The cryptocurrency market is experiencing a notable resurgence with the skyrocketing prices of Bitcoin (BTC) and many other altcoins, sparking debates about a possible new bull market. The recent volatility in the market indicates that cryptocurrencies are regaining investors’ trust and they are investing in riskier assets amidst renewed optimism.

Bitcoin’s Open Interest Movement

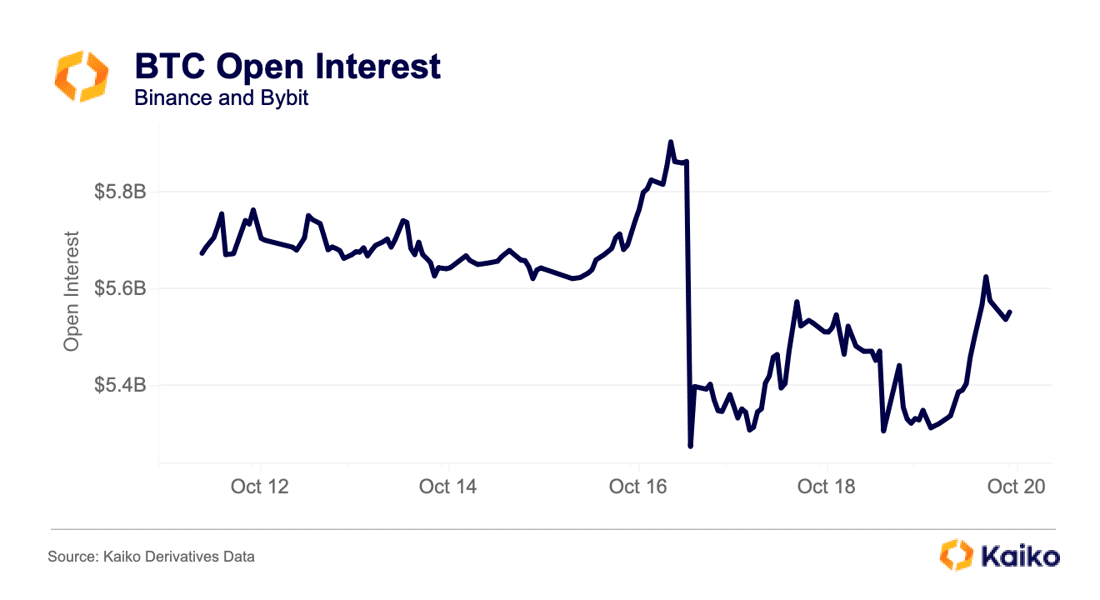

The largest cryptocurrency, Bitcoin, experienced a rally triggered by false news initially claiming that the SEC had given the green light to BlackRock’s spot Bitcoin ETF. During that time, Bitcoin’s open interest significantly increased, drawing the attention of market participants. However, after the news of the approval for the spot Bitcoin ETF was debunked, there was a significant drop of $600 million in open interest.

According to CoinGlass data, Bitcoin’s open interest is currently approaching the $15 billion mark, standing at $14.91 billion. Open interest represents the total number of outstanding derivative contracts, such as options or futures, that have yet to be settled. It provides data on the liquidity and interest in a particular contract by focusing on each open position within the contract. It helps measure whether there is an increase or decrease in capital inflows into the contract.

At the time of writing, the price of BTC is trading at $31,287, with a 4.75% increase. The trading volume has increased by 65.47% to $21.57 billion during the same period, and the market capitalization has reached $599.15 billion, showing a 4.59% increase compared to the previous day. Moreover, the largest cryptocurrency by market capitalization has surpassed the $31,000 level for the first time since July, indicating a significant upward trend.

The total market capitalization has reached $1.16 trillion, a 2.29% increase in the past 24 hours. However, the trading volume has decreased by 6.72% to $39.09 billion during the same period. Additionally, Bitcoin dominance (BTC.D) has increased by 0.07% to 51.51% compared to the previous day. The market’s volatility was initially triggered by rumors surrounding spot Bitcoin ETFs, which led to Bitcoin’s recent rally. However, a report by Kaiko shows that the open interest in Bitcoin decreased by approximately $600 million as investors evaluated the fake ETF rumors last week.

The Critical Threshold for Bitcoin: $31,000

Leading cryptocurrency analyst Rekt Capital closely monitors Bitcoin’s price movements and suggests that surpassing the $31,000 threshold would invalidate all bearish scenarios and potentially pave the way for further upward momentum in the market.

It is important to note that the cryptocurrency market remains highly sensitive to both news events and trading activities on major cryptocurrency exchanges. This highlights the need for traders and investors to be well-informed and cautious in the face of market volatility.