Fintech firm Block announced plans on May 6 to issue $1.5 billion in premium bonds exclusively for qualified institutional investors. The company stated that the terms of the bonds, including interest rates and maturity dates, are subject to negotiation with the initial buyers. Among the investors allowed to participate in the round are pension funds, banks, investment funds, and high-net-worth individuals.

Notable Move from Block Team

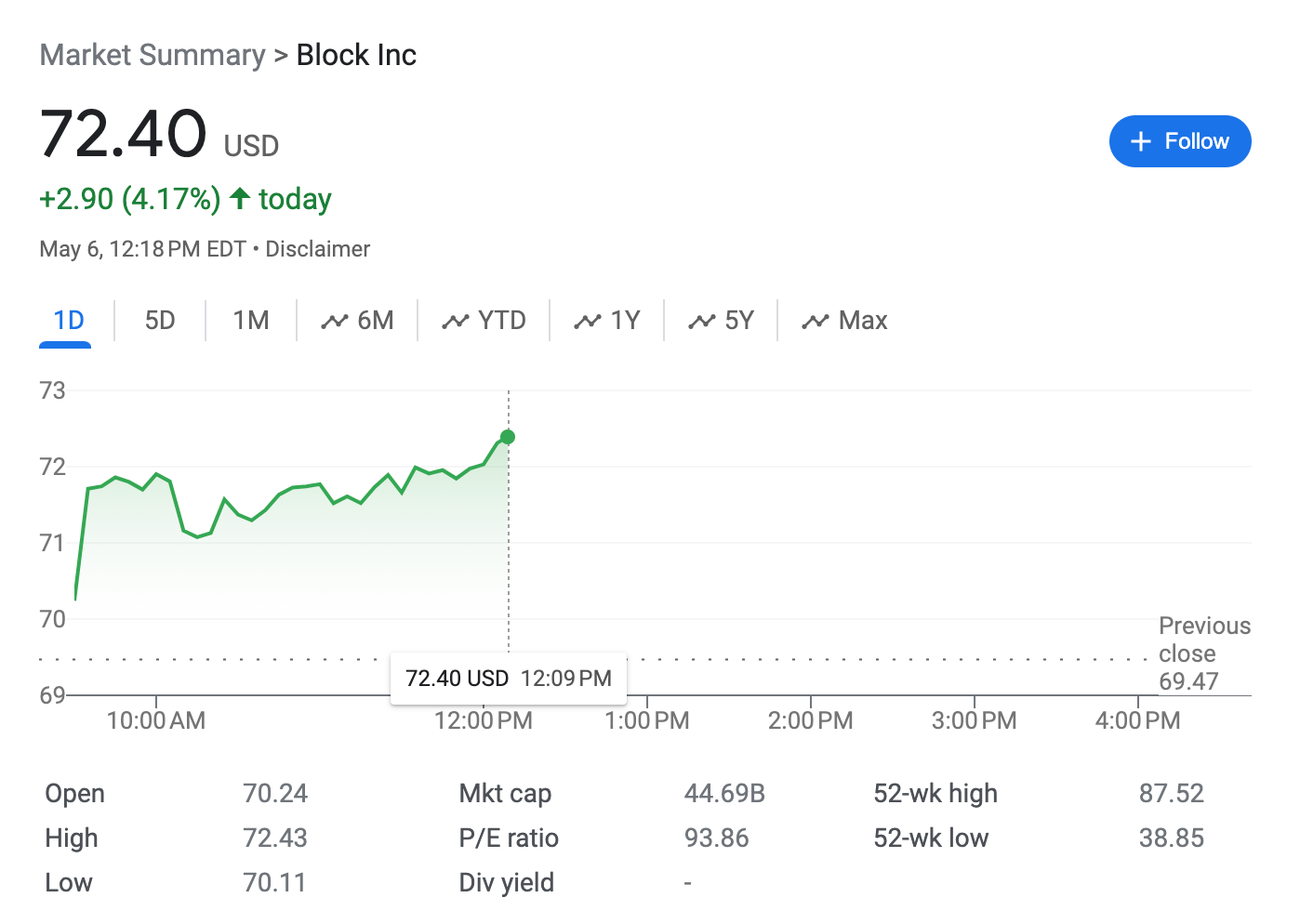

Following the announcement, Block’s shares showed an increase of more than 4%, trading at $72.40 at the time this article was written. The private process is a method of raising capital through the sale of securities such as stocks or bonds to a limited number of investors, instead of an initial public offering. According to Block, the funds raised through the sale will be used for the repayment of existing debts, potential acquisitions and strategic transactions, capital expenditures, investments, and working capital.

According to Fitch Ratings, Block is well positioned to benefit from continuous growth areas in payments and consumer financial services. Regarding the fintech’s debt structure, Fitch noted that since its initial public offering (IPO), Block has relied on the convertible debt market for most of its external capital needs.

As of March 2024, the company had approximately $2.15 billion in convertible bonds in circulation, an existing $775 million revolving credit facility due by June 2028, and $2 billion in senior unsecured bonds maturing in 2026 and 2031. Fitch wrote about the issue:

“The announced debt increase will add additional debt to the balance sheet and is expected to help with the refinancing of the maturities in 2025-2026, while also providing more cash support to an already strong balance sheet.”

Key Details About Block

The firm’s co-founder Jack Dorsey recently wrote in a letter to shareholders that Block was one of the first publicly traded companies to add Bitcoin to its balance sheet. Dorsey also stated that the company plans to allocate 10% of the gross profit from Bitcoin products each month to Bitcoin purchases. Block purchased $220 million worth of Bitcoin between the fourth quarter of 2020 and the first quarter of 2021:

“Going forward, we will invest 10% of the gross profit from our Bitcoin products into Bitcoin purchases each month.”

The fintech firm’s earnings exceeded market expectations in the first quarter of 2024. Block’s Bitcoin gross profit was $80 million, representing 3% of the $2.73 billion in Bitcoin revenue. The mobile payments and crypto platform Cash App saw a 25% increase in gross profit from the previous year in the first quarter, reaching $1.26 billion. The total gross profit for the quarter was up 22% from the previous quarter, reaching $2.09 billion. The company earned $0.85 per share, totaling $5.96 billion in revenue, surpassing analysts’ estimates.