Critical data that is as important for cryptocurrency investors as the Fed meeting has just been announced. So, what’s the situation? Although the price of Bitcoin reached new highs in November 2023, it experienced a slight pullback due to profit-taking. We are entering the last two months of the year, and the importance of future data in the macro landscape is increasing for investors.

Dollar, Bitcoin, and Cryptocurrencies

Fed has now halted interest rate hikes, and Powell has sent a message that there will be no further interest rate hikes unless there is a significant negativity. This is quite important and highlights the risk of changing interest rate expectations depending on future data. If the Fed continues to gradually reduce inflation and weaken employment, we may see the strengthening of risk markets through interest rate cuts starting from the middle of next year.

Today, Average Hourly Earnings, Non-Farm Payrolls, and Unemployment Rate data have been announced. These data provide insights into the current state of the US economy and can shape the decisions to be made at the Fed’s December meeting.

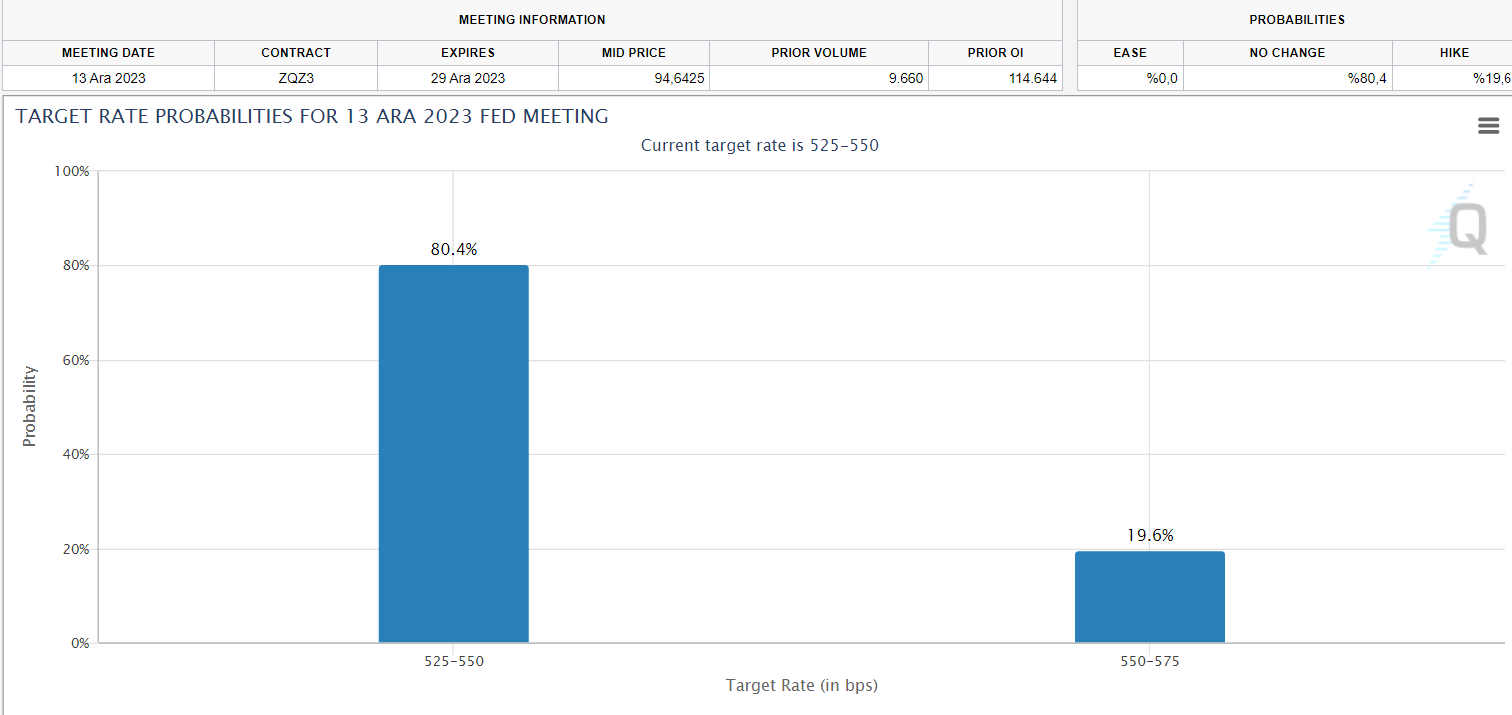

Before the release of the data, the expectation for the December 13 interest rate decision was that it would remain unchanged with an 80% probability. So, how did the data come out?

- Average Hourly Earnings (Announced: 4.1% Previous: 4.2%)

- Non-Farm Payrolls (Announced: 150K Expectation: 180K Previous: 336K)

- Unemployment Rate (Announced: 3.9% Expectation: 3.8% Previous: 3.8%)

The data came out in favor of cryptocurrencies. Bitcoin (BTC) may rise.