Senior macro strategist Mike McGlone from Bloomberg Intelligence has made important predictions about the current state and future of cryptocurrencies. McGlone, closely followed by crypto investors, has made many accurate predictions in the past, delving into important details. So, what does he say now?

Bloomberg Analyst on Bitcoin

Mike McGlone, senior macro strategist at Bloomberg Intelligence, has revealed his new predictions about the king cryptocurrency. McGlone says that BTC‘s stagnation at around $30,000 could indicate upcoming negative economic conditions.

“Stuck at around $30,000 amidst the potential launch of an ETF (exchange-traded fund) and unstoppable enthusiasm in the stock market, BTC could signal larger economic problems. Bitcoin could be pointing to bigger economic issues.”

Cryptocurrencies Could Fall

In the midst of the negativity in Bitcoin’s price, it cannot be expected that altcoins will perform positively. We have seen many times in the past that altcoins suffer much greater losses when the king cryptocurrency falls. McGlone says that Bitcoin has increased by 100% since its lowest level in 2022, but for Bitcoin to achieve more gains, its price needs to drop first.

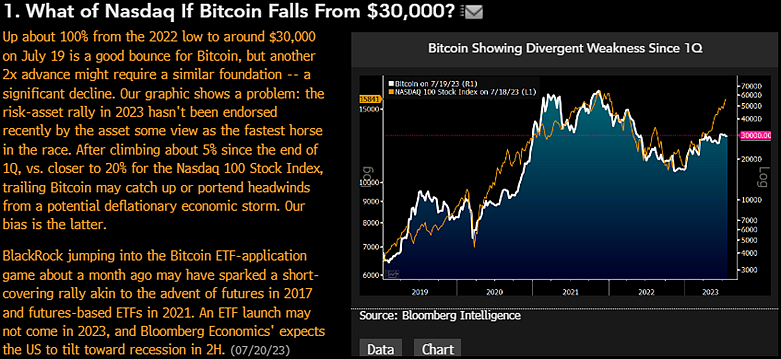

Additionally, he emphasizes how the Nasdaq 100 Stock Index, historically trading similarly to Bitcoin, has outperformed the king crypto and indicated weakness for BTC.

“It was nice to rise above $30,000 with an approximate 100% increase from the lowest level of 2022. It’s a good bounce for Bitcoin, but a two-fold advance may require a similar foundation, yes, a decline is coming. Our chart shows a problem: a risky asset rally in 2023 has not been endorsed by the asset that some see as the fastest route in the race.”

McGlone also says that the approval of BlackRock’s Bitcoin spot ETF application would provide significant support for Bitcoin, but he does not believe that a decision on the proposal will be made until 2023.

“BlackRock entering the Bitcoin ETF application game about a month ago could have triggered a short-term rally similar to the emergence of futures in 2017 and futures-based ETFs in 2021. An ETF launch may not happen in 2023, and Bloomberg Economics expects the US to enter a recession in the second half of the year.”

As the recession narrative increases, there may be a decline in crypto currencies. A recession has serious negative consequences on risk markets.