Saturday morning saw crypto investors face a massive shock. The 15-minute candles in the early hours were indeed alarming. The sales, appearing to be triggered by SEC pressure, were highly organized, dealing a hefty blow to the cumulative value. Now, the altcoin market is clinging to the edge of a precipice.

Cryptocurrencies Plummet

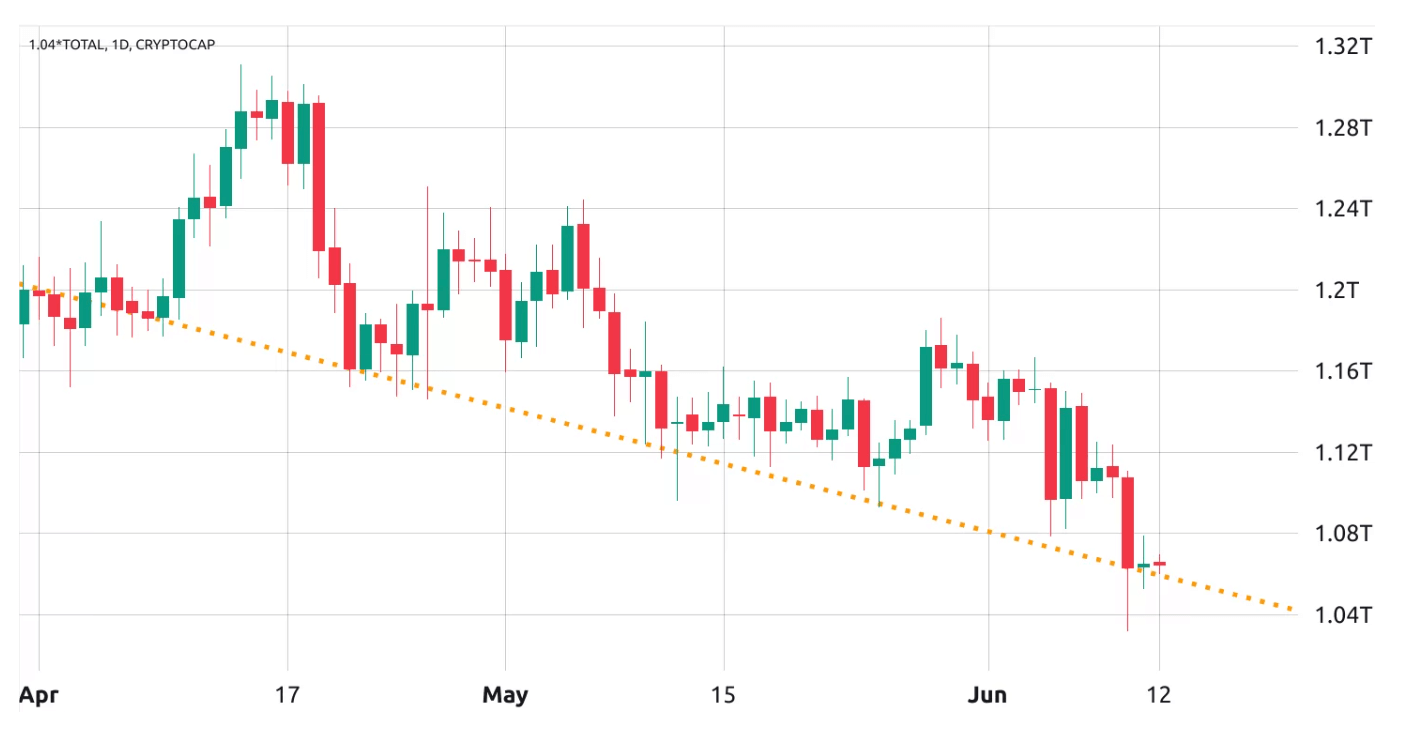

The bearish trend that has been putting pressure on cryptocurrency prices for the past eight weeks forced the cumulative value down to $1.06 trillion, a two-month low, with a 2.4% drop between June 4 and June 11. This time, the drop in cumulative value wasn’t significantly influenced by Bitcoin. While altcoins were being crushed, the king of cryptocurrencies managed to gain 0.8% over the seven-day period. The negative pressure came from a handful of altcoins, including BNB, Cardano, Solana, Polygon, and Polkadot, which showed a decline of more than 15%.

Take note that the downward trend, which started in mid-April, has tested the support level multiple times, suggesting that a bullish breakout would require additional effort from the bulls. Although altcoins have experienced a double-digit recovery from their recent low today, the risk isn’t over. If the $1 trillion support is lost, the cumulative value of altcoins (excluding ETH) will drop below its 2018 peak for the first time.

Future of Altcoins

Binance US recently stated that it would remove USD pairs and even suspend USD withdrawals/deposits. Additionally, on June 9, Cryptocom exchange announced it would no longer serve institutional clients in the United States. While the Singapore-based company cited a lack of customer demand, CryptoTea, founder of UtilizeWeb3, drew attention to the timing.

No dominance is visible in future contracts, either in long or short positions. The altcoins that triggered the decline have ended the short dominance. Currently, the Tether premium on OKX stands at 99.8%, reflecting balanced demand from individual investors. Given the balanced demand according to the funding rate and stablecoin markets, and considering that the latest regulatory FUD couldn’t push the crypto market capitalization below $1 trillion, bulls should be more than pleased.

For now, a V-shaped recovery doesn’t seem likely for altcoins. If the fear of the SEC has genuinely been overcome with the recent decline, the expected lower inflation and anticipated pass-over interest rate hike could be a good price catalyst in the coming hours.

On the other hand, if the US Department of Justice takes new steps related to exchanges (the biggest fear nowadays), it could mean crossing the $1 trillion threshold in loss for cryptocurrencies.