Bitcoin, often the first name that comes to mind when thinking of cryptocurrencies, has recently made headlines with market fluctuations. However, this time it’s not just ordinary volatility; Bitcoin’s more volatile trend compared to the other popular cryptocurrency Ethereum is noteworthy. Bitcoin holds a leading position in terms of market value and trading volume and is generally seen as a more stable asset by investors. However, recent developments seem to have shaken this perception somewhat.

Bitcoin’s One-Month Volatility Raises Eyebrows

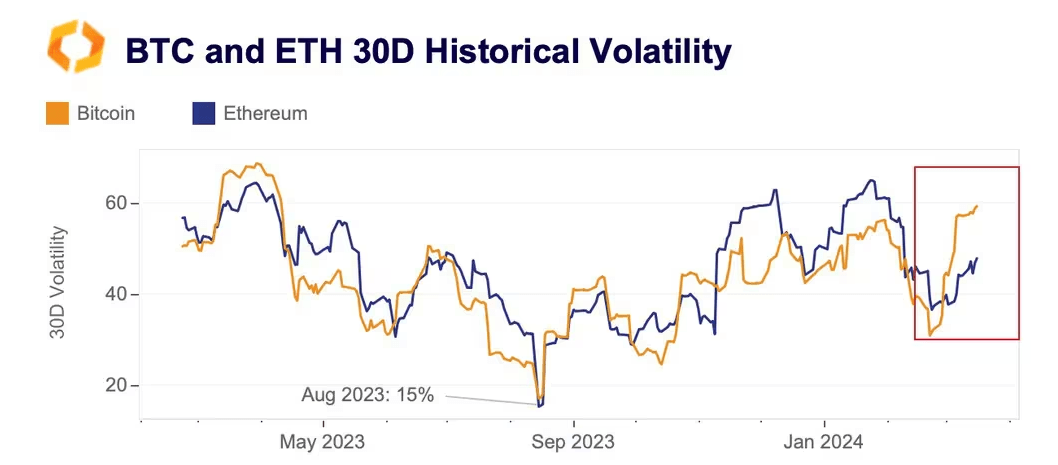

Last week, Bitcoin’s 30-day realized volatility rose to 60%, surpassing Ethereum‘s volatility by about 10 percentage points. This figure has been recorded as the highest difference in at least a year. Historical volatility indicates the degree of price turbulence over a certain period, and from this perspective, we can say that Bitcoin is more volatile compared to Ethereum.

This situation emerged after the US Securities and Exchange Commission (SEC) greenlighted spot Bitcoin exchange-traded funds (ETFs). Following this development, investors increased their interest in the cryptocurrency through ETFs, which in turn triggered an upward fluctuation in the market.

However, the situation is not so bright for Ethereum investors. The SEC’s decreased likelihood of approving an Ethereum ETF seems to be negatively affecting Ethereum’s value. This could make ETH less preferable compared to Bitcoin.

Bitcoin Halving Approaches

The upcoming reward halving on the Bitcoin Blockchain is also cited as another reason for the market’s volatility. This event, which occurs every four years, can affect prices by reducing Bitcoin’s supply.

On April 21st, we will face one of the biggest surprises in the crypto world: the internal code will reduce the block reward paid to miners from 6.25 BTC to 3.125 BTC. While this may seem like just a mathematical adjustment, its effects can be quite real and decisive. According to ByteTree, this change will halve the annual $26 billion miner revenue.

So, what does this mean? Here, there is a general consensus in the crypto community: If demand remains constant or increases, cutting the supply could lead to higher prices. This creates a supply-demand imbalance and pushes prices up. In Bitcoin’s previous halvings, especially those in 2012, 2016, and 2020, a similar scenario occurred, and the cryptocurrency experienced tremendous rallies.

Differences Emerge Before This Halving

However, there is something different this time. Bitcoin has surpassed its previous bull market peak of $69,000 weeks before the halving. This makes the upcoming event even more exciting for investors.

According to Greg Magadini, director of derivatives at Amberdata, the pre-halving rise in position could mean a potential “sell the news” pullback after the event. Magadini believes that the options market has priced in this event.