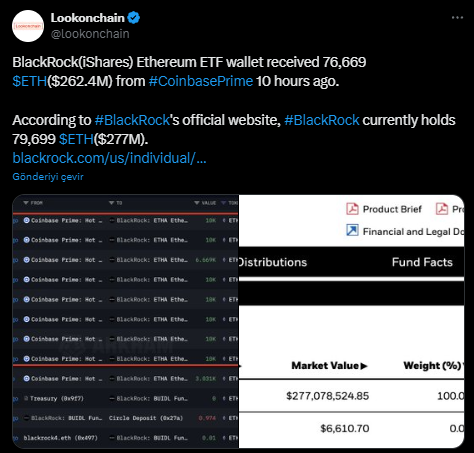

Spot Ethereum ETF’s second day in the market continues to see significant developments. On-chain data analysis shows BlackRock iShares Ether ETF purchased 76,669 Ethereum via Coinbase Prime. This indicates strong institutional interest in BlackRock’s newly launched Ethereum fund, similar to its strong position in the spot Bitcoin ETF market.

BlackRock Ethereum ETF

BlackRock Ethereum ETF may have completely outpaced its competitors. After two days of trading, it has become the market’s focal point. In the first 24 hours of trading, BlackRock’s iShares ETF saw a massive $266 million inflow.

However, inflows on the second day were not as expected, with BlackRock seeing only $17 million, indicating a significant drop in interest. As of today, BlackRock holds 79,699 ETH.

According to data provided by Farside Investors, spot Ethereum ETFs saw surprising outflows totaling $133 million on the second day of trading. This suggests a negative trend for Ethereum ETFs.

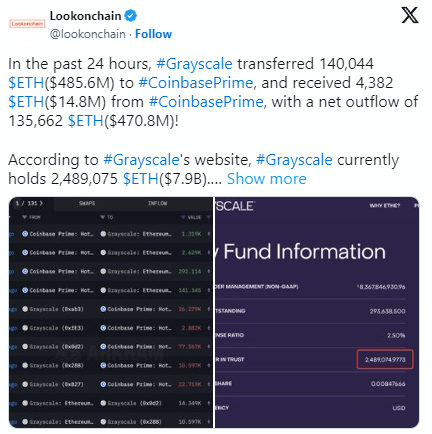

On the spot BTC ETF side, Grayscale’s Ethereum ETF, Grayscale Ethereum Trust (ETHE), was the source of the largest outflows.

On Wednesday, July 24, Grayscale’s ETHE saw net outflows of $386 million, moving above $811 million. Following this, Grayscale ETHE’s AUM fell below $8.0 billion today. Meanwhile, Grayscale’s other initiative, the Ethereum mini Trust, reflected inflows reaching $45 million.

What is the Current Price of ETH?

Recent price movements in Ethereum over the past two weeks have worried investors. ETH price dropped nearly 8% in the last 24 hours, trading at $3,150. There is speculation that the Ethereum ETF approval might be another “buy the rumor, sell the news” event, which may not be entirely incorrect.

Looking back to May before the ETF approval, with investor support, ETH price surged above $3,900, showing incredible price movement. Today, BTC is struggling to stay above $3,000. Market analysts suggest that, similar to Bitcoin, Ethereum might experience a dip before moving towards its all-time high.