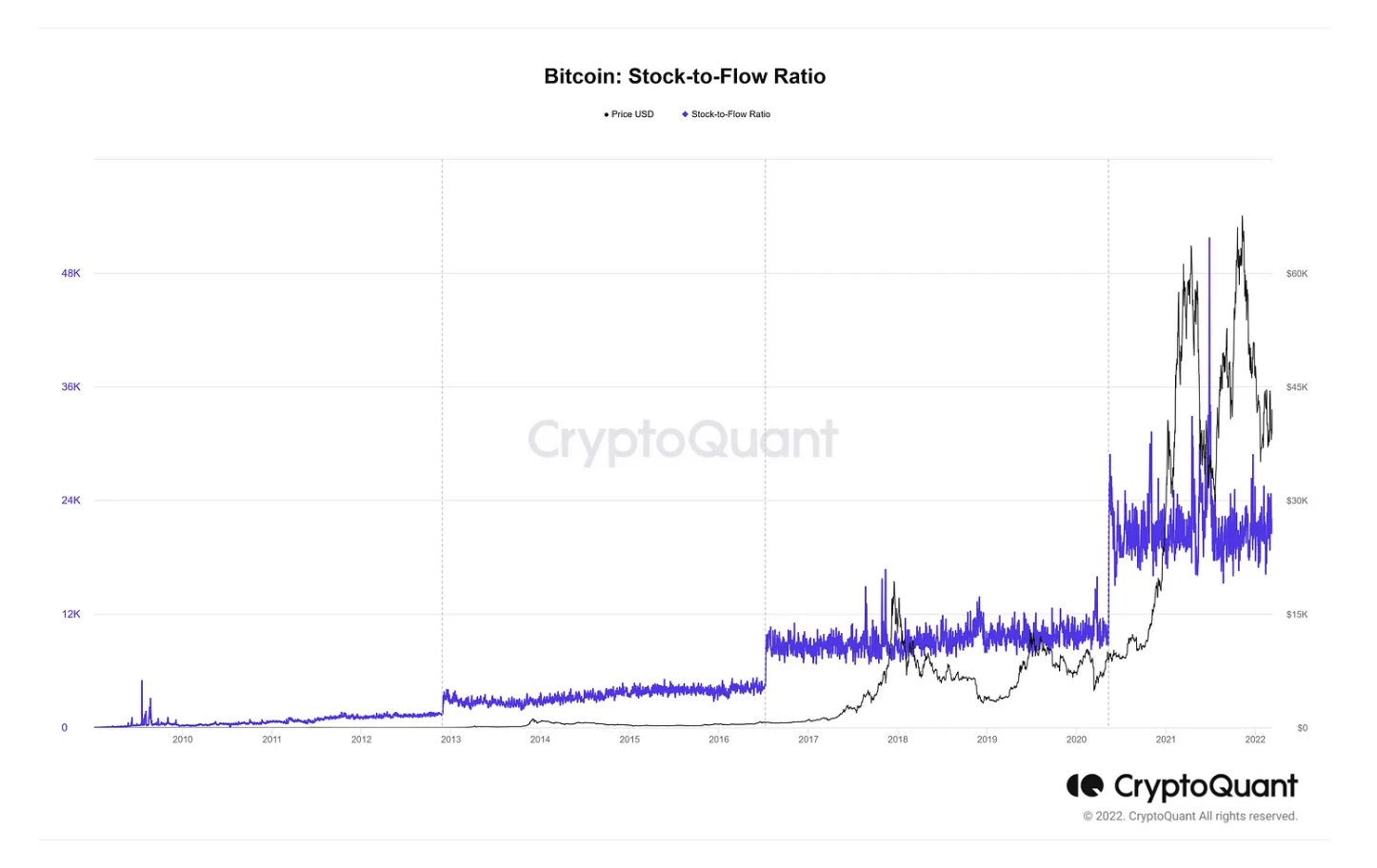

In recent periods, many analysts have struggled to accurately predict the peaks and troughs of Bitcoin‘s (BTC) cycles with little or no accuracy. PlanB’s stock-to-flow model (S2F) is perhaps a classic example of a highly publicized strategy.

BTC Analyses!

PlanB’s S2F model failed to accurately predict the market peak in 2021. However, could there be a more accurate version of the stock-to-flow model? CryptoQuant analyst Gigi Sulivan recently conducted an S2F analysis for Bitcoin, which could provide some clarity on what to expect before, during, and after the next Bitcoin halving.

According to Sulivan’s analysis, BTC’s S2F chart records an increase with each halving. Historically, each halving has led to a bull run that resulted in a new peak and subsequently a bear market.

The next Bitcoin halving is planned for May 2024. If it continues to exhibit similar features to previous halving events, a bull run could be in the cards. Sulivan’s analysis predicts that Bitcoin will peak between $160,288 and $206,824 during the fourth halving’s bull cycle. Additionally, the S2F predictions during the previous two halvings were significantly lower than the actual peaks.

This situation could mean that Bitcoin could go well above $260,000 during its next bull cycle, according to experts. But is the projected price for the next cycle truly achievable? Some past predictions have much higher expectations for Bitcoin‘s future price. For instance, some believe Bitcoin could be worth over $1 million in the future. This could mean that the prediction based on the S2F analysis might be more achievable, especially in the near term.

BTC ETF Applications!

Bitcoin will require a lot of liquidity to reach the projected prices. However, this prediction coincided with some interesting market observations. For instance, institutional demand for BTC has significantly rebounded in the past few months. Moreover, several Bitcoin ETFs were awaiting approval as of the writing of this article. They could accelerate BTC’s rise in the months leading up to the halving next year.

While Bitcoin investors should take note of these predictions, it’s also important to note that they are speculative. This means they do not guarantee that prices will rise to these levels. The market is known to be quite unpredictable, and therefore there is a significant chance that things may not go as expected. On the other hand, a rally above the predicted levels could also be possible.