Cryptocurrency market will experience a significant moment on June 28 with the expiration of Bitcoin (BTC) and Ethereum (ETH) options. Markets approaching maximum pain points for BTC and ETH are attracting investors‘ attention. The maximum pain point is crucial for investors as it represents the price level where most options expire worthless.

6.6 Billion Dollars Worth of Bitcoin Options Expiring

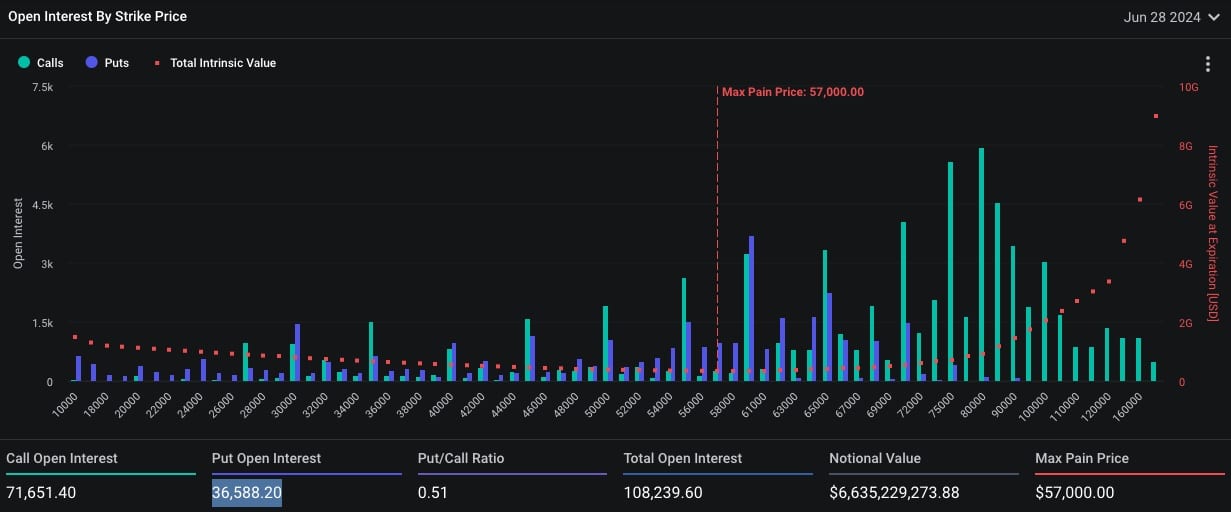

Bitcoin has a put/call ratio of 0.47 with the expiration of options worth 6.6 billion dollars. This ratio indicates a bullish trend in the market, with Bitcoin’s total open interest at 108,239.60, comprising 71,651.40 call options and 36,588.20 put options. Bitcoin’s maximum pain point is 57,000 dollars, and after dropping to 58,000 dollars at the beginning of the week, it rose above 61,000 dollars, experiencing a volatile week.

Similarly, the expiration of Ethereum options worth 3.5 billion dollars also occurs on the same day. Ethereum’s put/call ratio is at 0.58, with a total open interest of 1,049,020. Ethereum’s maximum pain point is 3,100 dollars, and its current price is around 3,382 dollars, having experienced a 4.7% drop last week.

The maximum pain point is a critical concept in options trading. This level represents the point where the highest number of options become worthless, creating pressure on the market as this level approaches. Investors are closely watching whether BTC and ETH prices will move towards these levels by the expiration date.

Current Status of Bitcoin and Ethereum

Bitcoin indicated a bottom formation after a 15% correction from its all-time high. According to CryptoQuant analysts, the decrease in open interest and funding rates before the options expiration suggests that the excessive leverage situation has been cleared. This indicates potential stabilization in Bitcoin’s price as investors adjust their positions.

Ethereum investors are eagerly awaiting the launch of spot Ethereum ETFs expected to go live on July 2. This development could significantly impact Ethereum’s price and trading dynamics. Companies like VanEck are preparing for this launch by offering zero transaction fees until the end of 2025, likely attracting more investors and traders to the market.