April holds great significance for the cryptocurrency market. The expected rise in trends associated with Bitcoin‘s (BTC) halving event is beginning to make its impact across the sector. During this period, we are observing a dominant long-term upward trend in the industry. Several crypto assets possess the potential to exert buying pressure that could affect their market values. In particular, some assets are approaching the threshold of a 100 billion dollar market value and are preparing for possible rallies.

BNB Could Surpass 100 Billion Dollars

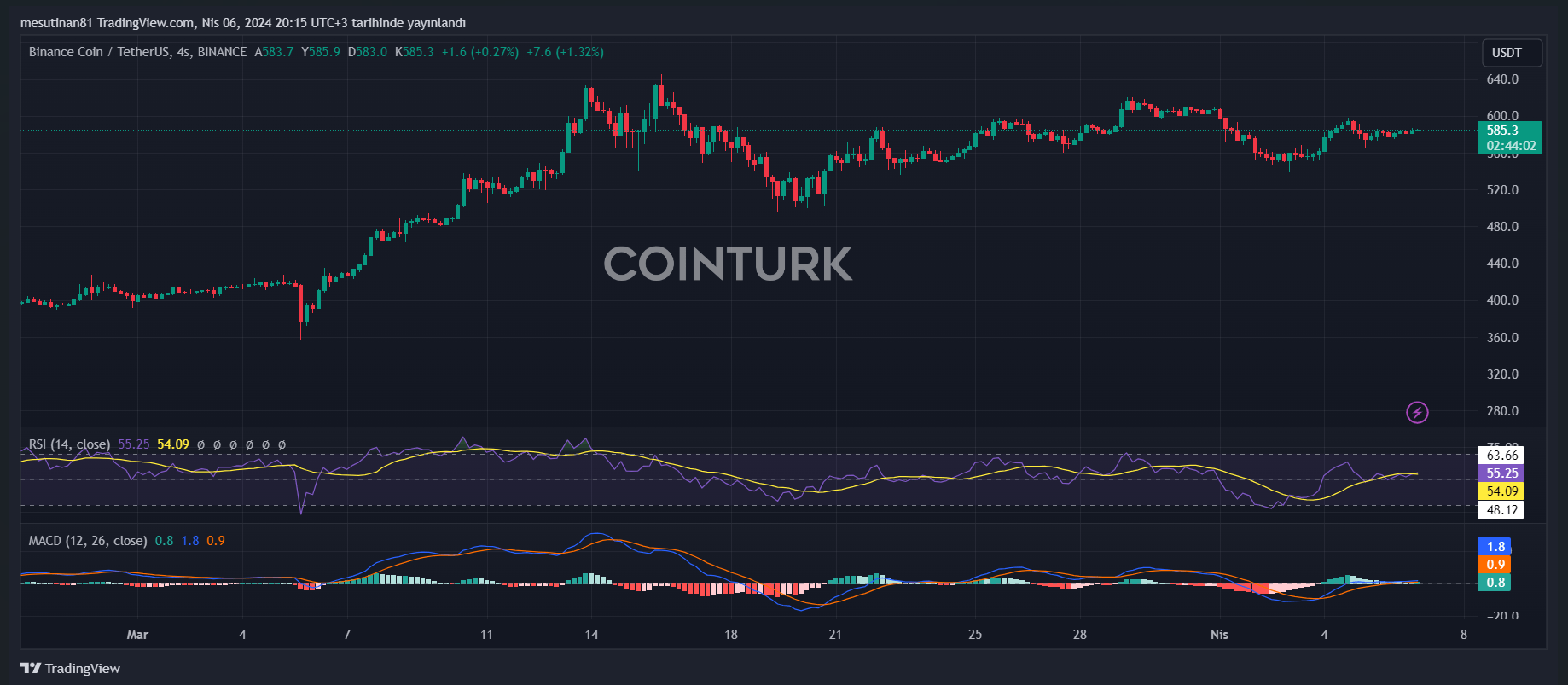

BNB, the native token of Binance, appears to have the potential to reach a market value of 100 billion dollars as the exchange grows. This could lead to an increase in demand for BNB and subsequently higher buying pressure. Besides being the native token of the world’s largest cryptocurrency exchange, various factors could potentially drive BNB towards the 100 billion dollar mark.

For example, Binance’s mechanism of periodically buying back and burning BNB tokens could contribute to a reduction in total supply, thereby increasing its value and market capitalization.

Moreover, activities within the BNB Chain ecosystem also seem to support the trajectory towards a 100 billion dollar market value. Positive revenue, earnings, and the price of BNB recorded in the first quarter could continue into April, potentially increasing BNB’s value.

Currently, with a market value of approximately 87 billion dollars, BNB has a solid foundation for a leap to 100 billion dollars by the end of April. This would require only a 14% increase. As of the last update, BNB was trading at 585 dollars.

Solana as a Significant Contender

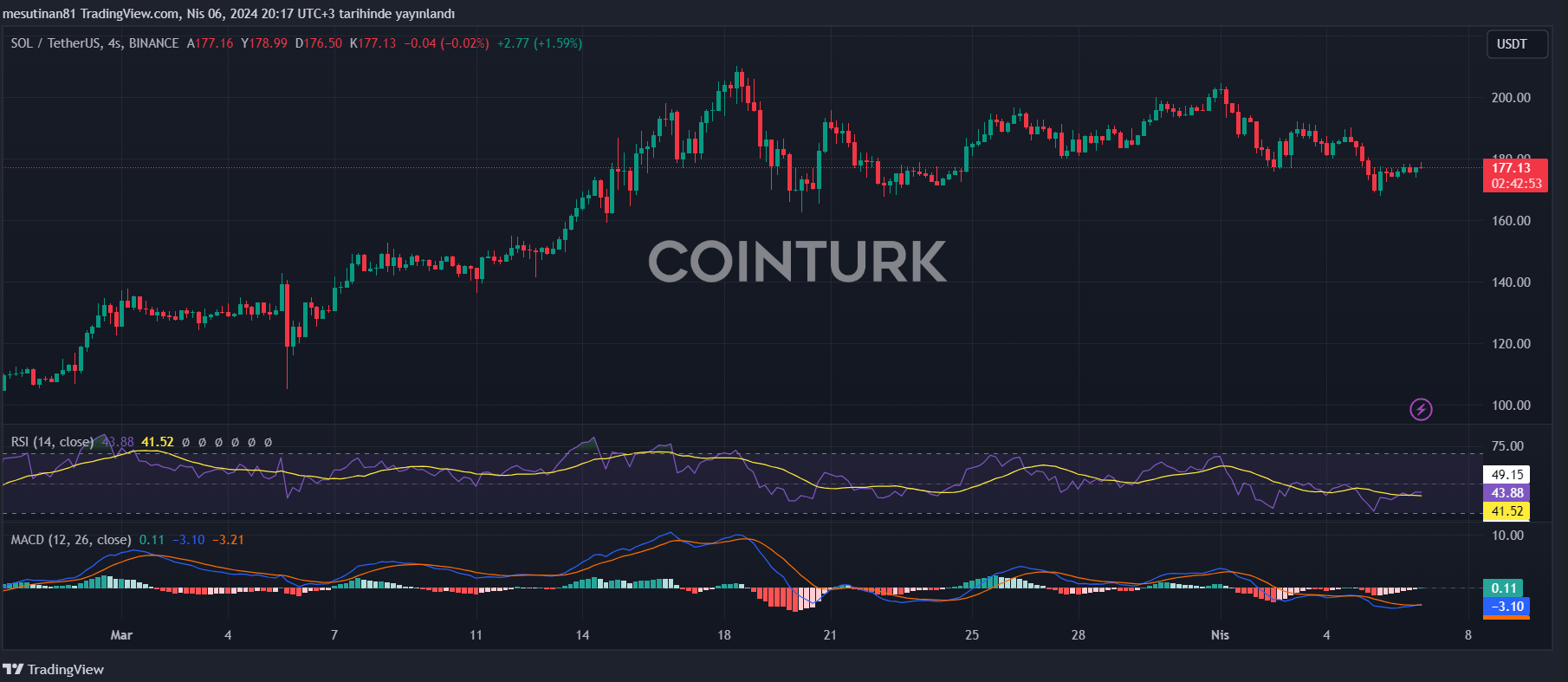

Solana (SOL) has a key feature that could drive its market value to 100 billion dollars: resilience. Its steady performance above the 170 dollar support region, despite network outages, highlights this resilience. The platform has experienced growth fueled by the excitement surrounding meme coins and a record-breaking 60 billion dollar decentralized exchange (DEX) trading volume.

Additionally, investor confidence in Solana is likely to increase as the network continues to demonstrate a commitment to resolving ongoing outages. Solana CEO Anatoly Yakovenko acknowledged the frustration caused by recent blockchain congestions, highlighting the complexity of addressing such issues. However, these challenges slow down the deployment process as they require extensive testing and updates.

Bitcoin Halving Could Positively Influence Price

The upcoming Bitcoin halving is expected to positively affect Solana’s price. Changelly, a cryptocurrency exchange and analysis platform, predicts that Solana could reach 321 dollars on April 20th, the day of Bitcoin’s halving.

Currently, Solana’s market value is at 79.11 billion dollars. Therefore, the asset needs to increase by 25% to reach the 100 billion dollar milestone. At the time of writing, Solana was valued at 177 dollars and had gained about 2% on a daily basis.