In the 2022 collapse, one of the popular cryptocurrency giants that fell was Celsius. Its story was truly a cautionary tale. After a long legal process, customer refunds began at the start of this year. So, how much of Celsius’s creditors have received their money back? What is the current balance? Here are the details.

Celsius Refunds

After going bankrupt, the price of CEL Token rapidly dropped and was delisted from many popular cryptocurrency exchanges. It still finds some buyers at a price of $0.15. Although it surpassed $2 again during this year’s rise, it fell back below $0.2 due to sales by investors convinced the platform would not resume operations.

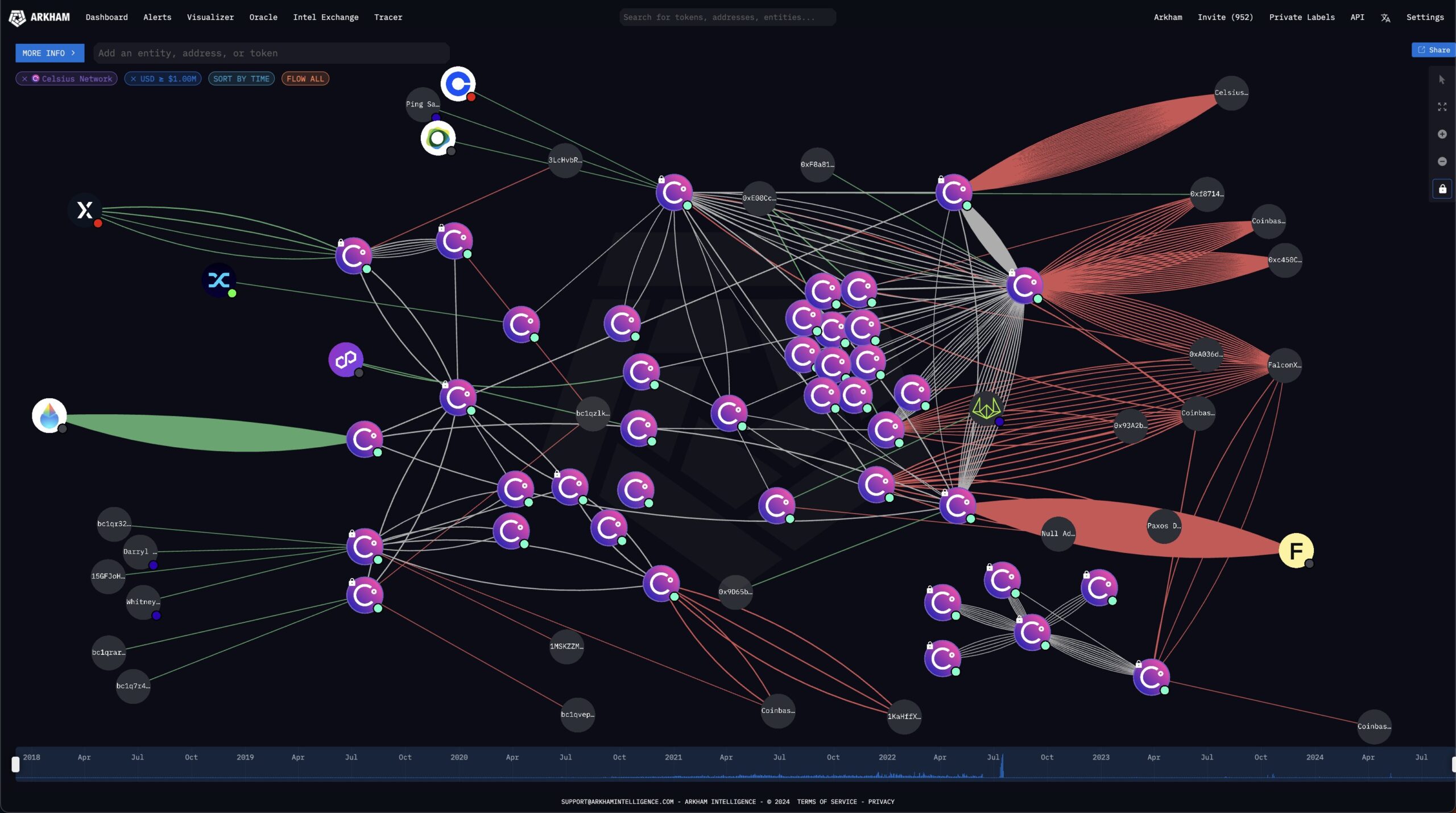

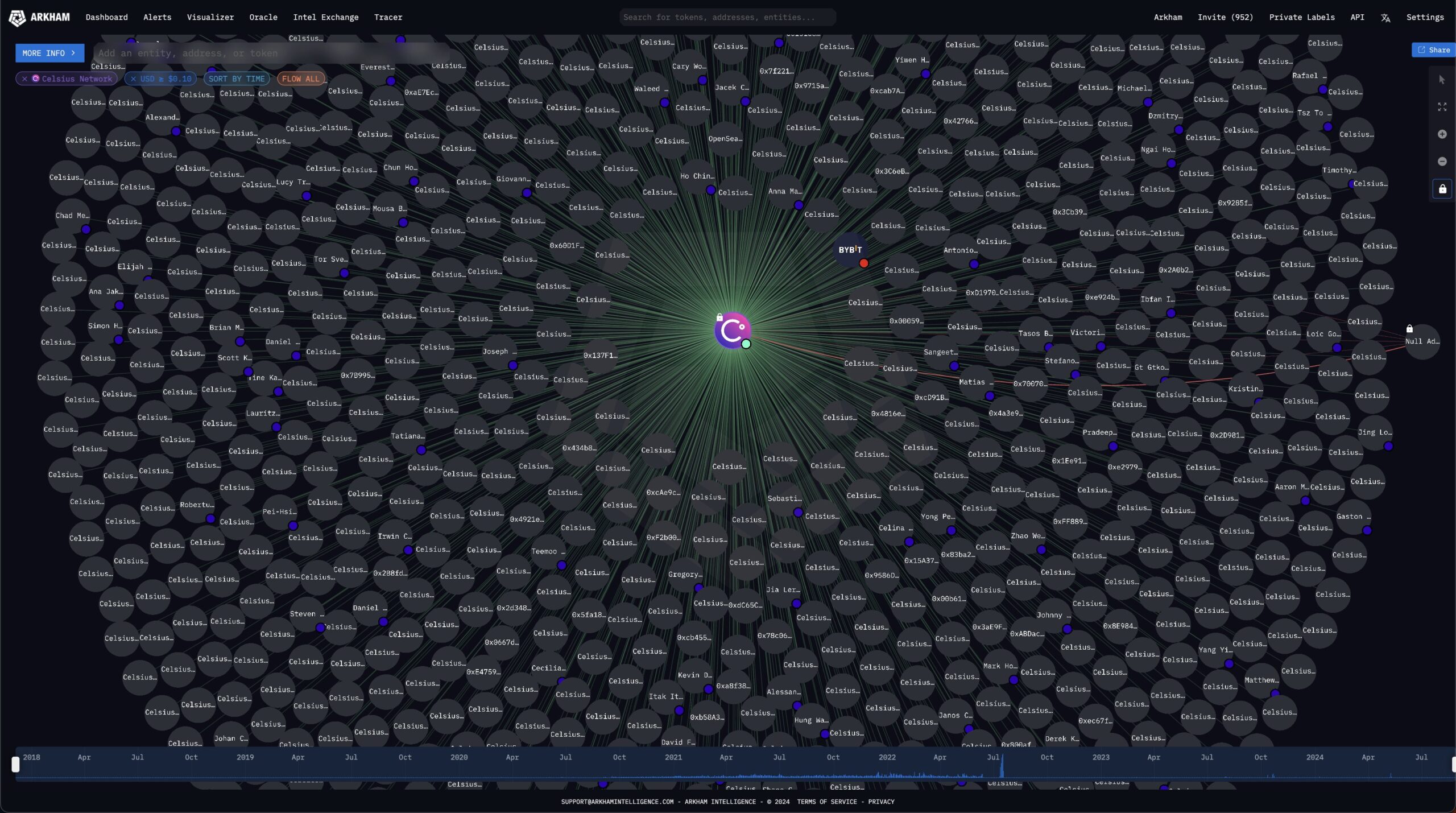

An on-chain analysis by Arkham indicates that 93% of the creditors have been refunded. In the latest assessment, on-chain experts wrote:

“According to the latest court filing, Celsius Network has distributed over $2.5 billion, or 93% of eligible funds, to more than 250,000 individual creditors.

Celsius began distributing over $3 billion in assets to creditors in January this year and now appears to hold only $5 million in crypto.”

The company’s use of blockchain for refunds once again highlights the transparency of crypto.

CEL Coin and Celsius

The company’s CEO foresaw the decline at the beginning of 2022 but predicted a market recovery for a bigger peak later. He took control by limiting the authority of all analysts and engaged in risky transactions with the balances lent by investors. Like 3AC founder Zhu Su, he expected a super cycle in 2022.

However, things did not go as expected. The collapse of LUNA and the subsequent blow to 3AC led to the downfall of the crypto lending story that underpinned the 2021 bull market, causing risk-loving credit customers to go bankrupt. Celsius also went bankrupt due to both the market decline and the collapse of the risk-taking companies it had lent to.

Subsequently, the price of CEL Coin steadily declined. This example shows the potential problems faced by crypto companies that were once considered extremely reliable and promised “risk-free” high returns to investors.