CoinShares’ Weekly Crypto Fund Flows Report, authored by James Butterfill, was published today. This report highlights a significant development in Ethereum and contrasting movements in Bitcoin and multi-asset products. Let’s review the trends and changes in crypto investment products from the past week.

30 Million Dollar Outflow

For the third consecutive week, outflows from crypto-focused investment products continued. This time, the total outflow amounted to 30 million dollars. This indicates a continuing trend, but the rate of outflows has significantly slowed compared to previous weeks.

Despite the overall outflows, small inflows were seen by most providers. However, significant outflows of 153 million dollars from Grayscale overshadowed these gains. It is worth noting that trading volumes increased by 43% compared to the previous week, reaching 6.2 billion dollars, but this figure is below the annual average of 14.2 billion dollars.

America Attracts Inflows

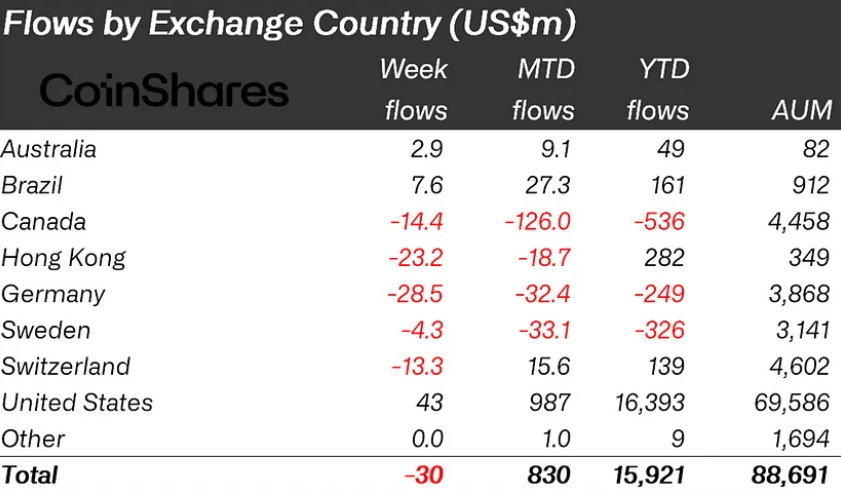

Regionally, trends varied significantly. The United States recorded an inflow of 43 million dollars, followed by Brazil with 7.6 million dollars and Australia with 3 million dollars. On the other hand, Germany, Hong Kong, Canada, and Switzerland experienced significant outflows of 29 million dollars, 23 million dollars, 14 million dollars, and 13 million dollars, respectively.

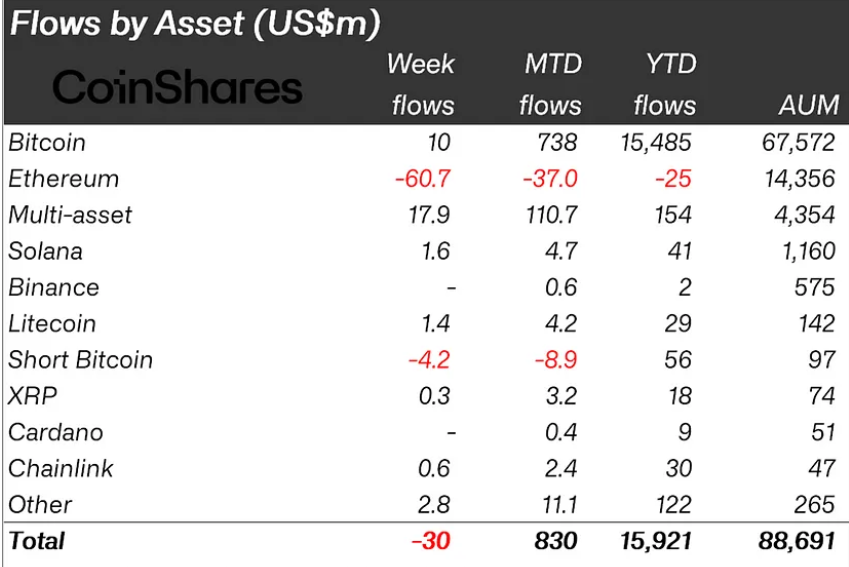

Particularly, Ethereum witnessed its largest outflows since August 2022, coming under significant pressure. Over the past two weeks, a total outflow of 119 million dollars occurred, making Ethereum the worst-performing asset in terms of net flows year-to-date. This sharp decline highlighted a negative sentiment towards Ethereum among investors.

Positive Sentiment Towards Bitcoin

In contrast, multi-asset and Bitcoin exchange-traded products (ETPs) showed resilience with inflows of 18 million dollars and 10 million dollars, respectively. The increase in inflows to these products indicated a growing interest in diversified crypto investments and a positive sentiment towards Bitcoin. Additionally, there were outflows from short-focused Bitcoin products, totaling 4.2 million dollars last week.

Solana and Litecoin led the inflows with 1.6 million dollars and 1.4 million dollars, respectively. Despite the overall positive sentiment towards cryptocurrencies this year, blockchain-focused stocks faced challenges. These stocks experienced outflows of 545 million dollars in 2023, representing 19% of their assets under management (AuM).