According to one analyst, as Bitcoin approaches the $70,000 price limit, short sellers are feeling the pressure due to decreasing downtrends and faster moving uptrends, leading to speculation that this could potentially push Bitcoin‘s price to $80,000. What can we expect for Bitcoin in the coming period? Let’s examine together.

What’s Happening on the Bitcoin Front?

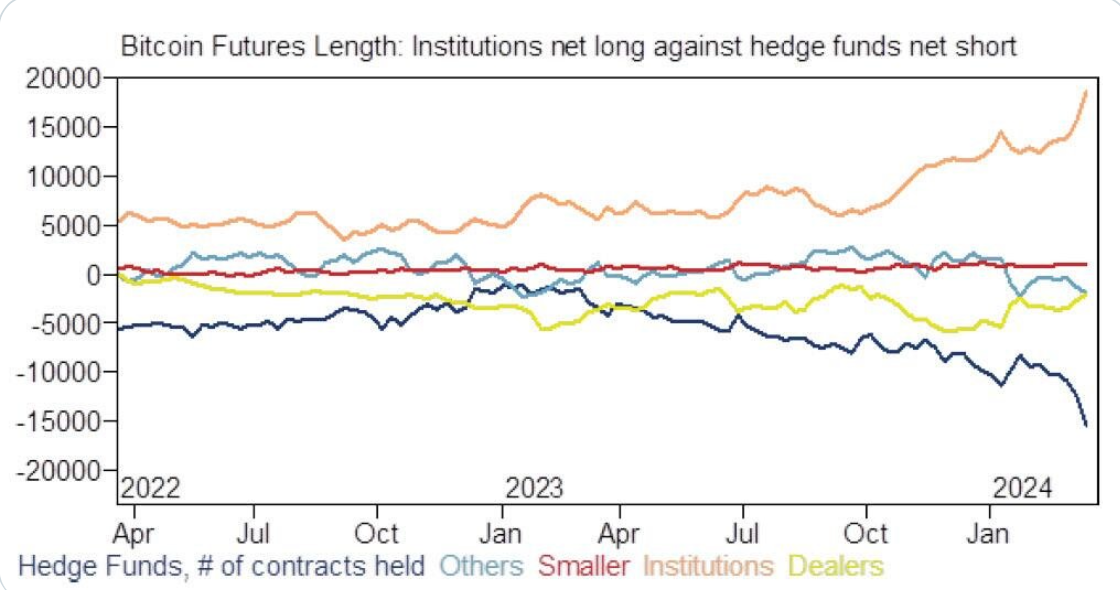

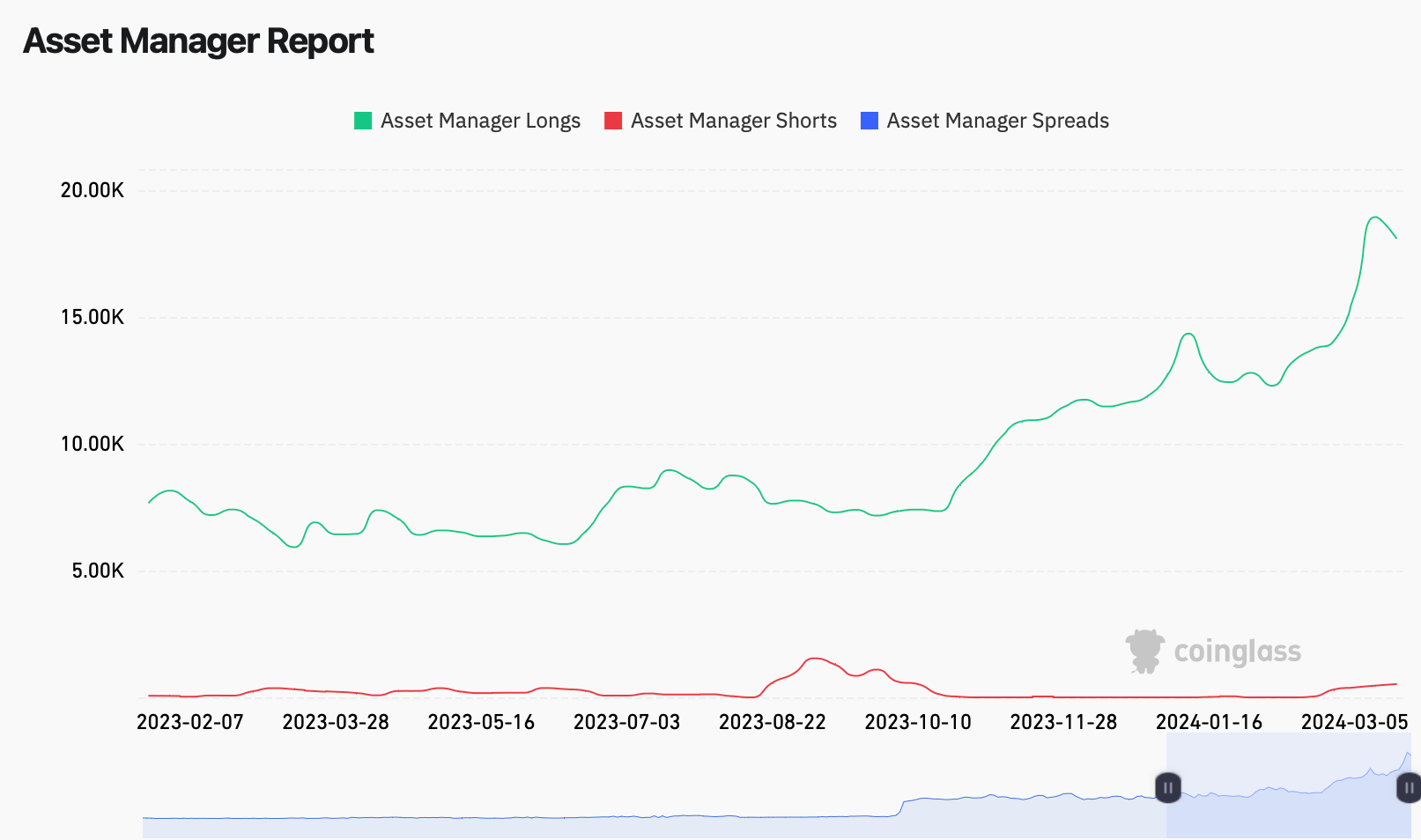

The source The Kobeissi Letter explained in a March 26th post that this development is a significant sign that short positions are being squeezed as we reach all-time highs. The Kobeissi Letter stated that the main factor of the Bitcoin short position squeeze is the record margin between institutional long positions and hedge fund short positions.

According to CoinMarketCap data, Bitcoin reached its lowest point on March 20th at $61,224, while on March 26th, it peaked at $71,511, representing only an 8.7% gap. At the time of writing, Bitcoin was trading at $70,236. CoinGlass data indicates that if it reaches $71,000, $156.18 million worth of short positions will be liquidated. If it rises to $75,000, then $3.85 billion worth of short positions will be liquidated.

Pav Hundal, the lead analyst at cryptocurrency exchange Swyftx, mentioned that at this point, Bitcoin could reach its all-time high. Currently, Bitcoin’s all-time high is $73,737. Hundal stated the following:

“The potential for a violent price movement is currently off the charts. If we see a short squeeze, Bitcoin could vertically shoot up to $80,000 and from there, you seriously start to consider the $100,000 mark at some point this year.”

Prominent Figures Weigh in on Bitcoin

Swan Bitcoin CEO Cory Klippsten, in his statement on the matter, said that although he enjoys watching the ongoing tug-of-war between long and short positions, eventually one group will break:

“At some point, someone has to break, they keep piling more capital behind their views to test and defend it. It’s a fascinating situation; we guide all our customers not to think about the next 5-10 years. Yet, I am a willing and eager speculator.”

Hundal suggested that asset managers might be protecting their positions with both long and short positions and added:

“This is not a classic bulls versus bears fight. Asset managers are sitting on record data regarding long-term investment in Bitcoin.”

Hundal claimed that asset managers are taking both positions to reduce downside risk:

“Probably the same investors are closing their positions by taking off their shorts. It’s a game of risk. Institutional investors will be happy to pay a premium to protect their downside risks,” he said.

Klippsten suggested that the increased trading activity in Bitcoin could be due to the anticipation of the Bitcoin halving event scheduled for April 21st:

“Bitcoin’s halving event is historically marked by speculative trade transactions, where investors buy the rumor and sell the news.”