The strict regulatory environment in the United States continues to make life difficult for crypto companies in the region. The immaturity of crypto-specific regulations and the delayed preparation of legislation have made things even more complicated. Additionally, regulatory agencies, particularly the SEC, are attempting to regulate the industry through sanctions.

The Current State of the Coinbase Lawsuit

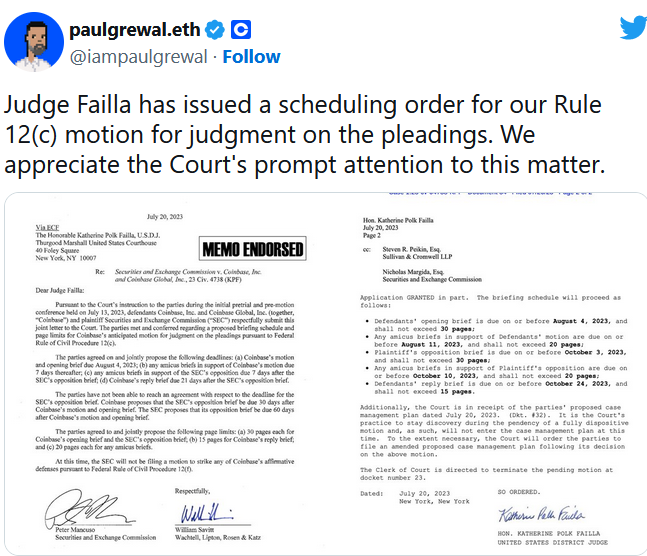

The latest development in the lawsuit filed by the United States Securities and Exchange Commission (SEC) against the crypto exchange Coinbase was the approval of a date for both parties to present their initial arguments. Today, Paul Grewal, the Chief Legal Officer of Coinbase, shared on his social media account the news that New York Judge Katherine Polk Failla has approved the joint request of the SEC and Coinbase to proceed with the hearings.

In the initial documents submitted by both parties, it was agreed upon that Coinbase’s petition and opening statement would be delivered on August 4, 2023, and that additional time could be requested for various subsequent supporting documents and responses.

However, no agreement was reached on a deadline for the SEC’s opposition statement, for which Coinbase proposed 30 days and the SEC proposed 60 days. Judge Failla approved the partial agreement, which includes the August 4 deadline for Coinbase’s initial statement and the August 11 deadline for supporting documents.

Cryptocurrency Lawsuits

The lawsuit filed by the SEC against Coinbase is just one of the cryptocurrency-related lawsuits, which have become a hot topic in the industry due to the Ripple Labs case. The regulatory agency surprised the industry by filing consecutive lawsuits against two major exchanges at the beginning of June. These lawsuits involve both companies in the unregistered securities offering. Additionally, the Binance case encompasses various allegations that may involve the US Department of Justice in the future.

It is expected that the SEC, which partially lost the Ripple case, will continue to aggressively fight against exchanges. At the same time, the regulatory agency has an ongoing case with Grayscale due to the rejection of Spot Bitcoin ETFs. Lastly, NASDAQ announced its intention to withdraw from the crypto business due to ongoing lawsuits and regulatory uncertainties.